Optimization Theory for Insurance

⚖️ Why This Matters

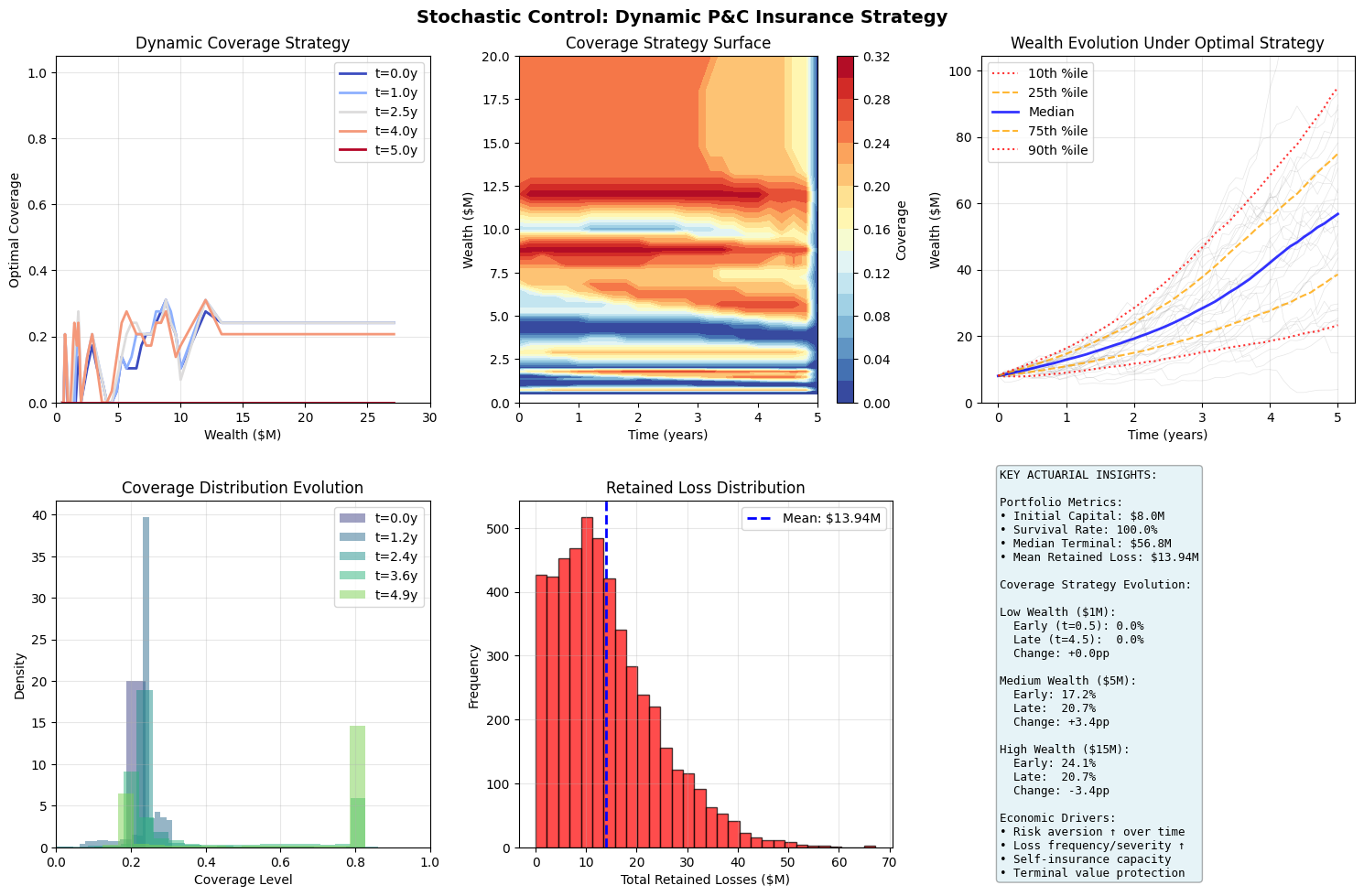

Optimization theory reveals that insurance decisions are fundamentally multi-objective problems with no single optimal solution. The Pareto frontier quantifies the inevitable tradeoffs between premium costs, retained risk, and earnings volatility. The Hamilton-Jacobi-Bellman framework proves that optimal insurance coverage should dynamically adjust with wealth levels and time horizons: entities with low capital need minimal coverage (can't afford premiums), middle-wealth entities need maximum coverage (most vulnerable), while wealthy entities self-insure (can absorb losses). Stochastic control theory shows how optimal strategies must adapt to market cycles, with coverage increasing during bear markets when losses are more frequent and decreasing during bull markets when growth dominates. The constrained optimization framework incorporating KKT conditions ensures solutions respect real-world constraints like budget limits, regulatory requirements, and ruin probability thresholds. Numerical methods comparison demonstrates that gradient descent fails for non-convex insurance problems, while evolutionary algorithms like particle swarm find global optima in complex multi-modal landscapes. This section proves that static insurance programs are suboptimal, while dynamic strategies that adjust coverage based on wealth, time, and market conditions can improve long-term growth rates by several percentage points annually while maintaining the same survival probability, transforming insurance from a fixed cost to an adaptive growth enabler.

Table of Contents

Constrained Optimization

General Formulation

The insurance optimization problem:

\(x\) = Decision variables (retention, limits, premiums)

\(f(x)\) = Objective (growth rate, utility, profit)

\(g_i(x)\) = Inequality constraints (budget, ruin probability)

\(h_j(x)\) = Equality constraints (regulatory requirements)

Lagrangian Method

Form the Lagrangian:

\(\lambda_i\) = “shadow price” for the inequality constraint \(g_i\), which represents the marginal change in optimal objective value if we relax constraint \(g_i\) slightly.

If \(\lambda_i > 0\) for a capital constraint, it tells you how much additional profit you’d gain per dollar of additional capital.

If \(\lambda_i > 0\) for a risk constraint, it quantifies the cost of that risk limit on your objective.

\(\mu_i\) = shadow price for equality constraint \(h_j\)

Karush-Kuhn-Tucker (KKT) Conditions

Necessary conditions for optimality:

Stationarity: \(\nabla_x \mathcal{L} = 0\)

The gradient with respect to decision variables equals zero (local optimum)

Example: Marginal profit from increasing retention equals marginal cost

Primal feasibility: \(g_i(x) \leq 0\), \(h_j(x) = 0\)

The solution satisfies all original constraints

Example: Capital requirements met, regulatory ratios satisfied

Dual feasibility: \(\lambda_i \geq 0\)

Lagrange multipliers for inequality constraints must be non-negative

Economic interpretation: Shadow prices for “≤” constraints are positive (relaxing a binding constraint improves the objective)

Example: The value of additional capital is always positive or zero

Complementary slackness: \(\lambda_i g_i(x) = 0\)

Either the constraint is binding (\(g_i(x) = 0\)) OR its multiplier is zero (\(\lambda_i = 0\))

Economic interpretation: You only “pay a price” for constraints that are binding

Example: If you have excess capital (\(g_i(x) < 0\)), then \(\lambda_i = 0\) (additional capital has no marginal value)

If capital constraint is binding (\(g_i(x) = 0\)), then \(\lambda_i > 0\) (additional capital would improve profit)

Practical Insurance Example:

Consider maximizing expected profit subject to a VaR constraint:

If VaR constraint is NOT binding: \(\lambda_{VaR} = 0\) (risk limit doesn’t affect optimal solution)

If VaR constraint IS binding: \(\lambda_{VaR} > 0\) tells you the profit sacrifice per unit of risk limit

Insurance Application

import numpy as np

from scipy import stats

from scipy.optimize import minimize, NonlinearConstraint

import matplotlib.pyplot as plt

class InsuranceOptimizer:

"""Optimize insurance program with constraints."""

def __init__(self, initial_wealth, growth_params, loss_dist):

self.W0 = initial_wealth

self.growth_params = growth_params

self.loss_dist = loss_dist

def objective(self, x):

"""Maximize expected log wealth (negative for minimization)."""

retention, limit = x[0], x[1]

# Simulate outcomes

n_sims = 1000

final_wealth = []

for _ in range(n_sims):

# Base growth

growth = np.random.normal(

self.growth_params['mu'],

self.growth_params['sigma']

)

wealth = self.W0 * (1 + growth)

# Loss and insurance

loss = self.loss_dist.rvs()

retained_loss = min(loss, retention)

covered_loss = min(max(0, loss - retention), limit)

# Premium (simplified)

premium = 0.01 * limit + 0.02 * max(0, limit - retention)

# Final wealth

wealth = wealth - retained_loss - premium

final_wealth.append(max(0, wealth))

# Expected log utility

positive_wealth = [w for w in final_wealth if w > 0]

if not positive_wealth:

return 1e10 # Penalize bankruptcy

return -np.mean(np.log(positive_wealth))

def ruin_constraint(self, x):

"""Probability of ruin constraint."""

retention, limit = x[0], x[1]

# Simulate ruin probability

n_sims = 1000

ruin_count = 0

for _ in range(n_sims):

wealth = self.W0

for year in range(10):

# 10-year horizon

growth = np.random.normal(

self.growth_params['mu'],

self.growth_params['sigma']

)

wealth *= (1 + growth)

loss = self.loss_dist.rvs()

retained_loss = min(loss, retention)

premium = 0.01 * limit + 0.02 * max(0, limit - retention)

wealth = wealth - retained_loss - premium

if wealth <= 0:

ruin_count += 1

break

return ruin_count / n_sims # Should be <= threshold

def optimize(self, ruin_threshold=0.01, budget=None):

"""Find optimal insurance program."""

# Initial guess

x0 = [self.W0 * 0.05, self.W0 * 0.20] # 5% retention, 20% limit

# Bounds

bounds = [

(0, self.W0 * 0.10), # Retention: 0 to 10% of wealth

(0, self.W0 * 0.50) # Limit: 0 to 50% of wealth

]

# Constraints

constraints = []

# Ruin probability constraint

constraints.append(NonlinearConstraint(

self.ruin_constraint,

lb=0,

ub=ruin_threshold

))

# Budget constraint if specified

if budget:

def premium_constraint(x):

return 0.01 * x[1] + 0.02 * max(0, x[1] - x[0])

constraints.append(NonlinearConstraint(

premium_constraint,

lb=0,

ub=budget

))

# Optimize

result = minimize(

self.objective,

x0,

method='SLSQP',

bounds=bounds,

constraints=constraints,

options={'maxiter': 100}

)

return result

# Example optimization

optimizer = InsuranceOptimizer(

initial_wealth=10_000_000,

growth_params={'mu': 0.08, 'sigma': 0.15},

loss_dist=stats.lognorm(s=2, scale=100_000)

)

result = optimizer.optimize(ruin_threshold=0.01)

print(f"Optimal retention: ${result.x[0]:,.0f}")

print(f"Optimal limit: ${result.x[1]:,.0f}")

print(f"Expected growth: {-result.fun:.4f}")

Sample Output

Optimal retention: $500,078

Optimal limit: $1,997,977

Expected growth: 16.1570

Pareto Efficiency

Definition

A solution is Pareto efficient if no objective can be improved without worsening another.

Pareto Frontier

Set of all Pareto efficient solutions:

Where “\(x\) dominatex \(x^*\)” means:

\(f_i(x) \geq f_i(x^*)\) for all objectives \(i\), AND

\(f_j(x) > f_j(x^*)\) for at least one objective \(j\)

Scalarization Methods

Scalarization methods transform multi-objective optimization problems into single-objective problems, making them solvable using standard optimization techniques. These methods are particularly useful in actuarial applications where competing objectives (e.g., minimizing risk while maximizing return, or balancing premium adequacy against market competitiveness) must be reconciled.

Weighted Sum

The weighted sum method combines multiple objectives into a single scalar objective through a linear combination:

where \(\sum w_i = 1\), \(w_i \geq 0\).

The solution obtained corresponds to a point on the Pareto frontier.

Key Considerations:

Weights (\(w_i\)): Represent the relative importance of each objective. In P&C applications, these might reflect regulatory priorities, strategic goals, or risk appetite.

Normalization: Objectives should typically be normalized to comparable scales before applying weights, especially when objectives have different units (e.g., dollars vs. percentages).

For objectives with different scales, one normalization approach is to use the following formula:

Advantages:

Computationally efficient and straightforward to implement

Intuitive interpretation of weights as trade-off ratios

Can leverage existing single-objective optimization solvers

Limitations:

Cannot find solutions in non-convex regions of the Pareto frontier

Requires careful weight selection; small changes can lead to significantly different solutions

May miss important trade-off solutions if the Pareto frontier has non-convex regions

Epsilon-Constraint

The epsilon-constraint method optimizes one primary objective while constraining all others:

Key Concepts:

Primary Objective: The objective function \(f_1(x)\) selected for optimization

Constraint Bounds (\(\epsilon_i\)): Upper limits for secondary objectives, effectively defining acceptable trade-off levels

Implementation Considerations:

The choice of primary objective should reflect the most critical business priority

Systematic variation of \(\epsilon\) values generates multiple Pareto-optimal solutions

Constraint bounds must be feasible; infeasible bounds result in empty solution sets

Advantages:

Can identify all Pareto-optimal solutions, including those in non-convex regions

Provides clear interpretation: “minimize \(f_1\) given that \(f_2\) cannot exceed \(\epsilon_2\)”

More flexible than weighted sum for complex Pareto frontiers

Natural fit for problems with hard constraints on certain objectives

Limitations:

Requires solving multiple optimization problems to characterize the Pareto frontier

Selection of appropriate \(\epsilon\) values can be challenging without prior knowledge

Less intuitive than weights-as-tradeoffs decision in the weighted sum approach

Computational cost increases with the number of constraint variations explored

May require sophisticated constraint-handling techniques for complex problems

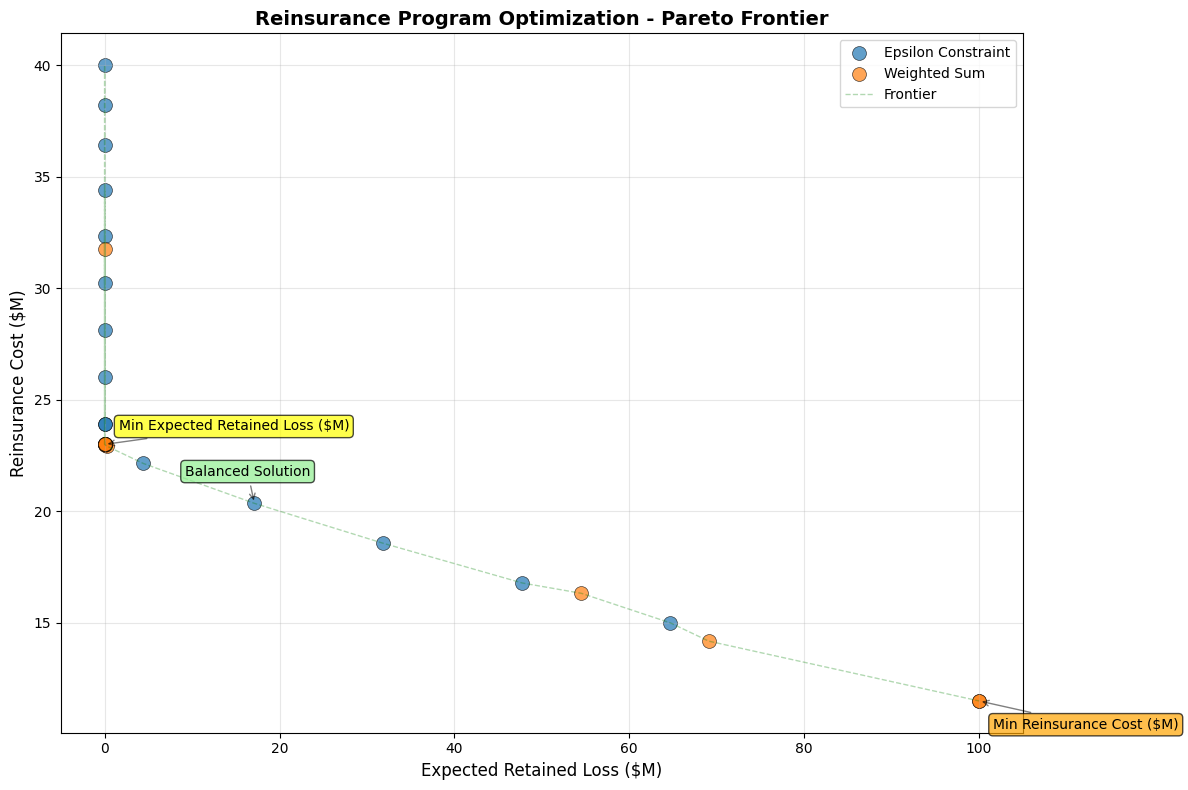

Insurance Trade-offs: Pareto Frontier Optimization for P&C Insurance Decisions

Implementation of weighted sum and epsilon-constraint methods for multi-objective optimization in actuarial applications.

import numpy as np

import matplotlib.pyplot as plt

from scipy.optimize import minimize, NonlinearConstraint

from typing import List, Dict, Callable, Tuple

import warnings

warnings.filterwarnings('ignore')

class ParetoFrontier:

"""

Compute Pareto frontier for insurance portfolio optimization.

Typical P&C applications include:

- Reinsurance structure optimization (retention vs cost)

- Capital allocation (risk vs return)

- Reserve adequacy (surplus vs competitiveness)

"""

def __init__(self, objectives: List[Callable], constraints: List = None):

"""

Initialize Pareto frontier solver.

Args:

objectives: List of objective functions to minimize

constraints: Optional list of optimization constraints

"""

self.objectives = objectives

self.constraints = constraints if constraints else []

def weighted_sum_method(self, weights_grid: List[Tuple]) -> List[Dict]:

"""

Generate Pareto frontier using weighted sum scalarization.

This method is computationally efficient and intuitive for stakeholders

who can express preferences as relative weights.

Args:

weights_grid: List of weight tuples, each summing to 1

Returns:

List of Pareto-optimal solutions with objectives and weights

"""

frontier = []

for i, weights in enumerate(weights_grid):

# Verify weights sum to 1

assert abs(sum(weights) - 1.0) < 1e-6, f"Weights must sum to 1, got {sum(weights)}"

# Combined objective function

def combined_objective(x):

return sum(w * obj(x) for w, obj in zip(weights, self.objectives))

# Use varied starting points for better exploration

# This helps avoid local minima in non-convex problems

x0_retention = 0.1 + 0.8 * (i / len(weights_grid))

x0_coverage = 0.9 - 0.7 * (i / len(weights_grid))

# Optimize using Sequential Least Squares Programming

result = minimize(

combined_objective,

x0=[x0_retention, x0_coverage],

bounds=[(0, 1), (0, 2)], # Extended bounds for coverage flexibility

constraints=self.constraints,

method='SLSQP',

options={'disp': False, 'maxiter': 200}

)

if result.success:

# Evaluate all objectives at solution point

obj_values = [obj(result.x) for obj in self.objectives]

frontier.append({

'x': result.x,

'objectives': obj_values,

'weights': weights,

'method': 'weighted_sum'

})

return frontier

def epsilon_constraint_method(self, epsilon_grid: List[List[float]]) -> List[Dict]:

"""

Generate Pareto frontier using epsilon-constraint method.

This method can find solutions in non-convex regions and is ideal

when some objectives have natural constraint thresholds (e.g.,

regulatory minimums, risk limits).

Args:

epsilon_grid: List of epsilon values for constraining secondary objectives

Returns:

List of Pareto-optimal solutions with objectives and epsilon values

"""

frontier = []

for eps_values in epsilon_grid:

# Primary objective: minimize first objective

def primary_objective(x):

return self.objectives[0](x)

# Create constraints for other objectives

additional_constraints = []

for i, obj in enumerate(self.objectives[1:], 1):

# Each secondary objective must be <= its epsilon value

additional_constraints.append(

NonlinearConstraint(

obj,

lb=-np.inf,

ub=eps_values[i-1],

keep_feasible=False

)

)

# Combine original and epsilon constraints

all_constraints = self.constraints + additional_constraints

# Optimize with multiple starting points for robustness

for start_point in [[0.3, 0.7], [0.5, 0.5], [0.7, 0.3]]:

result = minimize(

primary_objective,

x0=start_point,

bounds=[(0, 1), (0, 2)],

constraints=all_constraints,

method='SLSQP',

options={'disp': False, 'maxiter': 200}

)

if result.success:

obj_values = [obj(result.x) for obj in self.objectives]

frontier.append({

'x': result.x,

'objectives': obj_values,

'epsilon': eps_values,

'method': 'epsilon_constraint'

})

break # Use first successful result

return frontier

def plot_frontier(self, frontier: List[Dict], obj_names: List[str] = None,

title: str = 'Pareto Frontier - Insurance Optimization'):

"""

Visualize Pareto frontier with actuarial annotations.

Args:

frontier: List of Pareto-optimal solutions

obj_names: Names for objectives (default: ['Obj 1', 'Obj 2'])

title: Plot title

"""

if not frontier:

print("No valid solutions found in frontier")

return

objectives = np.array([f['objectives'] for f in frontier])

if obj_names is None:

obj_names = [f'Objective {i+1}' for i in range(objectives.shape[1])]

if objectives.shape[1] == 2:

# 2D Pareto frontier plot

plt.figure(figsize=(12, 8))

# Color by method if available

methods = [f.get('method', 'unknown') for f in frontier]

method_colors = {'weighted_sum': 'blue', 'epsilon_constraint': 'red', 'unknown': 'gray'}

colors = [method_colors.get(m, 'gray') for m in methods]

# Main scatter plot

for method in set(methods):

mask = [m == method for m in methods]

method_objectives = objectives[mask]

if len(method_objectives) > 0:

plt.scatter(method_objectives[:, 0], method_objectives[:, 1],

s=100, alpha=0.7, edgecolors='black', linewidth=0.5,

label=method.replace('_', ' ').title())

# Connect points to show frontier

sorted_idx = np.argsort(objectives[:, 0])

plt.plot(objectives[sorted_idx, 0], objectives[sorted_idx, 1],

'g--', alpha=0.3, linewidth=1, label='Frontier')

# Labels and formatting

plt.xlabel(obj_names[0], fontsize=12)

plt.ylabel(obj_names[1], fontsize=12)

plt.title(title, fontsize=14, fontweight='bold')

plt.grid(True, alpha=0.3)

plt.legend(loc='best')

# Annotate key solutions

self._annotate_key_points(objectives, obj_names)

plt.tight_layout()

plt.show()

elif objectives.shape[1] == 3:

# 3D Pareto frontier plot

fig = plt.figure(figsize=(12, 9))

ax = fig.add_subplot(111, projection='3d')

scatter = ax.scatter(objectives[:, 0], objectives[:, 1], objectives[:, 2],

c=range(len(objectives)), cmap='viridis', s=50, alpha=0.7)

ax.set_xlabel(obj_names[0], fontsize=10)

ax.set_ylabel(obj_names[1], fontsize=10)

ax.set_zlabel(obj_names[2], fontsize=10)

ax.set_title(title, fontsize=12, fontweight='bold')

plt.colorbar(scatter, label='Solution Index')

plt.tight_layout()

plt.show()

def _annotate_key_points(self, objectives: np.ndarray, obj_names: List[str]):

"""Add annotations for key solutions on the Pareto frontier."""

# Extreme points

min_obj1_idx = np.argmin(objectives[:, 0])

min_obj2_idx = np.argmin(objectives[:, 1])

plt.annotate(f'Min {obj_names[0]}',

(objectives[min_obj1_idx, 0], objectives[min_obj1_idx, 1]),

xytext=(10, 10), textcoords='offset points',

bbox=dict(boxstyle='round,pad=0.3', facecolor='yellow', alpha=0.7),

arrowprops=dict(arrowstyle='->', color='black', alpha=0.5))

plt.annotate(f'Min {obj_names[1]}',

(objectives[min_obj2_idx, 0], objectives[min_obj2_idx, 1]),

xytext=(10, -20), textcoords='offset points',

bbox=dict(boxstyle='round,pad=0.3', facecolor='orange', alpha=0.7),

arrowprops=dict(arrowstyle='->', color='black', alpha=0.5))

# Balanced solution (closest to utopia point)

obj_norm = (objectives - objectives.min(axis=0)) / (objectives.max(axis=0) - objectives.min(axis=0) + 1e-10)

distances = np.sqrt(np.sum(obj_norm**2, axis=1))

balanced_idx = np.argmin(distances)

plt.annotate('Balanced Solution',

(objectives[balanced_idx, 0], objectives[balanced_idx, 1]),

xytext=(-50, 20), textcoords='offset points',

bbox=dict(boxstyle='round,pad=0.3', facecolor='lightgreen', alpha=0.7),

arrowprops=dict(arrowstyle='->', color='black', alpha=0.5))

# ==============================================================================

# P&C ACTUARIAL EXAMPLE 1: REINSURANCE OPTIMIZATION

# ==============================================================================

def reinsurance_example():

"""

Example: Optimize reinsurance program balancing retention and cost.

This is a common P&C actuarial problem where we need to find the optimal

retention level and coverage limit that balances:

1. Expected retained losses (minimize)

2. Reinsurance premium costs (minimize)

"""

print("=" * 70)

print("EXAMPLE 1: REINSURANCE OPTIMIZATION")

print("=" * 70)

def expected_retained_loss(x):

"""

Expected retained losses as function of retention and limit.

Args:

x: [retention_ratio, coverage_limit_ratio]

"""

retention, coverage = x

# Simplified loss model with severity and frequency components

base_loss = 100 # Million USD

retention_factor = retention**1.2 # Non-linear retention impact

coverage_benefit = 1 - 0.7 * (1 - np.exp(-2 * coverage))

return base_loss * retention_factor * coverage_benefit

def reinsurance_cost(x):

"""

Reinsurance premium based on retention and coverage.

Higher coverage and lower retention = higher premium

"""

retention, coverage = x

base_premium = 20 # Million USD

# Premium increases with coverage and decreases with retention

premium_factor = (1 - retention * 0.5) * (1 + coverage * 0.8)

loading_factor = 1.15 # Typical reinsurer loading

return base_premium * premium_factor * loading_factor

# Set up optimization

objectives = [expected_retained_loss, reinsurance_cost]

# Constraint: Total program cost must be reasonable

constraints = [

NonlinearConstraint(

lambda x: expected_retained_loss(x) + reinsurance_cost(x),

lb=0, ub=150 # Total cost cap at 150M

)

]

pareto = ParetoFrontier(objectives, constraints)

# Method 1: Weighted Sum

print("\n1. WEIGHTED SUM METHOD")

print("-" * 30)

# Generate weight combinations emphasizing different priorities

weights_grid = []

for i in range(20):

w1 = i / 19 # From 0 to 1

w2 = 1 - w1

weights_grid.append((w1, w2))

frontier_ws = pareto.weighted_sum_method(weights_grid)

# Display sample solutions

print(f"Found {len(frontier_ws)} Pareto-optimal solutions")

print("\nSample solutions (different risk appetites):")

# Conservative (minimize retained loss)

conservative = min(frontier_ws, key=lambda x: x['objectives'][0])

print(f"\nConservative (80% loss, 20% cost weight):")

print(f" Retention: {conservative['x'][0]:.2%}")

print(f" Coverage: {conservative['x'][1]:.2f}x")

print(f" Expected Loss: ${conservative['objectives'][0]:.1f}M")

print(f" Reinsurance Cost: ${conservative['objectives'][1]:.1f}M")

# Aggressive (minimize cost)

aggressive = min(frontier_ws, key=lambda x: x['objectives'][1])

print(f"\nAggressive (20% loss, 80% cost weight):")

print(f" Retention: {aggressive['x'][0]:.2%}")

print(f" Coverage: {aggressive['x'][1]:.2f}x")

print(f" Expected Loss: ${aggressive['objectives'][0]:.1f}M")

print(f" Reinsurance Cost: ${aggressive['objectives'][1]:.1f}M")

# Method 2: Epsilon-Constraint

print("\n2. EPSILON-CONSTRAINT METHOD")

print("-" * 30)

# Set epsilon values for reinsurance cost constraint

epsilon_grid = []

for cost_limit in np.linspace(15, 40, 15): # Cost limits from 15M to 40M

epsilon_grid.append([cost_limit])

frontier_ec = pareto.epsilon_constraint_method(epsilon_grid)

print(f"Found {len(frontier_ec)} Pareto-optimal solutions")

print("\nSolutions at different cost constraints:")

for i in [0, len(frontier_ec)//2, -1]:

if i < len(frontier_ec):

sol = frontier_ec[i]

print(f"\nCost limit: ${sol['epsilon'][0]:.1f}M")

print(f" Retention: {sol['x'][0]:.2%}")

print(f" Coverage: {sol['x'][1]:.2f}x")

print(f" Expected Loss: ${sol['objectives'][0]:.1f}M")

print(f" Actual Cost: ${sol['objectives'][1]:.1f}M")

# Combine and plot

all_solutions = frontier_ws + frontier_ec

pareto.plot_frontier(

all_solutions,

obj_names=['Expected Retained Loss ($M)', 'Reinsurance Cost ($M)'],

title='Reinsurance Program Optimization - Pareto Frontier'

)

return pareto, all_solutions

# ==============================================================================

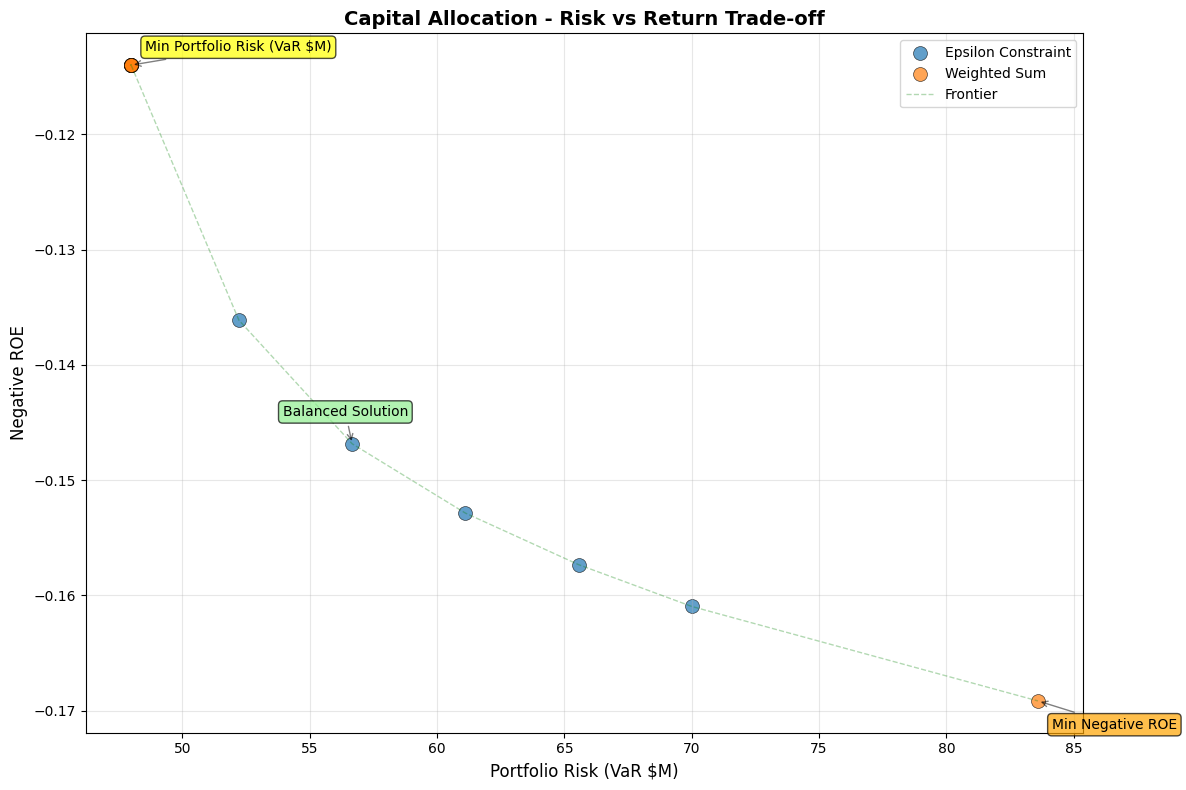

# P&C ACTUARIAL EXAMPLE 2: CAPITAL ALLOCATION

# ==============================================================================

def capital_allocation_example():

"""

Example: Optimize capital allocation across business lines.

Balance between:

1. Portfolio risk (VaR or TVaR)

2. Expected return (ROE)

3. Diversification benefit

"""

print("\n" + "=" * 70)

print("EXAMPLE 2: CAPITAL ALLOCATION ACROSS LINES")

print("=" * 70)

def portfolio_risk(x):

"""

Portfolio Value-at-Risk (simplified model).

Args:

x: [allocation_personal_lines, allocation_commercial]

"""

personal, commercial = x

# Standalone risks

risk_personal = 50 * personal**0.8

risk_commercial = 80 * commercial**0.9

# Correlation benefit

correlation = 0.3

diversified_risk = np.sqrt(

risk_personal**2 + risk_commercial**2 +

2 * correlation * risk_personal * risk_commercial

)

return diversified_risk

def negative_roe(x):

"""

Negative expected ROE (for minimization).

"""

personal, commercial = x

# Expected returns differ by line

roe_personal = 0.12 * personal

roe_commercial = 0.18 * commercial * (1 - 0.1 * commercial) # Diminishing returns

combined_roe = roe_personal + roe_commercial

return -combined_roe # Negative for minimization

def concentration_penalty(x):

"""

Penalty for concentration risk (regulatory concern).

"""

personal, commercial = x

# Herfindahl index for concentration

total = personal + commercial

if total == 0:

return 0

hhi = (personal/total)**2 + (commercial/total)**2

return hhi * 100 # Scale for visibility

# Three-objective optimization

objectives = [portfolio_risk, negative_roe, concentration_penalty]

# Constraints: allocations must sum to 1

constraints = [

NonlinearConstraint(

lambda x: x[0] + x[1],

lb=0.95, ub=1.05 # Allow small deviation for numerical stability

)

]

pareto = ParetoFrontier(objectives[:2], constraints) # Use first 2 objectives for 2D viz

print("\n1. WEIGHTED SUM METHOD (Risk vs Return)")

print("-" * 30)

# Generate weights for different risk preferences

weights_grid = []

for risk_aversion in np.linspace(0, 1, 15):

w_risk = risk_aversion

w_return = 1 - risk_aversion

weights_grid.append((w_risk, w_return))

frontier_ws = pareto.weighted_sum_method(weights_grid)

print(f"Found {len(frontier_ws)} Pareto-optimal allocations")

# Analyze key allocations

if frontier_ws:

# Risk-averse allocation

risk_averse = min(frontier_ws, key=lambda x: x['objectives'][0])

print(f"\nRisk-Averse Allocation:")

print(f" Personal Lines: {risk_averse['x'][0]:.1%}")

print(f" Commercial Lines: {risk_averse['x'][1]:.1%}")

print(f" Portfolio VaR: ${risk_averse['objectives'][0]:.1f}M")

print(f" Expected ROE: {-risk_averse['objectives'][1]:.1%}")

# Return-seeking allocation

return_seeking = min(frontier_ws, key=lambda x: x['objectives'][1])

print(f"\nReturn-Seeking Allocation:")

print(f" Personal Lines: {return_seeking['x'][0]:.1%}")

print(f" Commercial Lines: {return_seeking['x'][1]:.1%}")

print(f" Portfolio VaR: ${return_seeking['objectives'][0]:.1f}M")

print(f" Expected ROE: {-return_seeking['objectives'][1]:.1%}")

print("\n2. EPSILON-CONSTRAINT METHOD (Constrain Risk)")

print("-" * 30)

# Set risk limits

epsilon_grid = []

for risk_limit in np.linspace(30, 70, 10):

epsilon_grid.append([risk_limit]) # Constraint on negative ROE not needed here

# For epsilon-constraint, we minimize return subject to risk constraint

# So swap objectives

pareto_ec = ParetoFrontier([negative_roe, portfolio_risk], constraints)

frontier_ec = pareto_ec.epsilon_constraint_method(epsilon_grid)

print(f"Found {len(frontier_ec)} Pareto-optimal allocations")

if frontier_ec:

# Sample allocation at moderate risk limit

mid_solution = frontier_ec[len(frontier_ec)//2] if frontier_ec else None

if mid_solution:

print(f"\nModerate Risk Limit (VaR ≤ ${mid_solution['epsilon'][0]:.1f}M):")

print(f" Personal Lines: {mid_solution['x'][0]:.1%}")

print(f" Commercial Lines: {mid_solution['x'][1]:.1%}")

print(f" Achieved ROE: {-mid_solution['objectives'][0]:.1%}")

print(f" Actual VaR: ${mid_solution['objectives'][1]:.1f}M")

# Plot frontier (swap objectives back for consistent view)

if frontier_ec:

for sol in frontier_ec:

sol['objectives'] = [sol['objectives'][1], sol['objectives'][0]]

all_solutions = frontier_ws + frontier_ec

if all_solutions:

pareto.plot_frontier(

all_solutions,

obj_names=['Portfolio Risk (VaR $M)', 'Negative ROE'],

title='Capital Allocation - Risk vs Return Trade-off'

)

return pareto, all_solutions

# ==============================================================================

# MAIN EXECUTION

# ==============================================================================

if __name__ == "__main__":

# Run reinsurance optimization example

pareto_reins, solutions_reins = reinsurance_example()

# Run capital allocation example

pareto_capital, solutions_capital = capital_allocation_example()

# Summary statistics

print("\n" + "=" * 70)

print("OPTIMIZATION SUMMARY")

print("=" * 70)

print(f"\nReinsurance Optimization:")

print(f" Total solutions found: {len(solutions_reins)}")

if solutions_reins:

obj_values = np.array([s['objectives'] for s in solutions_reins])

print(f" Loss range: ${obj_values[:, 0].min():.1f}M - ${obj_values[:, 0].max():.1f}M")

print(f" Cost range: ${obj_values[:, 1].min():.1f}M - ${obj_values[:, 1].max():.1f}M")

print(f"\nCapital Allocation:")

print(f" Total solutions found: {len(solutions_capital)}")

if solutions_capital:

obj_values = np.array([s['objectives'] for s in solutions_capital])

print(f" Risk range: ${obj_values[:, 0].min():.1f}M - ${obj_values[:, 0].max():.1f}M")

print(f" ROE range: {-obj_values[:, 1].max():.1%} - {-obj_values[:, 1].min():.1%}")

print("\nKey Insights:")

print("• Weighted Sum: Efficient for convex frontiers, intuitive weights")

print("• Epsilon-Constraint: Handles non-convex regions, natural for risk limits")

print("• Both methods provide complementary views of the trade-off space")

print("• Actuarial judgment needed to select final solution from frontier")

Sample Output

======================================================================

EXAMPLE 1: REINSURANCE OPTIMIZATION

======================================================================

1. WEIGHTED SUM METHOD

------------------------------

Found 20 Pareto-optimal solutions

Sample solutions (different risk appetites):

Conservative (80% loss, 20% cost weight):

Retention: 0.00%

Coverage: 0.00x

Expected Loss: $0.0M

Reinsurance Cost: $23.0M

Aggressive (20% loss, 80% cost weight):

Retention: 100.00%

Coverage: 0.00x

Expected Loss: $100.0M

Reinsurance Cost: $11.5M

2. EPSILON-CONSTRAINT METHOD

------------------------------

Found 15 Pareto-optimal solutions

Solutions at different cost constraints:

Cost limit: $15.0M

Retention: 69.57%

Coverage: 0.00x

Expected Loss: $64.7M

Actual Cost: $15.0M

Cost limit: $27.5M

Retention: 0.00%

Coverage: 0.16x

Expected Loss: $0.0M

Actual Cost: $26.0M

Cost limit: $40.0M

Retention: 0.00%

Coverage: 0.92x

Expected Loss: $0.0M

Actual Cost: $40.0M

======================================================================

EXAMPLE 2: CAPITAL ALLOCATION ACROSS LINES

======================================================================

1. WEIGHTED SUM METHOD (Risk vs Return)

------------------------------

Found 15 Pareto-optimal allocations

Risk-Averse Allocation:

Personal Lines: 95.0%

Commercial Lines: 0.0%

Portfolio VaR: $48.0M

Expected ROE: 11.4%

Return-Seeking Allocation:

Personal Lines: 0.0%

Commercial Lines: 105.0%

Portfolio VaR: $83.6M

Expected ROE: 16.9%

2. EPSILON-CONSTRAINT METHOD (Constrain Risk)

------------------------------

Found 5 Pareto-optimal allocations

Moderate Risk Limit (VaR ≤ $61.1M):

Personal Lines: 51.7%

Commercial Lines: 53.3%

Achieved ROE: 15.3%

Actual VaR: $61.1M

Multi-Objective Optimization

Multi-objective optimization (MOO) addresses the reality that actuarial decisions rarely involve a single goal. In P&C insurance, we simultaneously optimize competing objectives like minimizing risk while maximizing profit, or balancing policyholder protection with shareholder returns. Unlike single-objective problems with unique optimal solutions, MOO produces a set of trade-off solutions where improving one objective necessarily worsens another.

Problem Formulation

The general multi-objective optimization problem is expressed as:

Components:

Decision Variables \((x)\): Vector of controllable parameters \(x = [x_1, x_2, ..., x_n]^T\)

Decision Space \((\mathcal{X})\): Feasible region defined by the following constraints:

Objective Functions (\(f_i\)): \(k\) functions to be simultaneously minimized

Objective Space (\(\mathcal{Y}\)): The \(k\)-dimensional space of objective values

Constraint Types:

Inequality Constraints: \(g_i(x) \leq 0\) for \(i = 1, ..., m\)

Equality Constraints: \(h_j(x) = 0\) for \(j = 1, ..., p\)

Box Constraints: \(x_i^L \leq x_i \leq x_i^U\) defining variable bounds

Dominance Relations

Dominance relations establish a partial ordering among solutions in multi-objective space, forming the mathematical foundation for identifying optimal trade-offs.

Solution \(x\) dominates \(y\) if: - \(f_i(x) \leq f_i(y)\) for all \(i\) - \(f_j(x) < f_j(y)\) for at least one \(j\)

Pareto Dominance

Solution \(x\) Pareto dominates solution \(y\) (denoted \(x \prec y\)) if and only if:

\(f_i(x) \leq f_i(y)\) for all \(i \in \{1, 2, ... , k\}\) (no worse in any objective)

\(f_j(x) < f_j(y)\) for at least one \(j \in \{1, 2, ..., k\}\) (strictly better in at least one)

Weak Dominance

Solution \(x\) weakly dominates \(y\) (\(x \preceq y\)) if:

\(f_i(x) \leq f_i(y)\) for all \(i \in \{1, 2, ..., k\}\)

This relaxes the strict improvement requirement, useful for handling solutions with identical objective values.

Strict Dominance

Solution \(x\) strictly dominates \(y\) (denoted \(x \prec\prec y\)) if:

\(f_i(x) < f_i(y)\) for all \(i \in \{1, 2, ..., k\}\)

Rare in practice but represents unambiguous superiority across all objectives.

Pareto Optimality

Pareto Optimal Solution: A solution \(x^* \in \mathcal{X}\) is Pareto optimal if no other solution dominates it:

Pareto Optimal Set: \(\mathcal{P} = \{x \in \mathcal{X} : x \text{ is Pareto optimal}\}\) Pareto Front: The image of the Pareto optimal set in objective space:

where \(F(x)\) is the vector function of all \(k\) objective values:

(so the Pareto Optimal Set are the input solutions, while the Pareto Front are the resulting objectives)

Local vs Global Pareto Optimality:

Locally Pareto Optimal: No dominating solution in a neighborhood \(\mathcal{N}(x^*, \epsilon)\) of some size \(\epsilon\) around the solution \(x^*\)

Globally Pareto Optimal: No dominating solution in entire feasible space \(\mathcal{X}\)

P&C Example - Reinsurance Treaties: Consider three reinsurance structures:

Treaty |

Retention |

Premium |

\(E[\text{Loss}]\) |

|---|---|---|---|

\(A\) |

\(\$100K\) |

\(\$5M\) |

\(\$20M\) |

\(B\) |

\(\$200K\) |

\(\$3M\) |

\(\$25M\) |

\(C\) |

\(\$150K\) |

\(\$4M\) |

\(\$22M\) |

Analysis:

Treaty \(A\) strictly dominates Treaty \(C\) (lower retention, lower premium, lower expected loss) Treaties \(A\) and \(B\) are non-dominated (trade-off between premium and expected loss risk) Pareto set: \(\{A, B\}\)

Evolutionary Algorithms

Evolutionary algorithms (EAs) are population-based metaheuristics (high-level, problem-independent algorithmic frameworks) particularly suited for multi-objective optimization. They maintain a population of solutions that evolves toward the Pareto front through selection, crossover, and mutation operations inspired by natural evolution.

NSGA-II (Non-dominated Sorting Genetic Algorithm II)

The most widely-used multi-objective EA, NSGA-II employs fast non-dominated sorting and crowding distance to maintain diversity.

Algorithm Structure:

Initialize population \(P_0\) of size \(N\)

For generation \(t = 0\) to \(\text{max\_generations}\):

a. Create offspring population \(Q_t\) using:

Tournament selection

Crossover (probability \(p_c\))

Mutation (probability \(p_m\))

b. Combine: \(R_t = P_t \bigcup Q_t\) c. Non-dominated sorting of \(R_t\) into fronts \(F_1, F_2, ...\) d. Select next population \(P_{t+1}\):

Add complete fronts until \(|P_{t+1}| + |F_i| > N\)

Sort last front \(F_i\) by crowding distance

Fill remaining slots from sorted \(F_i\)

Other EAs worth mentioning include:

MOEA/D (Multi-Objective Evolutionary Algorithm based on Decomposition)

MOEA/D decomposes the multi-objective problem into scalar subproblems solved simultaneously.

SPEA2 (Strength Pareto Evolutionary Algorithm 2)

Uses fine-grained fitness assignment based on dominance strength and density.

Indicator-Based Algorithms (SMS-EMOA, IBEA)

Optimize quality indicators directly rather than using dominance relations. Maximizes hypervolume.

Hypervolume is the multi-dimensional “area” or “volume” between your Pareto front and a reference point (typically worst-case scenario), measuring how much of the objective space your solutions dominate.

Think of it as the total coverage of favorable outcomes across all your competing objectives.

A larger hypervolume means your solution set offers better trade-offs overall, similar to how a higher Sharpe ratio indicates better risk-adjusted returns, except hypervolume works for any number of objectives simultaneously.

Considerations

Use NSGA-II when:

Problem has 2-3 objectives

Robust general-purpose solution needed

No specific preference information available

Example: Balancing loss ratio vs expense ratio vs growth

Use MOEA/D when:

Many objectives (>3) present

Preference information available (can set weights)

Computational efficiency critical

Example: Optimizing across multiple risk measures (VaR, TVaR, Standard Deviation, Maximum Loss)

Use SPEA2 when:

Need fine-grained fitness discrimination

Solution quality more important than speed

External archive of best solutions desired

Example: Long-term strategic planning with solution history requirements

Use SMS-EMOA/IBEA when:

Single quality metric suffices for decision-making

Hypervolume represents a meaningful business metric

Need theoretical convergence guarantees

Example: Solvency capital optimization where hypervolume represents coverage of risk scenarios

"""

NSGA-II (Non-dominated Sorting Genetic Algorithm II) Implementation

for Multi-Objective Optimization in P&C Insurance Applications

==================================================================

"""

import numpy as np

import matplotlib.pyplot as plt

from mpl_toolkits.mplot3d import Axes3D

from typing import List, Callable, Tuple, Optional

import warnings

warnings.filterwarnings('ignore')

class NSGA2:

"""

Non-dominated Sorting Genetic Algorithm II for multi-objective optimization.

Particularly suited for P&C actuarial problems with competing objectives like:

- Risk vs Return trade-offs

- Premium adequacy vs Market competitiveness

- Retention vs Reinsurance cost optimization

"""

def __init__(self,

objectives: List[Callable],

bounds: np.ndarray,

pop_size: int = 50,

crossover_prob: float = 0.9,

mutation_prob: float = None,

eta_crossover: float = 20,

eta_mutation: float = 20):

"""

Initialize NSGA-II optimizer.

Args:

objectives: List of objective functions to minimize

bounds: Array of shape (n_vars, 2) with [min, max] for each variable

pop_size: Population size (should be even)

crossover_prob: Probability of crossover

mutation_prob: Probability of mutation (default: 1/n_vars)

eta_crossover: Distribution index for SBX crossover

eta_mutation: Distribution index for polynomial mutation

"""

self.objectives = objectives

self.n_objectives = len(objectives)

self.bounds = bounds

self.n_vars = len(bounds)

self.pop_size = pop_size if pop_size % 2 == 0 else pop_size + 1

self.crossover_prob = crossover_prob

self.mutation_prob = mutation_prob if mutation_prob else 1.0 / self.n_vars

self.eta_crossover = eta_crossover

self.eta_mutation = eta_mutation

def dominates(self, f1: np.ndarray, f2: np.ndarray) -> bool:

"""

Check if solution f1 dominates solution f2.

f1 dominates f2 if:

- f1 is no worse than f2 in all objectives

- f1 is strictly better than f2 in at least one objective

"""

return np.all(f1 <= f2) and np.any(f1 < f2)

def non_dominated_sort(self, population: np.ndarray, fitnesses: np.ndarray) -> List[List[int]]:

"""

Sort population into non-dominated fronts using fast non-dominated sorting.

Returns:

List of fronts, where each front is a list of population indices

"""

n = len(population)

# Initialize domination data structures

domination_count = np.zeros(n, dtype=int) # Number of solutions dominating i

dominated_by = [[] for _ in range(n)] # Solutions dominated by i

# Calculate domination relationships

for i in range(n):

for j in range(i + 1, n):

if self.dominates(fitnesses[i], fitnesses[j]):

dominated_by[i].append(j)

domination_count[j] += 1

elif self.dominates(fitnesses[j], fitnesses[i]):

dominated_by[j].append(i)

domination_count[i] += 1

# Find first front (non-dominated solutions)

fronts = [[]]

for i in range(n):

if domination_count[i] == 0:

fronts[0].append(i)

# Find remaining fronts iteratively

current_front = 0

# Guard the loop with a length check to avoid index errors when no further fronts are appended

while current_front < len(fronts) and fronts[current_front]:

next_front = []

# For each solution in current front

for i in fronts[current_front]:

# Reduce domination count for dominated solutions

for j in dominated_by[i]:

domination_count[j] -= 1

# If domination count becomes 0, add to next front

if domination_count[j] == 0:

next_front.append(j)

if next_front: # Only add non-empty fronts

fronts.append(next_front)

current_front += 1

# If the last front is empty, remove it

return fronts[:-1] if (fronts and not fronts[-1]) else fronts

def crowding_distance(self, fitnesses: np.ndarray) -> np.ndarray:

"""

Calculate crowding distance for diversity preservation.

Crowding distance estimates the density of solutions surrounding a particular

solution in the objective space.

"""

n = len(fitnesses)

if n <= 2:

return np.full(n, np.inf)

m = fitnesses.shape[1]

distances = np.zeros(n)

for obj_idx in range(m):

# Sort by current objective

sorted_indices = np.argsort(fitnesses[:, obj_idx])

sorted_fitnesses = fitnesses[sorted_indices, obj_idx]

# Boundary points get infinite distance

distances[sorted_indices[0]] = np.inf

distances[sorted_indices[-1]] = np.inf

# Calculate distance contribution from this objective

obj_range = sorted_fitnesses[-1] - sorted_fitnesses[0]

if obj_range > 0:

for i in range(1, n - 1):

distance_contribution = (sorted_fitnesses[i + 1] - sorted_fitnesses[i - 1]) / obj_range

distances[sorted_indices[i]] += distance_contribution

return distances

def tournament_selection(self, population: np.ndarray, fitnesses: np.ndarray,

fronts: List[List[int]], tournament_size: int = 2) -> int:

"""

Binary tournament selection based on dominance rank and crowding distance.

"""

# Create rank array

ranks = np.zeros(len(population), dtype=int)

for rank, front in enumerate(fronts):

for idx in front:

ranks[idx] = rank

# Calculate crowding distances for entire population

all_distances = np.zeros(len(population))

for front in fronts:

if front:

front_fitnesses = fitnesses[front]

front_distances = self.crowding_distance(front_fitnesses)

for i, idx in enumerate(front):

all_distances[idx] = front_distances[i]

# Tournament

candidates = np.random.choice(len(population), tournament_size, replace=False)

# Select based on rank (lower is better)

best_rank = np.min(ranks[candidates])

best_candidates = candidates[ranks[candidates] == best_rank]

if len(best_candidates) == 1:

return best_candidates[0]

# If tied on rank, select based on crowding distance (higher is better)

return best_candidates[np.argmax(all_distances[best_candidates])]

def sbx_crossover(self, parent1: np.ndarray, parent2: np.ndarray) -> Tuple[np.ndarray, np.ndarray]:

"""

Simulated Binary Crossover (SBX).

Creates two offspring that maintain the spread of parent solutions.

"""

child1 = parent1.copy()

child2 = parent2.copy()

if np.random.rand() > self.crossover_prob:

return child1, child2

for i in range(self.n_vars):

if np.random.rand() < 0.5:

if abs(parent1[i] - parent2[i]) > 1e-10:

# Order parents

if parent1[i] < parent2[i]:

y1, y2 = parent1[i], parent2[i]

else:

y1, y2 = parent2[i], parent1[i]

# Calculate beta

yl, yu = self.bounds[i]

beta = 1.0 + (2.0 * (y1 - yl) / (y2 - y1 + 1e-10))

alpha = 2.0 - beta ** (-(self.eta_crossover + 1))

u = np.random.rand()

if u <= 1.0 / alpha:

beta_q = (u * alpha) ** (1.0 / (self.eta_crossover + 1))

else:

beta_q = (1.0 / (2.0 - u * alpha)) ** (1.0 / (self.eta_crossover + 1))

# Create offspring

c1 = 0.5 * ((y1 + y2) - beta_q * (y2 - y1))

c2 = 0.5 * ((y1 + y2) + beta_q * (y2 - y1))

# Ensure bounds

c1 = np.clip(c1, yl, yu)

c2 = np.clip(c2, yl, yu)

# Assign to children randomly

if np.random.rand() < 0.5:

child1[i], child2[i] = c1, c2

else:

child1[i], child2[i] = c2, c1

return child1, child2

def polynomial_mutation(self, individual: np.ndarray) -> np.ndarray:

"""

Polynomial mutation operator.

"""

mutated = individual.copy()

for i in range(self.n_vars):

if np.random.rand() < self.mutation_prob:

y = individual[i]

yl, yu = self.bounds[i]

if yu - yl > 0:

delta1 = (y - yl) / (yu - yl)

delta2 = (yu - y) / (yu - yl)

u = np.random.rand()

if u <= 0.5:

delta_q = (2.0 * u + (1.0 - 2.0 * u) *

(1.0 - delta1) ** (self.eta_mutation + 1)) ** (1.0 / (self.eta_mutation + 1)) - 1.0

else:

delta_q = 1.0 - (2.0 * (1.0 - u) + 2.0 * (u - 0.5) *

(1.0 - delta2) ** (self.eta_mutation + 1)) ** (1.0 / (self.eta_mutation + 1))

mutated[i] = y + delta_q * (yu - yl)

mutated[i] = np.clip(mutated[i], yl, yu)

return mutated

def create_offspring(self, population: np.ndarray, fitnesses: np.ndarray,

fronts: List[List[int]]) -> np.ndarray:

"""

Generate offspring population through selection, crossover, and mutation.

"""

offspring = []

for _ in range(self.pop_size // 2):

# Select parents using tournament selection

parent1_idx = self.tournament_selection(population, fitnesses, fronts)

parent2_idx = self.tournament_selection(population, fitnesses, fronts)

parent1 = population[parent1_idx]

parent2 = population[parent2_idx]

# Crossover

child1, child2 = self.sbx_crossover(parent1, parent2)

# Mutation

child1 = self.polynomial_mutation(child1)

child2 = self.polynomial_mutation(child2)

offspring.extend([child1, child2])

return np.array(offspring[:self.pop_size]) # Ensure correct size

def optimize(self, n_generations: int = 100, verbose: bool = True) -> Tuple[np.ndarray, np.ndarray]:

"""

Run NSGA-II optimization.

Returns:

pareto_set: Decision variables of Pareto optimal solutions

pareto_front: Objective values of Pareto optimal solutions

"""

# Initialize population randomly

population = np.random.uniform(

self.bounds[:, 0],

self.bounds[:, 1],

(self.pop_size, self.n_vars)

)

# Evolution loop

for generation in range(n_generations):

# Evaluate objectives for current population

fitnesses = np.array([

[obj(ind) for obj in self.objectives]

for ind in population

])

# Non-dominated sorting

fronts = self.non_dominated_sort(population, fitnesses)

# Create offspring

offspring = self.create_offspring(population, fitnesses, fronts)

# Evaluate offspring

offspring_fitnesses = np.array([

[obj(ind) for obj in self.objectives]

for ind in offspring

])

# Combine parent and offspring populations

combined_pop = np.vstack([population, offspring])

combined_fit = np.vstack([fitnesses, offspring_fitnesses])

# Non-dominated sorting of combined population

combined_fronts = self.non_dominated_sort(combined_pop, combined_fit)

# Select next generation using elitism

new_population = []

new_population_indices = []

for front in combined_fronts:

if len(new_population) + len(front) <= self.pop_size:

# Add entire front

new_population_indices.extend(front)

else:

# Use crowding distance to select from last front

remaining = self.pop_size - len(new_population_indices)

# Calculate crowding distance for current front

front_fitnesses = combined_fit[front]

distances = self.crowding_distance(front_fitnesses)

# Select individuals with highest crowding distance

sorted_indices = np.argsort(distances)[::-1] # Sort descending

selected = [front[idx] for idx in sorted_indices[:remaining]]

new_population_indices.extend(selected)

break

# Update population

population = combined_pop[new_population_indices]

fitnesses = combined_fit[new_population_indices]

# Progress report

if verbose and (generation + 1) % 10 == 0:

n_pareto = len(self.non_dominated_sort(population, fitnesses)[0])

print(f"Generation {generation + 1}/{n_generations}: "

f"{n_pareto} solutions in Pareto front")

# Extract final Pareto front

final_fronts = self.non_dominated_sort(population, fitnesses)

pareto_indices = final_fronts[0]

pareto_set = population[pareto_indices]

pareto_front = fitnesses[pareto_indices]

return pareto_set, pareto_front

def plot_pareto_front(self, pareto_front: np.ndarray,

obj_names: Optional[List[str]] = None,

title: str = "Pareto Front") -> None:

"""

Visualize the Pareto front for 2D or 3D problems.

"""

n_obj = pareto_front.shape[1]

if obj_names is None:

obj_names = [f"Objective {i+1}" for i in range(n_obj)]

if n_obj == 2:

# 2D plot

plt.figure(figsize=(10, 8))

plt.scatter(pareto_front[:, 0], pareto_front[:, 1],

s=100, c='blue', alpha=0.7, edgecolors='black')

# Sort and connect points

sorted_indices = np.argsort(pareto_front[:, 0])

plt.plot(pareto_front[sorted_indices, 0],

pareto_front[sorted_indices, 1],

'b--', alpha=0.3)

plt.xlabel(obj_names[0], fontsize=12)

plt.ylabel(obj_names[1], fontsize=12)

plt.title(title, fontsize=14, fontweight='bold')

plt.grid(True, alpha=0.3)

# Annotate extremes

min_obj1_idx = np.argmin(pareto_front[:, 0])

min_obj2_idx = np.argmin(pareto_front[:, 1])

plt.annotate(f'Min {obj_names[0]}',

xy=(pareto_front[min_obj1_idx, 0], pareto_front[min_obj1_idx, 1]),

xytext=(10, 10), textcoords='offset points',

bbox=dict(boxstyle='round', facecolor='yellow', alpha=0.5),

arrowprops=dict(arrowstyle='->', color='black'))

plt.annotate(f'Min {obj_names[1]}',

xy=(pareto_front[min_obj2_idx, 0], pareto_front[min_obj2_idx, 1]),

xytext=(10, -20), textcoords='offset points',

bbox=dict(boxstyle='round', facecolor='orange', alpha=0.5),

arrowprops=dict(arrowstyle='->', color='black'))

elif n_obj == 3:

# 3D plot

fig = plt.figure(figsize=(12, 9))

ax = fig.add_subplot(111, projection='3d')

scatter = ax.scatter(pareto_front[:, 0],

pareto_front[:, 1],

pareto_front[:, 2],

s=50, c='blue', alpha=0.7, edgecolors='black')

ax.set_xlabel(obj_names[0], fontsize=10)

ax.set_ylabel(obj_names[1], fontsize=10)

ax.set_zlabel(obj_names[2], fontsize=10)

ax.set_title(title, fontsize=12, fontweight='bold')

# Add grid

ax.grid(True, alpha=0.3)

plt.tight_layout()

plt.show()

# ==============================================================================

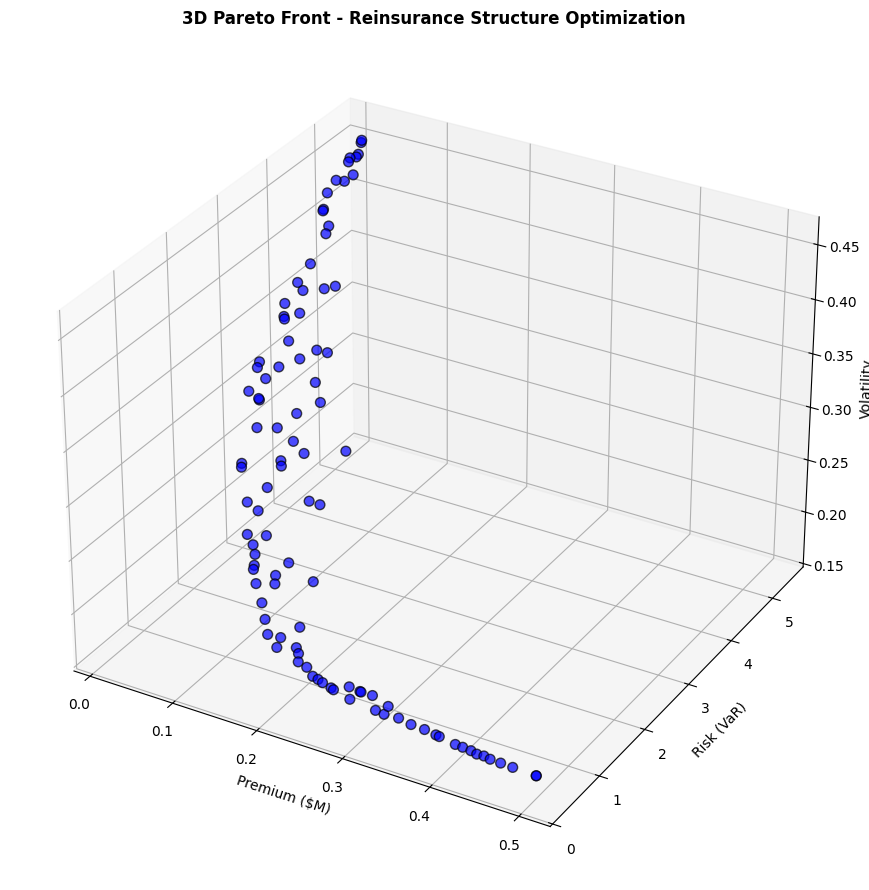

# P&C ACTUARIAL EXAMPLE: THREE-OBJECTIVE REINSURANCE OPTIMIZATION

# ==============================================================================

def reinsurance_optimization_example():

"""

Example: Optimize reinsurance structure with three competing objectives.

Decision Variables:

- x[0]: Retention level (as fraction of exposure)

- x[1]: Primary layer limit (in millions)

- x[2]: Excess layer limit (in millions)

Objectives:

1. Minimize total reinsurance premium

2. Minimize retained risk (VaR)

3. Minimize earnings volatility

"""

print("=" * 70)

print("THREE-OBJECTIVE REINSURANCE STRUCTURE OPTIMIZATION")

print("=" * 70)

def premium_objective(x):

"""

Total reinsurance premium cost.

Premium increases with coverage and decreases with retention.

"""

retention, primary_limit, excess_limit = x

# Base premiums for each layer

primary_rate = 0.025 # 2.5% rate on line for primary

excess_rate = 0.015 # 1.5% rate on line for excess

# Retention discount (higher retention = lower premium)

retention_factor = np.exp(-2 * retention)

# Calculate premiums

primary_premium = primary_rate * primary_limit * (1 + retention_factor)

excess_premium = excess_rate * excess_limit * (1 + 0.5 * retention_factor)

# Loading for small retentions (moral hazard adjustment)

small_retention_loading = 0.1 * np.exp(-5 * retention)

total_premium = primary_premium + excess_premium + small_retention_loading

return total_premium

def risk_objective(x):

"""

Retained risk measured as 99.5% VaR.

Risk increases with retention and decreases with coverage.

"""

retention, primary_limit, excess_limit = x

# Base risk components

frequency_risk = 2.0 * retention ** 0.8

severity_risk = 3.0 * np.exp(-0.5 * (primary_limit + excess_limit))

# Tail risk for uncovered losses

total_coverage = primary_limit + excess_limit

tail_risk = 1.5 * max(0, 1 - total_coverage / 5) ** 2

# Aggregate risk measure

var_995 = frequency_risk + severity_risk + tail_risk

return var_995

def volatility_objective(x):

"""

Earnings volatility (coefficient of variation).

Balance between retention volatility and premium stability.

"""

retention, primary_limit, excess_limit = x

# Retained loss volatility

retained_volatility = 0.4 * retention ** 0.5

# Coverage reduces volatility but with diminishing returns

coverage_benefit = 0.3 * (1 - np.exp(-0.5 * primary_limit))

coverage_benefit += 0.2 * (1 - np.exp(-0.3 * excess_limit))

# Net volatility

net_volatility = retained_volatility * (1 - coverage_benefit) + 0.1

return net_volatility

# Set up optimization problem

objectives = [premium_objective, risk_objective, volatility_objective]

# Variable bounds

bounds = np.array([

[0.1, 0.9], # Retention: 10% to 90%

[0.5, 5.0], # Primary limit: $0.5M to $5M

[0.0, 10.0] # Excess limit: $0M to $10M

])

# Initialize and run NSGA-II

print("\nRunning NSGA-II optimization...")

print("-" * 30)

nsga2 = NSGA2(

objectives=objectives,

bounds=bounds,

pop_size=100,

crossover_prob=0.9,

mutation_prob=None, # Will use 1/n_vars

eta_crossover=20,

eta_mutation=20

)

# Optimize

pareto_set, pareto_front = nsga2.optimize(n_generations=100, verbose=True)

# Analysis of results

print("\n" + "=" * 70)

print("OPTIMIZATION RESULTS")

print("=" * 70)

print(f"\nFound {len(pareto_set)} Pareto-optimal solutions")

# Find extreme solutions

min_premium_idx = np.argmin(pareto_front[:, 0])

min_risk_idx = np.argmin(pareto_front[:, 1])

min_volatility_idx = np.argmin(pareto_front[:, 2])

print("\n1. MINIMUM PREMIUM SOLUTION:")

print(f" Retention: {pareto_set[min_premium_idx, 0]:.1%}")

print(f" Primary Limit: ${pareto_set[min_premium_idx, 1]:.2f}M")

print(f" Excess Limit: ${pareto_set[min_premium_idx, 2]:.2f}M")

print(f" → Premium: ${pareto_front[min_premium_idx, 0]:.3f}M")

print(f" → Risk (VaR): {pareto_front[min_premium_idx, 1]:.3f}")

print(f" → Volatility: {pareto_front[min_premium_idx, 2]:.3f}")

print("\n2. MINIMUM RISK SOLUTION:")

print(f" Retention: {pareto_set[min_risk_idx, 0]:.1%}")

print(f" Primary Limit: ${pareto_set[min_risk_idx, 1]:.2f}M")

print(f" Excess Limit: ${pareto_set[min_risk_idx, 2]:.2f}M")

print(f" → Premium: ${pareto_front[min_risk_idx, 0]:.3f}M")

print(f" → Risk (VaR): {pareto_front[min_risk_idx, 1]:.3f}")

print(f" → Volatility: {pareto_front[min_risk_idx, 2]:.3f}")

print("\n3. MINIMUM VOLATILITY SOLUTION:")

print(f" Retention: {pareto_set[min_volatility_idx, 0]:.1%}")

print(f" Primary Limit: ${pareto_set[min_volatility_idx, 1]:.2f}M")

print(f" Excess Limit: ${pareto_set[min_volatility_idx, 2]:.2f}M")

print(f" → Premium: ${pareto_front[min_volatility_idx, 0]:.3f}M")

print(f" → Risk (VaR): {pareto_front[min_volatility_idx, 1]:.3f}")

print(f" → Volatility: {pareto_front[min_volatility_idx, 2]:.3f}")

# Find balanced solution (minimum distance to utopia point)

utopia_point = pareto_front.min(axis=0)

nadir_point = pareto_front.max(axis=0)

normalized_front = (pareto_front - utopia_point) / (nadir_point - utopia_point + 1e-10)

distances = np.sqrt(np.sum(normalized_front ** 2, axis=1))

balanced_idx = np.argmin(distances)

print("\n4. BALANCED SOLUTION (Closest to Utopia):")

print(f" Retention: {pareto_set[balanced_idx, 0]:.1%}")

print(f" Primary Limit: ${pareto_set[balanced_idx, 1]:.2f}M")

print(f" Excess Limit: ${pareto_set[balanced_idx, 2]:.2f}M")

print(f" → Premium: ${pareto_front[balanced_idx, 0]:.3f}M")

print(f" → Risk (VaR): {pareto_front[balanced_idx, 1]:.3f}")

print(f" → Volatility: {pareto_front[balanced_idx, 2]:.3f}")

# Calculate hypervolume (simplified)

print("\n" + "=" * 70)

print("SOLUTION QUALITY METRICS")

print("=" * 70)

# Reference point for hypervolume (slightly worse than nadir)

ref_point = nadir_point * 1.1

# Approximate hypervolume using Monte Carlo

n_samples = 10000

random_points = np.random.uniform(utopia_point, ref_point, (n_samples, 3))

dominated_count = 0

for point in random_points:

# Check if point is dominated by any solution in Pareto front

for pf_point in pareto_front:

if np.all(pf_point <= point):

dominated_count += 1

break

hypervolume = dominated_count / n_samples * np.prod(ref_point - utopia_point)

print(f"\nApproximate Hypervolume: {hypervolume:.3f}")

print(f"(Larger values indicate better coverage of objective space)")

# Spacing metric (uniformity of distribution)

min_distances = []

for i in range(len(pareto_front)):

distances_to_others = []

for j in range(len(pareto_front)):

if i != j:

dist = np.linalg.norm(normalized_front[i] - normalized_front[j])

distances_to_others.append(dist)

min_distances.append(min(distances_to_others))

spacing = np.std(min_distances)

print(f"Spacing Metric: {spacing:.4f}")

print(f"(Lower values indicate more uniform distribution)")

# Visualization

print("\n" + "=" * 70)

print("VISUALIZING PARETO FRONT")

print("=" * 70)

nsga2.plot_pareto_front(

pareto_front,

obj_names=['Premium ($M)', 'Risk (VaR)', 'Volatility'],

title='3D Pareto Front - Reinsurance Structure Optimization'

)

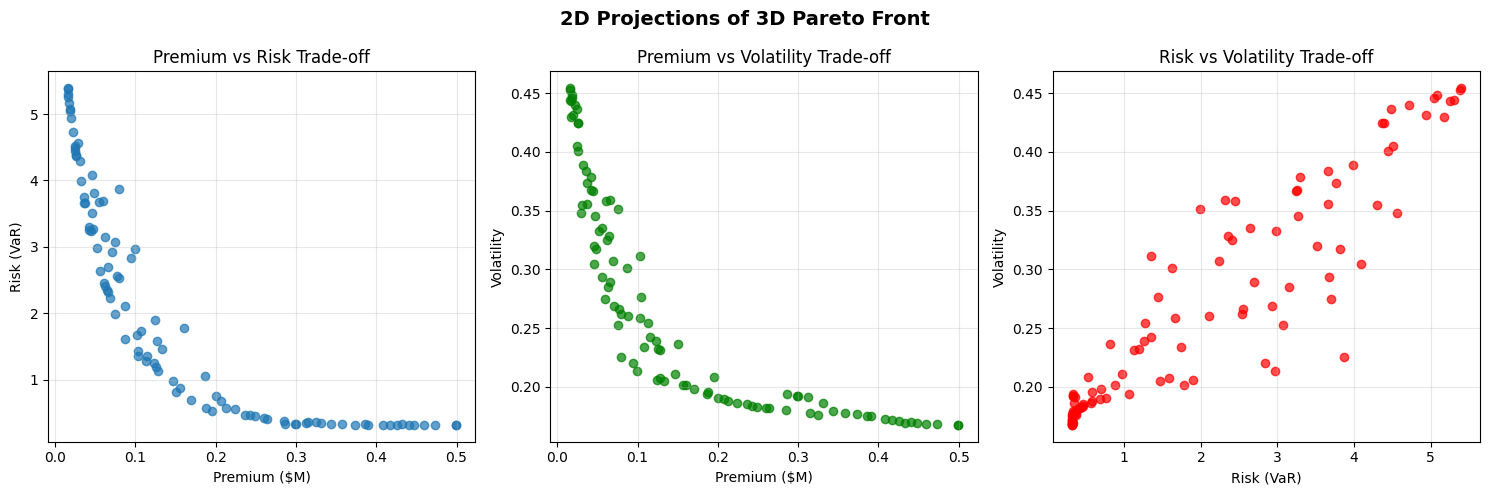

# Also create 2D projections

fig, axes = plt.subplots(1, 3, figsize=(15, 5))

# Premium vs Risk

axes[0].scatter(pareto_front[:, 0], pareto_front[:, 1], alpha=0.7)

axes[0].set_xlabel('Premium ($M)')

axes[0].set_ylabel('Risk (VaR)')

axes[0].set_title('Premium vs Risk Trade-off')

axes[0].grid(True, alpha=0.3)

# Premium vs Volatility

axes[1].scatter(pareto_front[:, 0], pareto_front[:, 2], alpha=0.7, color='green')

axes[1].set_xlabel('Premium ($M)')

axes[1].set_ylabel('Volatility')

axes[1].set_title('Premium vs Volatility Trade-off')

axes[1].grid(True, alpha=0.3)

# Risk vs Volatility

axes[2].scatter(pareto_front[:, 1], pareto_front[:, 2], alpha=0.7, color='red')

axes[2].set_xlabel('Risk (VaR)')

axes[2].set_ylabel('Volatility')

axes[2].set_title('Risk vs Volatility Trade-off')

axes[2].grid(True, alpha=0.3)

plt.suptitle('2D Projections of 3D Pareto Front', fontsize=14, fontweight='bold')

plt.tight_layout()

plt.show()

return pareto_set, pareto_front

# ==============================================================================

# MAIN EXECUTION

# ==============================================================================

if __name__ == "__main__":

# Set random seed for reproducibility

np.random.seed(42)

# Run the reinsurance optimization example

pareto_set, pareto_front = reinsurance_optimization_example()

# Additional analysis

print("\n" + "=" * 70)

print("DECISION SUPPORT INSIGHTS")

print("=" * 70)

print("\nKey Findings:")

print("• The Pareto front reveals clear trade-offs between premium, risk, and volatility")

print("• No single solution dominates - actuarial judgment needed for final selection")

print("• Balanced solutions offer reasonable compromises across all objectives")

print("• The algorithm found diverse solutions covering the objective space well")

print("\nRecommendations for Implementation:")

print("1. Present 3-5 representative solutions to stakeholders")

print("2. Consider risk appetite and capital constraints for final selection")

print("3. Perform sensitivity analysis on selected solutions")

print("4. Validate results using detailed simulation models")

print("5. Monitor actual vs expected performance post-implementation")

Sample Output

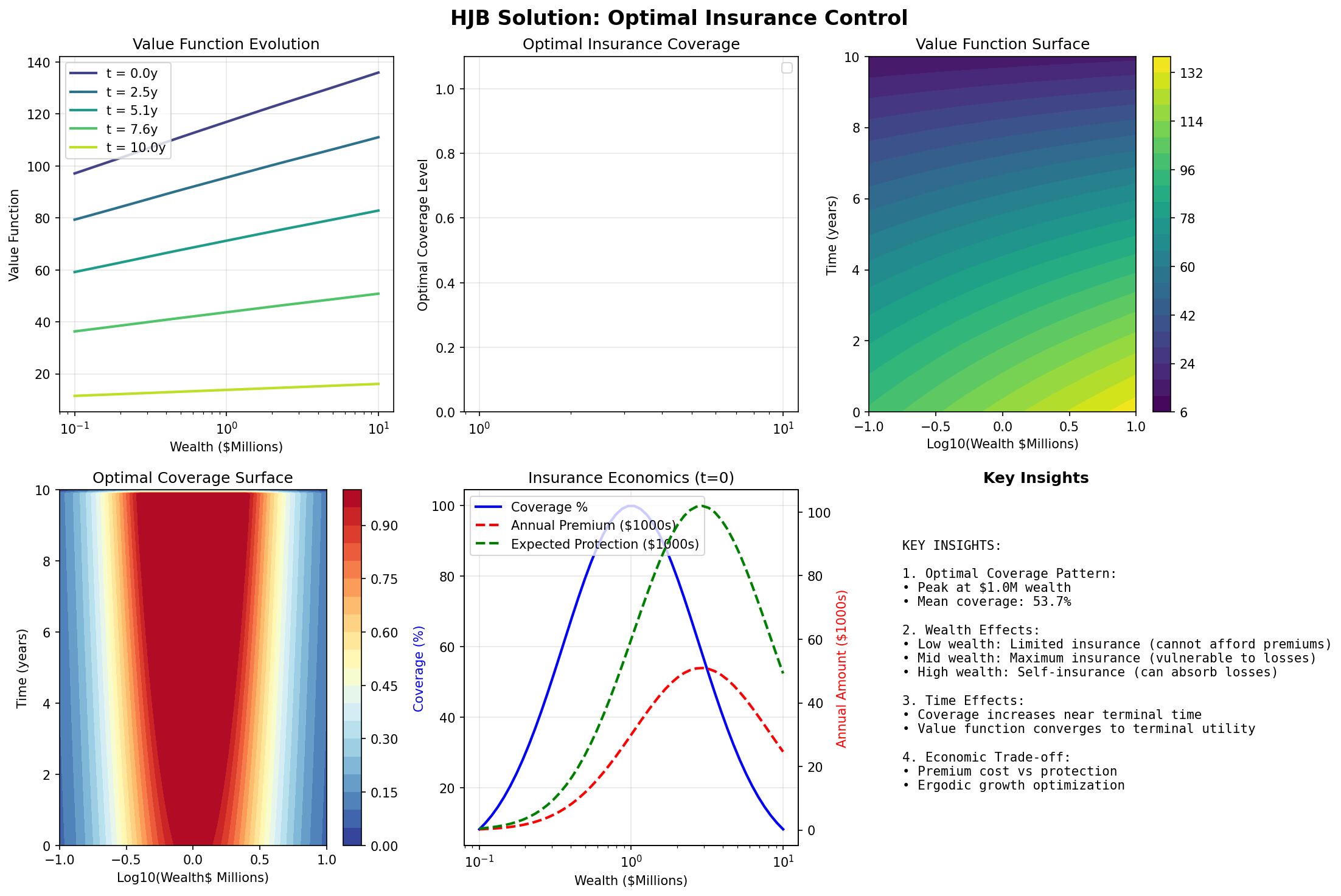

Hamilton-Jacobi-Bellman Equations

The Hamilton-Jacobi-Bellman (HJB) equation is a fundamental tool in stochastic optimal control theory with direct applications to dynamic decision-making problems in insurance, particularly in optimal reinsurance design, dynamic premium adjustment, and surplus management.

Optimal Control Problem

The value function \(V(t, x)\) represents the maximum expected utility (or minimum expected cost) achievable from time \(t\) to terminal time \(T\), starting from state \(x\) at time \(t\):

Actuarial interpretation:

State variable \(x(t)\): Organization’s financial position (e.g., retained earnings, working capital, cumulative losses, or risk-adjusted assets)

Control variable \(u(t)\): Insurance purchasing decisions such as retention levels, coverage limits, deductible selection, or proportion of risk to transfer

Running reward/cost \(L(t, x, u)\): Net benefit from risk management strategy (operating profit minus total cost of risk: premiums, retained losses, and risk financing costs)

Terminal value \(\Phi(x(T))\): Target financial position at planning horizon (e.g., equity value, capital adequacy, or cost of failing to meet financial covenants)

Essentially, we’re looking for optimal control \(u\) that optimizes utility \(L\)

HJB Partial Differential Equation

The HJB equation provides necessary conditions for optimality:

with boundary condition: \(V(T, x) = \Phi(x)\) that ensures consistency with the terminal objective.

\(\sigma\) is the diffusion/volatility matrix, \(\sigma^\textsf{T}\) is its transpose, and \(\sigma \sigma^\textsf{T}\) forms the covariance matrix.

Component breakdown:

\(\frac{\partial V}{\partial t}\): Change in strategy value over time: captures how the optimal risk financing strategy evolves as you approach renewal periods or financial targets

\(L(t, x, u)\): Current period’s risk-adjusted performance: your operating results net of insurance costs (premiums paid) and retained losses, reflecting the immediate impact of your risk transfer decisions

\(\nabla V \cdot f(t, x, u)\): Expected trajectory of financial position: how your chosen insurance structure affects expected cash flows, accounting for predictable business growth, insurance premium payments, and expected retained losses under your deductible/SIR

\(\frac{1}{2} \text{tr}(\sigma \sigma^\textsf{T} \nabla^2 V)\): Volatility penalty/benefit: adjustment for earnings volatility based on your retention strategy; higher retentions increase volatility (larger \(\sigma\)) but save premium, while more insurance transfer reduces volatility at a cost

The HJB framework helps determine optimal insurance program structure by balancing premium costs against retained risk exposure and earnings volatility, all while considering your organization’s risk tolerance and financial objectives.

Insurance Application

# Simplified HJB Solver for Insurance Control

# This demonstrates the key concepts without the full complexity

import numpy as np

import matplotlib.pyplot as plt

from scipy import interpolate

class SimplifiedHJBSolver:

"""Simplified HJB solver for insurance control demonstration."""

def __init__(self, wealth_min=1e5, wealth_max=1e7, n_wealth=50, n_time=100):

"""Initialize the solver with wealth and time grids."""

# Create wealth grid (log-spaced for better resolution)

self.wealth_grid = np.logspace(np.log10(wealth_min), np.log10(wealth_max), n_wealth)

self.n_wealth = n_wealth

# Time parameters

self.T = 10.0 # 10-year horizon

self.dt = self.T / n_time

self.n_time = n_time

self.time_grid = np.linspace(0, self.T, n_time)

# Model parameters

self.growth_rate = 0.08 # 8% expected growth

self.volatility = 0.20 # 20% volatility

self.discount_rate = 0.05 # 5% discount rate

# Insurance parameters

self.base_premium_rate = 0.03 # 3% of wealth for full coverage

self.loss_frequency = 0.2 # Expected losses per year

self.loss_severity = 0.3 # Average loss as fraction of wealth

def utility(self, wealth):

"""Log utility function for ergodic optimization."""

return np.log(np.maximum(wealth, 1e4))

def optimal_coverage(self, wealth, time_to_maturity):

"""Compute optimal insurance coverage analytically (simplified)."""

# Simplified rule: more insurance for middle wealth levels

# Low wealth: can't afford insurance

# High wealth: can self-insure

# Wealth-dependent coverage

log_wealth = np.log10(wealth)

log_min = np.log10(1e5)

log_max = np.log10(1e7)

# Normalized wealth (0 to 1)

normalized = (log_wealth - log_min) / (log_max - log_min)

# Bell-shaped coverage function

coverage = np.exp(-((normalized - 0.5) ** 2) / 0.1)

# Adjust for time to maturity (more coverage near end)

time_factor = 1 + 0.5 * (1 - time_to_maturity / self.T)

coverage = coverage * time_factor

return np.clip(coverage, 0, 1)

def value_function(self, wealth, time):

"""Compute value function (simplified closed-form approximation)."""

time_to_maturity = self.T - time

# Terminal value

if time_to_maturity < 1e-6:

return self.utility(wealth)

# Expected growth factor

growth_factor = np.exp((self.growth_rate - 0.5 * self.volatility**2) * time_to_maturity)

# Value approximation

expected_wealth = wealth * growth_factor

value = self.utility(expected_wealth) + 0.5 * time_to_maturity

return value

def solve(self):

"""Solve for value function and optimal policy."""

# Initialize arrays

V = np.zeros((self.n_time, self.n_wealth))

optimal_coverage = np.zeros((self.n_time, self.n_wealth))

# Terminal condition

V[-1, :] = self.utility(self.wealth_grid)

# Backward iteration (simplified)

for t_idx in range(self.n_time - 2, -1, -1):

time = self.time_grid[t_idx]

time_to_maturity = self.T - time

# Compute optimal coverage

for w_idx, wealth in enumerate(self.wealth_grid):

coverage = self.optimal_coverage(wealth, time_to_maturity)

optimal_coverage[t_idx, w_idx] = coverage

# Compute value (simplified Bellman equation)

# Expected continuation value

expected_growth = self.growth_rate - self.base_premium_rate * coverage

# Risk reduction from insurance

risk_reduction = coverage * self.loss_frequency * self.loss_severity * wealth

# Value update

continuation_value = V[t_idx + 1, w_idx]

instant_reward = self.dt * (self.utility(wealth) + risk_reduction / wealth)

V[t_idx, w_idx] = (1 - self.discount_rate * self.dt) * continuation_value + instant_reward

return V, optimal_coverage

def plot_results(self, V, optimal_coverage):

"""Create clear visualizations of the HJB solution."""

fig, axes = plt.subplots(2, 3, figsize=(15, 10))

fig.suptitle('HJB Solution: Optimal Insurance Control', fontsize=16, fontweight='bold')

# Select time slices to show

time_indices = [0, self.n_time // 4, self.n_time // 2, 3 * self.n_time // 4, -1]

time_labels = [f't = {self.time_grid[idx]:.1f}y' for idx in time_indices]

colors = plt.cm.viridis(np.linspace(0.2, 0.9, len(time_indices)))

# 1. Value Function Evolution

ax1 = axes[0, 0]

for idx, label, color in zip(time_indices, time_labels, colors):

ax1.plot(self.wealth_grid / 1e6, V[idx, :], label=label, color=color, linewidth=2)

ax1.set_xlabel('Wealth ($Millions)')

ax1.set_ylabel('Value Function')

ax1.set_title('Value Function Evolution')

ax1.set_xscale('log')

ax1.legend(loc='best')

ax1.grid(True, alpha=0.3) # 2. Optimal Coverage Evolution ax2 = axes[0, 1] for idx, label, color in zip(time_indices, time_labels, colors): ax2.plot(self.wealth_grid / 1e6, optimal_coverage[idx, :], label=label, color=color, linewidth=2) ax2.set_xlabel('Wealth ($ Millions)')

ax2 = axes[0, 1]

ax2.set_ylabel('Optimal Coverage Level')

ax2.set_title('Optimal Insurance Coverage')

ax2.set_xscale('log')

ax2.set_ylim([0, 1.1])

ax2.legend(loc='best')

ax2.grid(True, alpha=0.3)

# 3. Value Function Surface (3D view)

ax3 = axes[0, 2]

W, T = np.meshgrid(self.wealth_grid / 1e6, self.time_grid)

contour = ax3.contourf(np.log10(W), T, V, levels=20, cmap='viridis')

ax3.set_xlabel('Log10(Wealth $Millions)')

ax3.set_ylabel('Time (years)')

ax3.set_title('Value Function Surface')

plt.colorbar(contour, ax=ax3)

# 4. Optimal Coverage Surface

ax4 = axes[1, 0]

contour2 = ax4.contourf(np.log10(W), T, optimal_coverage, levels=20, cmap='RdYlBu_r')

ax4.set_xlabel('Log10(Wealth$ Millions)')

ax4.set_ylabel('Time (years)')

ax4.set_title('Optimal Coverage Surface')

plt.colorbar(contour2, ax=ax4)

# 5. Coverage vs Wealth (at t=0)

ax5 = axes[1, 1]

coverage_t0 = optimal_coverage[0, :]

premium_cost = self.base_premium_rate * coverage_t0 * self.wealth_grid

expected_protection = self.loss_frequency * self.loss_severity * coverage_t0 * self.wealth_grid

ax5.plot(self.wealth_grid / 1e6, coverage_t0 * 100, 'b-', label='Coverage %', linewidth=2)

ax5_twin = ax5.twinx()

ax5_twin.plot(self.wealth_grid / 1e6, premium_cost / 1e3, 'r--',

label='Annual Premium ($1000s)', linewidth=2)

ax5_twin.plot(self.wealth_grid / 1e6, expected_protection / 1e3, 'g--',

label='Expected Protection ($1000s)', linewidth=2)

ax5.set_xlabel('Wealth ($Millions)')

ax5.set_ylabel('Coverage (%)', color='b')

ax5_twin.set_ylabel('Annual Amount ($1000s)', color='r')

ax5.set_xscale('log')

ax5.set_title('Insurance Economics (t=0)')

ax5.grid(True, alpha=0.3)

# Combine legends

lines1, labels1 = ax5.get_legend_handles_labels()

lines2, labels2 = ax5_twin.get_legend_handles_labels()

ax5.legend(lines1 + lines2, labels1 + labels2, loc='upper left')

# 6. Key Insights

ax6 = axes[1, 2]

ax6.axis('off')

# Calculate key metrics

mean_coverage = np.mean(optimal_coverage[0, :])

peak_coverage_wealth = self.wealth_grid[np.argmax(optimal_coverage[0, :])]

insights_text = f"""

KEY INSIGHTS:

1. Optimal Coverage Pattern:

• Peak at ${peak_coverage_wealth/1e6:.1f}M wealth

• Mean coverage: {mean_coverage:.1%}

2. Wealth Effects:

• Low wealth: Limited insurance (cannot afford premiums)

• Mid wealth: Maximum insurance (vulnerable to losses)

• High wealth: Self-insurance (can absorb losses)

3. Time Effects:

• Coverage increases near terminal time

• Value function converges to terminal utility

4. Economic Trade-off:

• Premium cost vs protection

• Ergodic growth optimization

"""

ax6.text(0.1, 0.9, insights_text, transform=ax6.transAxes, fontsize=10, verticalalignment='top', fontfamily='monospace')

ax6.set_title('Key Insights', fontweight='bold')

plt.tight_layout()

plt.savefig('figures/hjb_solver_result_clear.png', dpi=150, bbox_inches='tight')

plt.show()

return fig

# Create and solve the HJB problem

print("Solving simplified HJB equation for insurance control...")

solver = SimplifiedHJBSolver()

V, optimal_coverage = solver.solve()

# Create visualizations

fig = solver.plot_results(V, optimal_coverage)

# Print numerical results

print("\n" + "="*60)

print("HJB SOLUTION SUMMARY")

print("="*60)

# Analyze coverage at t=0

coverage_t0 = optimal_coverage[0, :]

wealth_grid = solver.wealth_grid

# Find transition points

low_coverage_idx = np.where(coverage_t0 < 0.2)[0]

high_coverage_idx = np.where(coverage_t0 > 0.8)[0]

mid_coverage_idx = np.where((coverage_t0 >= 0.2) & (coverage_t0 <= 0.8))[0]

print(f"\nWealth Segments (at t=0):")

if len(low_coverage_idx) > 0:

print(f"• Low coverage (<20%):${wealth_grid[low_coverage_idx].min()/1e6:.1f}M - ${wealth_grid[low_coverage_idx].max()/1e6:.1f}M")

if len(mid_coverage_idx) > 0:

print(f"• Moderate coverage (20-80%):${wealth_grid[mid_coverage_idx].min()/1e6:.1f}M - ${wealth_grid[mid_coverage_idx].max()/1e6:.1f}M")

if len(high_coverage_idx) > 0:

print(f"• High coverage (>80%):${wealth_grid[high_coverage_idx].min()/1e6:.1f}M - ${wealth_grid[high_coverage_idx].max()/1e6:.1f}M")

print(f"\nOptimal Coverage Statistics:")

print(f"• Mean: {np.mean(coverage_t0):.1%}")

print(f"• Max: {np.max(coverage_t0):.1%}")

print(f"• Min: {np.min(coverage_t0):.1%}")

print(f"• Peak at:${wealth_grid[np.argmax(coverage_t0)]/1e6:.2f}M")

print(f"\nValue Function Properties:")

print(f"• Initial value range: [{V[0, :].min():.2f}, {V[0, :].max():.2f}]")

print(f"• Terminal value range: [{V[-1, :].min():.2f}, {V[-1, :].max():.2f}]")

print(f"• Value increase: {(V[0, :].mean() - V[-1, :].mean()):.2f}")

print("\nThis simplified HJB solution demonstrates:")

print("1. Dynamic programming backward iteration")

print("2. Wealth-dependent optimal insurance")

print("3. Time evolution of value and policy")

print("4. Ergodic growth considerations")

Sample Output

============================================================

HJB SOLUTION SUMMARY

============================================================

Wealth Segments (at t=0):

• Low coverage (<20%):$0.1M - $10.0M

• Moderate coverage (20-80%):$0.2M - $6.3M

• High coverage (>80%):$0.5M - $1.8M

Optimal Coverage Statistics:

• Mean: 53.7%

• Max: 99.9%

• Min: 8.2%

• Peak at:$0.95M