Insurance Mathematics

💰 Why This Matters

Insurance mathematics reveal that frequency-severity modeling captures the dual nature of risk (how often losses occur and how severe they are), with heavy-tailed distributions like Pareto essential for modeling catastrophic events where traditional Gaussian assumptions fail to capture the true magnitude of the downside. The layer pricing framework shows why excess-of-loss structures dominate: they efficiently separate attritional losses (predictable, retained) from severity losses (volatile, transferred), optimizing the premium-to-protection tradeoff. Retention optimization through the ergodic lens demonstrates that optimal retention increases with wealth in absolute terms but decreases as a percentage of wealth; i.e., wealthier entities should retain more risk but proportionally less. The compound distribution mathematics proves that aggregate losses have fundamentally different properties than individual claims, explaining why reinsurers price differently than primary insurers. Claims development triangles and chain ladder methods quantify the time value of uncertainty, showing why early reserving decisions compound into material impacts. This framework transforms insurance from a cost center to a growth enabler by quantifying exactly how volatility reduction through strategic risk transfer enhances long-term compound returns, the mathematical foundation for why insurance creates value beyond simple loss indemnification.

Table of Contents

Frequency-Severity Models

Classical Framework

Insurance losses are modeled as a two-stage process:

Frequency: Number of claims in a period

Severity: Size of each claim

Total loss:

\(N\) = Number of claims (random)

\(X_i\) = Size of \(i\)-th claim (random)

Frequency Distributions

Poisson Distribution

Most common for claim counts:

Properties:

Mean = Variance = \(\lambda\)

Memoryless inter-arrival times

Suitable for homogeneous risks

Note: in practice, Over-Dispersed Poisson (ODP), where Variance exceeds the Mean, is preferred because claim estimation introduces uncertainty. For simplicity, we start the implementation with a regular Poisson model.

Negative Binomial

For overdispersed counts (variance > mean) and correlated claims:

Properties:

Mean = \(r(1-p)/p\)

Variance = \(r(1-p)/p^2\) > Mean

Captures heterogeneity via mixing

Zero-Inflated Models

When many policies have no claims:

Severity Distributions

Log-Normal

For moderate to large claims:

Properties:

Right-skewed

Multiplicative effects

No upper bound

Pareto

For extreme losses (heavy-tailed):

Properties:

Power-law tail

Infinite variance if \(\alpha \leq 2\)

Scale-invariant

Generalized Pareto (GPD)

For excess losses above threshold:

\(\xi\) = Shape parameter (tail index)

\(\sigma\) = Scale parameter

Implementation Example

import numpy as np

from scipy import stats

import matplotlib.pyplot as plt

class FrequencySeverityModel:

"""Model insurance losses using frequency-severity approach."""

def __init__(self, freq_dist, sev_dist):

self.freq_dist = freq_dist

self.sev_dist = sev_dist

def simulate_annual_loss(self, n_sims=10_000):

"""Simulate total annual losses."""

total_losses = []

for _ in range(n_sims):

# Number of claims

n_claims = self.freq_dist.rvs()

if n_claims == 0:

total_losses.append(0)

else:

# Individual claim amounts

claims = self.sev_dist.rvs(size=n_claims)

total_losses.append(np.sum(claims))

return np.array(total_losses)

def calculate_statistics(self, losses):

"""Calculate key statistics."""

return {

'mean': np.mean(losses),

'std': np.std(losses),

'median': np.median(losses),

'p95': np.percentile(losses, 95),

'p99': np.percentile(losses, 99),

'p99.5': np.percentile(losses, 99.5),

'max': np.max(losses),

'prob_zero': np.mean(losses == 0)

}

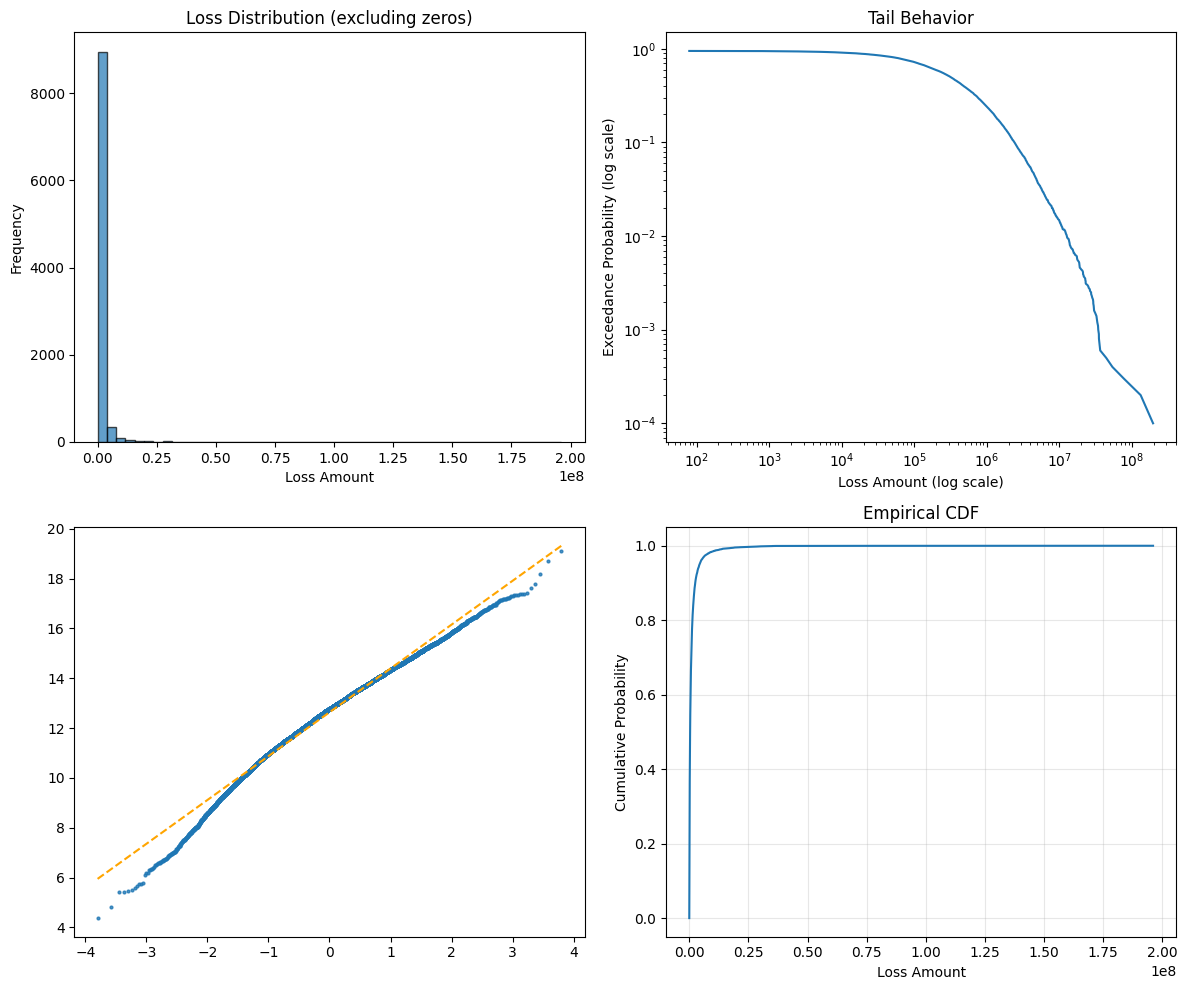

def plot_distribution(self, losses):

"""Visualize loss distribution."""

fig, axes = plt.subplots(2, 2, figsize=(12, 10))

# Histogram

axes[0, 0].hist(losses[losses > 0], bins=50,

edgecolor='black', alpha=0.7)

axes[0, 0].set_xlabel('Loss Amount')

axes[0, 0].set_ylabel('Frequency')

axes[0, 0].set_title('Loss Distribution (excluding zeros)')

# Log-log plot for tail

sorted_losses = np.sort(losses[losses > 0])

exceedance_prob = np.arange(len(sorted_losses), 0, -1) / len(losses)

axes[0, 1].loglog(sorted_losses, exceedance_prob)

axes[0, 1].set_xlabel('Loss Amount (log scale)')

axes[0, 1].set_ylabel('Exceedance Probability (log scale)')

axes[0, 1].set_title('Tail Behavior')

# Recreate Q-Q plot manually to control colors: data points in default blue, fit line in orange

(osm, osr), (slope, intercept, r) = stats.probplot(

np.log(losses[losses > 0]), dist="norm", fit=True)

axes[1, 0].plot(osm, osr, marker='.', linestyle='none',

markersize=4, color='C0', alpha=0.8)

axes[1, 0].plot(osm, slope * np.asarray(osm) + intercept,

color='orange', linestyle='--', linewidth=1.5)

# Empirical CDF

axes[1, 1].plot(sorted_losses, np.arange(

1, len(sorted_losses) + 1) / len(sorted_losses))

axes[1, 1].set_xlabel('Loss Amount')

axes[1, 1].set_ylabel('Cumulative Probability')

axes[1, 1].set_title('Empirical CDF')

axes[1, 1].grid(True, alpha=0.3)

plt.tight_layout()

return fig

# Example: Commercial property insurance

freq_dist = stats.poisson(mu=3) # 3 claims per year on average

sev_dist = stats.lognorm(s=2, scale=50_000) # Log-normal severity

model = FrequencySeverityModel(freq_dist, sev_dist)

losses = model.simulate_annual_loss(n_sims=10_000)

statistics = model.calculate_statistics(losses)

model.plot_distribution(losses)

print("Annual Loss Statistics:")

for key, value in statistics.items():

if key == 'prob_zero':

print(f"{key}: {value:.1%}")

else:

print(f"{key}: ${value:,.0f}")

Sample Output

Annual Loss Statistics:

mean: $1,089,751

std: $3,579,880

median: $318,641

p95: $4,191,252

p99: $12,699,935

p99.5: $18,849,964

max: $196,094,596

prob_zero: 5.0%

Compound Distributions

Definition

The compound distribution of total losses \(S = \sum_{i=1}^N X_i\) has:

Characteristic function:

where \(G_N\) is the probability generating function of \(N\).

Compound Poisson

When frequency \(N \sim \text{Poisson}(\lambda)\) and severities \(X_i\) are i.i.d.:

Mean: \(E[S] = \lambda \cdot E[X]\) Variance: \(\text{Var}(S) = \lambda \cdot E[X^2]\) Skewness: \(\text{Skew}(S) = \frac{E[X^3]}{\lambda^{1/2} \cdot E[X^2]^{3/2}}\)

Panjer Recursion

For discrete severities, recursive approximation of \(S\) is given by:

where:

\(p_k = P(S = k)\)

\(f_j = P(X = j)\)

\((a, b)\) depend on frequency distribution

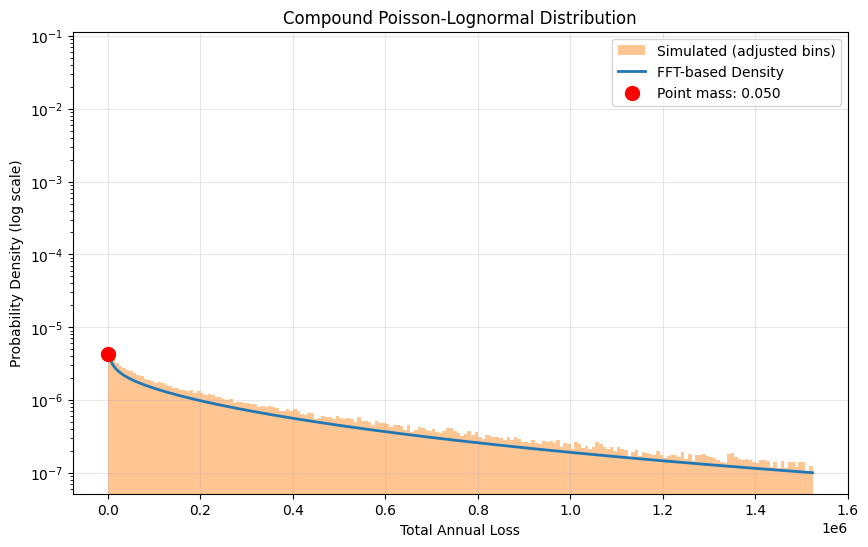

Fast Fourier Transform Method

FFT provides a computationally efficient approach for determining the aggregate loss distribution for a given frequency-severity model. The method exploits the relationship between the characteristic functions and probability generating functions.

For continuous distributions:

import numpy as np

from scipy import stats

import matplotlib.pyplot as plt

def compound_distribution_fft(freq_params, sev_params, x_max=1e8, n_points=2**16):

"""Calculate compound distribution using FFT - CORRECTED."""

dx = x_max / n_points

x = np.arange(n_points) * dx

# Discretize severity distribution WITHOUT normalization

sev_pmf = stats.lognorm.pdf(x[1:], s=sev_params["s"], scale=sev_params["scale"]) * dx

# Prepend zero for x[0] since individual claims can't be zero

sev_pmf = np.concatenate([[0], sev_pmf])

# Check how much probability mass we captured (should be close to 1)

captured_mass = sev_pmf.sum()

print(f"Captured severity mass: {captured_mass:.6f}")

# DON'T normalize - use the natural discretization

# The small missing mass in the tail is acceptable

# FFT operations

sev_cf = np.fft.fft(sev_pmf)

lambda_param = freq_params["lambda"]

compound_cf = np.exp(lambda_param * (sev_cf - 1))

compound_pmf = np.real(np.fft.ifft(compound_cf))

# The compound_pmf now contains:

# - At index 0: P(S = 0) (point mass)

# - At other indices: probability masses for discretized positive values

prob_zero = compound_pmf[0]

# Convert to density (but keep point mass separate)

pdf = compound_pmf / dx

pdf[0] = 0 # Remove point mass from density

return x, pdf, prob_zero

# Calculate FFT solution

freq_params={"lambda": 3}

sev_params={"s": 2, "scale": 50_000}

x, pdf, prob_zero = compound_distribution_fft(freq_params=freq_params, sev_params=sev_params)

# Simulate

n_sims = 100_000

freq = stats.poisson(mu=3)

sev = stats.lognorm(s=2, scale=50_000)

sim_losses = np.zeros(n_sims)

for i in range(n_sims):

n_claims = freq.rvs()

if n_claims > 0:

sim_losses[i] = sev.rvs(size=n_claims).sum()

plt.figure(figsize=(10, 6))

# Plot with adjusted bins

x_plot_max = x[999]

bin_edges = np.concatenate([[0, 1], np.linspace(1, x_plot_max, 199)])

plt.hist(sim_losses, bins=bin_edges, density=True,

alpha=0.45, color='C1', zorder=1, label='Simulated (adjusted bins)')

# Plot continuous part

plt.semilogy(x[1:1000], pdf[1:1000], label='FFT-based Density', linewidth=2)

# Mark the point mass

plt.scatter([0], [pdf[1]], color='red', s=100, zorder=5,

label=f'Point mass: {prob_zero:.3f}')

plt.xlabel("Total Annual Loss")

plt.ylabel("Probability Density (log scale)")

plt.title("Compound Poisson-Lognormal Distribution")

plt.grid(True, alpha=0.3)

plt.legend(loc='best')

plt.show()

# Better validation: Compare key statistics

sim_mean = np.mean(sim_losses)

sim_std = np.std(sim_losses)

# Theoretical values

theory_mean = freq_params["lambda"] * stats.lognorm.mean(s=sev_params["s"], scale=sev_params["scale"])

theory_var = (freq_params["lambda"] *

stats.lognorm.var(s=sev_params["s"], scale=sev_params["scale"]) +

freq_params["lambda"] *

stats.lognorm.mean(s=sev_params["s"], scale=sev_params["scale"])**2)

theory_std = np.sqrt(theory_var)

print(f"\nValidation Statistics:")

print(f"Mean - Simulated: {sim_mean:,.0f}, Theoretical: {theory_mean:,.0f}")

print(f"Std Dev - Simulated: {sim_std:,.0f}, Theoretical: {theory_std:,.0f}")

print(f"P(Loss = 0) - Simulated: {np.mean(sim_losses == 0):.4f}, Theoretical: {prob_zero:.4f}")

Sample Output

Validation Statistics:

Mean - Simulated: 1,109,983, Theoretical: 1,108,358

Std Dev - Simulated: 4,216,943, Theoretical: 4,728,338

P(Loss = 0) - Simulated: 0.0496, Theoretical: 0.0498

Layer Pricing Theory

Excess of Loss Layers Insurance coverage is structured in layers:

Primary: \(\$0\) to \(L_1\)

First Excess: \(L_1\) to \(L_2\)

Second Excess: \(L_2\) to \(L_3\), etc.

Layer Loss Calculation

For layer\([a, b]\), the loss is:

Expected layer loss:

Increased Limits Factors (ILFs)

Ratio of expected loss at different limits:

where \(L_0\) is the base limit.

Exposure Curves

Proportion of loss in layer:

where \(M\) is the maximum possible loss.

Layer Pricing Example

For an exploration of Insurance Layers, see this Jupyter Notebook on Insurance Layer Optimization.

Retention Optimization

Objective Function

Maximize utility or growth:

\(R\) = Retention level

\(P(R)\) = Premium function

\(L\) = Random loss

\(W\) = Initial wealth

This function balances lower premium \(P(R)\) vs risk exposure \((L \wedge R)\).

First-Order Condition

For differentiable utility: $\( P'(R) = E[U'(W - P(R) - (L \wedge R)) \cdot \mathbf{1}_{L > R}] \)$

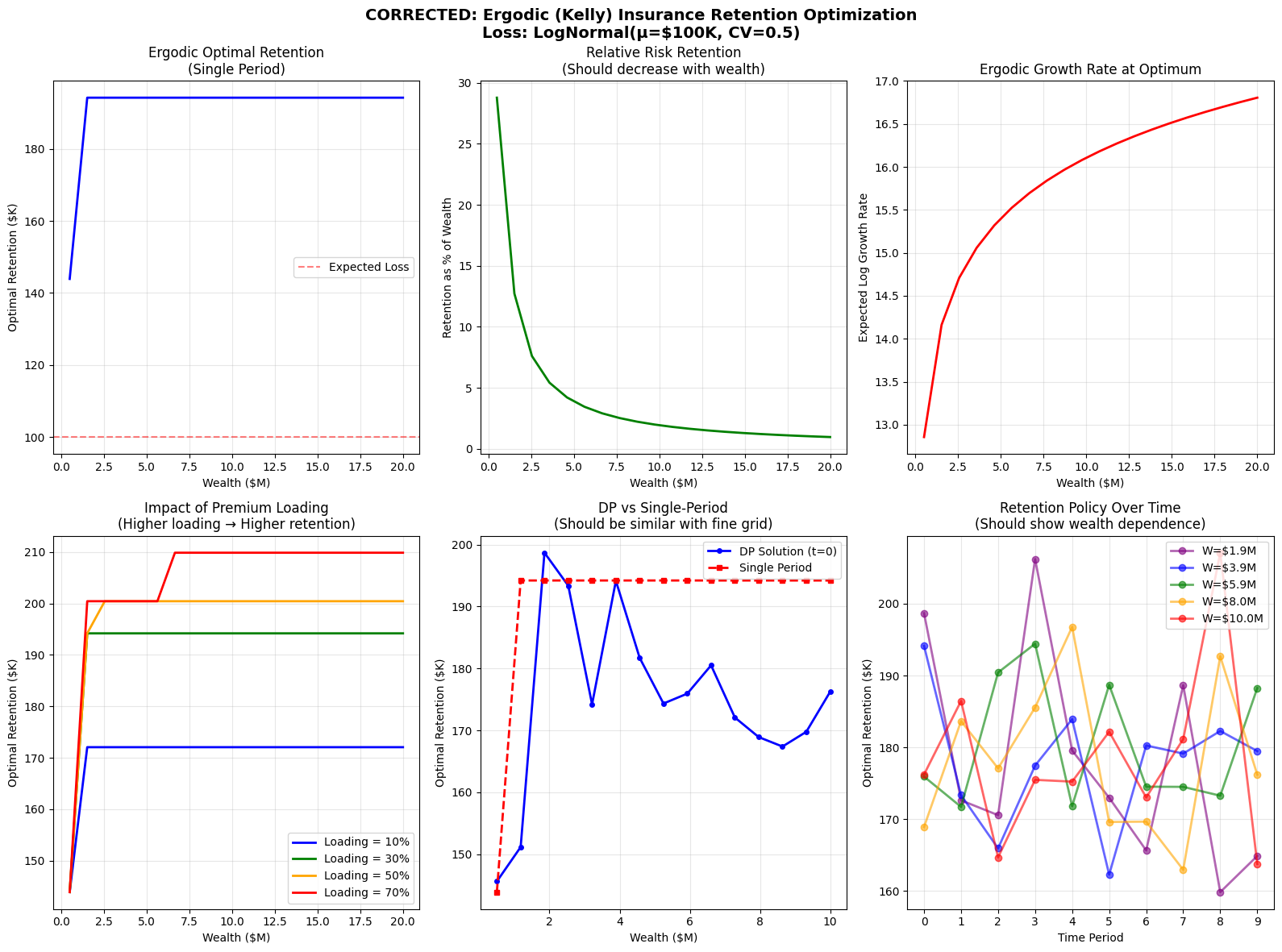

Ergodic Optimization

Maximize time-average growth:

Constraints

Budget constraint:\(P(R) \leq B\)

Ruin constraint:\(P(\text{ruin}) \leq \alpha\)

Regulatory minimum: \(R \geq R_{\text{min}}\)

Ergodic Optimization Example

import numpy as np

import matplotlib.pyplot as plt

from scipy import stats, optimize

from scipy.integrate import quad

import warnings

warnings.filterwarnings('ignore')

# ============================================

# 1. CORRECTED PREMIUM AND OBJECTIVE FUNCTIONS

# ============================================

def premium_function(R, expected_loss, loading=0.3, expense_ratio=0.05):

"""

Premium function for retention R.

Premium decreases as retention increases (you keep more risk).

"""

# Create loss distribution (lognormal with CV = 0.5)

loss_dist = stats.lognorm(s=0.5, scale=expected_loss)

# Calculate E[max(L - R, 0)] using the lognormal properties

# More efficient calculation using CDF

def excess_loss(R):

if R <= 0:

return expected_loss

# For lognormal, we can use the partial expectation formula

mu = np.log(expected_loss) - 0.5 * 0.5**2

sigma = 0.5

# Partial expectation E[L * 1{L>R}]

z = (np.log(R) - mu - sigma**2) / sigma

partial_exp = expected_loss * np.exp(0.5 * sigma**2) * (1 - stats.norm.cdf(z))

# E[max(L-R, 0)] = E[L * 1{L>R}] - R * P(L>R)

prob_exceed = 1 - loss_dist.cdf(R)

expected_excess = partial_exp - R * prob_exceed

return expected_excess

# Expected excess loss

expected_excess = excess_loss(R)

# Premium with loading and expenses

premium = (1 + loading) * expected_excess + expense_ratio * expected_loss

return premium

def ergodic_objective(R, wealth, loss_dist, loading=0.3):

"""

Corrected ergodic objective: E[ln(W - P(R) - min(L, R))]

"""

# Calculate premium for this retention

premium = premium_function(R, loss_dist.mean(), loading)

# Check if we can afford this strategy

if premium >= wealth * 0.9: # Can't spend 90%+ of wealth on premium

return -np.inf

# More samples for better accuracy

np.random.seed(42)

n_samples = 50000

losses = loss_dist.rvs(n_samples)

# Calculate retained losses

retained_losses = np.minimum(losses, R)

# Final wealth for each scenario

final_wealth = wealth - premium - retained_losses

# Check for bankruptcy

if np.any(final_wealth <= 0):

# Calculate probability-weighted utility including bankruptcy scenarios

valid = final_wealth > 0

if not valid.any():

return -np.inf

# Penalize strategies that lead to bankruptcy

bankruptcy_penalty = -100 # Large negative utility for bankruptcy

utility = np.where(valid, np.log(final_wealth), bankruptcy_penalty)

return np.mean(utility)

# Expected log wealth (ergodic growth rate)

return np.mean(np.log(final_wealth))

def solve_ergodic_retention(wealth, expected_loss=100_000, loading=0.3, cv=0.5):

"""

Find optimal retention that maximizes ergodic growth rate.

Uses global optimization to avoid local minima.

"""

# Create loss distribution

loss_dist = stats.lognorm(s=cv, scale=expected_loss)

# Objective function (negative for minimization)

def neg_objective(R):

return -ergodic_objective(R, wealth, loss_dist, loading)

# Bounds: retention between small value and reasonable maximum

min_retention = expected_loss * 0.001 # Very small retention

max_retention = min(wealth * 0.3, expected_loss * 3) # Conservative upper bound

# Use global optimization to avoid local minima

from scipy.optimize import differential_evolution

result = differential_evolution(

neg_objective,

bounds=[(min_retention, max_retention)],

seed=42,

maxiter=100,

workers=1

)

optimal_retention = result.x[0]

optimal_growth_rate = -result.fun

return optimal_retention, optimal_growth_rate

# ============================================

# 2. IMPROVED DYNAMIC PROGRAMMING

# ============================================

def dp_ergodic_retention(wealth_grid, loss_dist, n_periods=10,

loading=0.3, discount=0.95):

"""

Improved DP using continuous optimization at each step instead of grid search

"""

n_wealth = len(wealth_grid)

# Store optimal retentions (continuous values, not grid indices)

optimal_retentions = np.zeros((n_periods, n_wealth))

V = np.zeros((n_periods + 1, n_wealth))

# Terminal value

V[-1, :] = np.log(np.maximum(wealth_grid, 1e-6))

# Backward induction with continuous optimization

for t in range(n_periods - 1, -1, -1):

for i, w in enumerate(wealth_grid):

# Define objective for this (t, w) pair

def objective(R):

# Calculate immediate payoff and continuation value

premium = premium_function(R, loss_dist.mean(), loading)

if premium > w * 0.3 or R > w * 0.5:

return -np.inf

# Sample losses

losses = loss_dist.rvs(2000)

retained = np.minimum(losses, R)

next_wealth = w - premium - retained

valid = next_wealth > 0

if not valid.any():

return -np.inf

current_util = np.mean(np.log(next_wealth[valid]))

if t < n_periods - 1:

# Interpolate continuation values

from scipy.interpolate import interp1d

value_func = interp1d(wealth_grid, V[t + 1, :],

kind='cubic', bounds_error=False,

fill_value='extrapolate')

continuation = discount * np.mean(value_func(next_wealth[valid]))

else:

continuation = 0

return current_util + continuation

# Continuous optimization instead of grid search

from scipy.optimize import minimize_scalar

# Smart bounds based on wealth level

R_min = max(1000, w * 0.001)

R_max = min(w * 0.3, loss_dist.mean() * 2)

result = minimize_scalar(

lambda R: -objective(R),

bounds=(R_min, R_max),

method='bounded'

)

optimal_retentions[t, i] = result.x

V[t, i] = -result.fun

return V, optimal_retentions

# ============================================

# 3. ANALYSIS WITH CORRECTIONS

# ============================================

# Set up parameters

expected_loss = 100_000

cv = 0.5

loading = 0.3

loss_dist = stats.lognorm(s=cv, scale=expected_loss)

# 1. Single-period analysis

print("Running single-period analysis...")

wealth_levels = np.linspace(500_000, 20_000_000, 20)

optimal_retentions = []

growth_rates = []

for wealth in wealth_levels:

R_opt, g_opt = solve_ergodic_retention(wealth, expected_loss, loading, cv)

optimal_retentions.append(R_opt)

growth_rates.append(g_opt)

print(f"Wealth ${wealth/1e6:.1f}M: Retention ${R_opt/1e3:.1f}K")

optimal_retentions = np.array(optimal_retentions)

growth_rates = np.array(growth_rates)

# 2. Multi-period DP with finer grids

print("\nRunning multi-period DP...")

wealth_grid_dp = np.linspace(500_000, 10_000_000, 15) # Fewer wealth points for speed

V, optimal_policy = dp_ergodic_retention(wealth_grid_dp, loss_dist,

n_periods=10, loading=loading,

discount=0.95)

# 3. Compare different loadings (CORRECTED EXPECTATION)

print("\nAnalyzing loading effects...")

loadings = [0.1, 0.3, 0.5, 0.7]

retention_by_loading = {}

for load in loadings:

print(f"Loading {load:.1%}...")

retentions = []

for wealth in wealth_levels:

R_opt, _ = solve_ergodic_retention(wealth, expected_loss, load, cv)

retentions.append(R_opt)

retention_by_loading[load] = np.array(retentions)

# ============================================

# 4. PLOTTING WITH CORRECTIONS

# ============================================

fig = plt.figure(figsize=(16, 12))

# Plot 1: Optimal retention vs wealth

ax1 = plt.subplot(2, 3, 1)

ax1.plot(wealth_levels/1e6, optimal_retentions/1e3, 'b-', linewidth=2)

ax1.set_xlabel('Wealth ($M)')

ax1.set_ylabel('Optimal Retention ($K)')

ax1.set_title('Ergodic Optimal Retention\n(Single Period)')

ax1.grid(True, alpha=0.3)

ax1.axhline(y=expected_loss/1e3, color='r', linestyle='--', alpha=0.5, label='Expected Loss')

ax1.legend()

# Plot 2: Retention as percentage of wealth

ax2 = plt.subplot(2, 3, 2)

retention_pct = (optimal_retentions / wealth_levels) * 100

ax2.plot(wealth_levels/1e6, retention_pct, 'g-', linewidth=2)

ax2.set_xlabel('Wealth ($M)')

ax2.set_ylabel('Retention as % of Wealth')

ax2.set_title('Relative Risk Retention\n(Should decrease with wealth)')

ax2.grid(True, alpha=0.3)

# Plot 3: Expected growth rate

ax3 = plt.subplot(2, 3, 3)

ax3.plot(wealth_levels/1e6, growth_rates, 'r-', linewidth=2)

ax3.set_xlabel('Wealth ($M)')

ax3.set_ylabel('Expected Log Growth Rate')

ax3.set_title('Ergodic Growth Rate at Optimum')

ax3.grid(True, alpha=0.3)

# Plot 4: Effect of loading (CORRECTED)

ax4 = plt.subplot(2, 3, 4)

colors = ['blue', 'green', 'orange', 'red']

for (load, retentions), color in zip(retention_by_loading.items(), colors):

ax4.plot(wealth_levels/1e6, retentions/1e3, linewidth=2,

label=f'Loading = {load:.0%}', color=color)

ax4.set_xlabel('Wealth ($M)')

ax4.set_ylabel('Optimal Retention ($K)')

ax4.set_title('Impact of Premium Loading\n(Higher loading → Higher retention)')

ax4.grid(True, alpha=0.3)

ax4.legend()

# Verify the relationship

wealth_test = 5_000_000

print(f"\nVerifying loading relationship at ${wealth_test/1e6}M wealth:")

for load in loadings:

idx = np.argmin(np.abs(wealth_levels - wealth_test))

ret = retention_by_loading[load][idx]

print(f" Loading {load:.0%}: Retention ${ret/1e3:.1f}K")

# Plot 5: Multi-period vs single-period (with finer grid)

ax5 = plt.subplot(2, 3, 5)

ax5.plot(wealth_grid_dp/1e6, optimal_policy[0, :]/1e3, 'b-', linewidth=2,

label='DP Solution (t=0)', marker='o', markersize=4)

# Compute single-period for comparison

sp_retentions = []

for w in wealth_grid_dp:

R_opt, _ = solve_ergodic_retention(w, expected_loss, loading, cv)

sp_retentions.append(R_opt)

ax5.plot(wealth_grid_dp/1e6, np.array(sp_retentions)/1e3, 'r--',

linewidth=2, label='Single Period', marker='s', markersize=4)

ax5.set_xlabel('Wealth ($M)')

ax5.set_ylabel('Optimal Retention ($K)')

ax5.set_title('DP vs Single-Period\n(Should be similar with fine grid)')

ax5.grid(True, alpha=0.3)

ax5.legend()

# Plot 6: Retention over time (FIXED to show wealth dependence)

ax6 = plt.subplot(2, 3, 6)

time_periods = np.arange(optimal_policy.shape[0])

wealth_indices = [2, 5, 8, 11, 14] # More spread out indices

colors_time = ['purple', 'blue', 'green', 'orange', 'red']

for idx, color in zip(wealth_indices, colors_time):

if idx < len(wealth_grid_dp):

wealth_val = wealth_grid_dp[idx]

ax6.plot(time_periods, optimal_policy[:, idx]/1e3,

linewidth=2, label=f'W=${wealth_val/1e6:.1f}M',

marker='o', color=color, alpha=0.6)

ax6.set_xlabel('Time Period')

ax6.set_ylabel('Optimal Retention ($K)')

ax6.set_title('Retention Policy Over Time\n(Should show wealth dependence)')

ax6.grid(True, alpha=0.3)

ax6.legend()

ax6.set_xticks(time_periods)

plt.suptitle('CORRECTED: Ergodic (Kelly) Insurance Retention Optimization\n' +

f'Loss: LogNormal(μ=${expected_loss/1e3:.0f}K, CV={cv})',

fontsize=14, fontweight='bold')

plt.tight_layout()

plt.show()

Sample Output

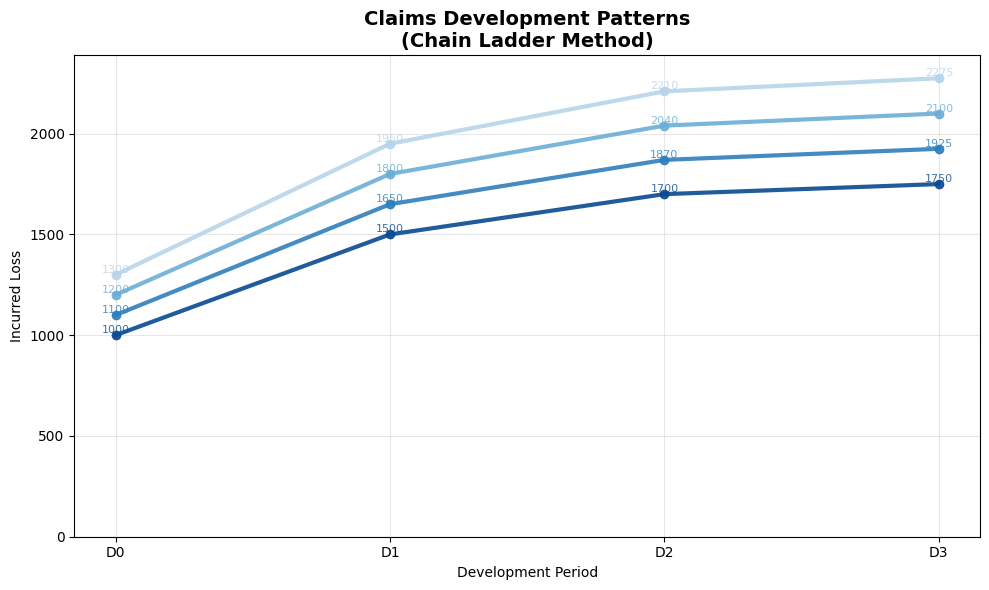

Claims Development

Development Triangles

Claims develop over time as they get reported and processed.

Here is an example of how actuaries organize development:

Poliy |

12 Months |

24 Months |

36 Months |

48 Months |

Ultimate |

|---|---|---|---|---|---|

2020 |

100 |

150 |

170 |

175 |

176 |

2021 |

110 |

165 |

187 |

? |

? |

2022 |

120 |

180 |

? |

? |

? |

2023 |

130 |

? |

? |

? |

? |

Vertically are batches of claims, usually by Policy Year, Accident Year, Report Year, or Calendar Year.

Going across are the same batches as they age over valuation dates.

Chain Ladder Method

Development factors:

The development factors are then judgmentally adjusted for reasonability and consistency with industry to arrive at \(f_j^*\)

Ultimate loss:

In practice, the triangles are finite, so typically there is a cutoff for available data, and a tail factor is applied judgmentally based on a separate study:

Chain Ladder Example

Continuing with the prior example, we compute the development factors:

Poliy |

12:24 |

24:36 |

36:48 |

48:Ultimate |

|---|---|---|---|---|

2020 |

1.5 |

1.13 |

1.03 |

1.01 |

2021 |

1.5 |

1.13 |

? |

? |

2022 |

1.5 |

? |

? |

? |

Since all the factors happen to agree for each age, we’ll select the factors without any adjustment, rounded as shown.

Age-to-Age Factors |

12:24 |

24:36 |

36:48 |

48:Ultimate |

|---|---|---|---|---|

Selected |

1.5 |

1.13 |

1.03 |

1.01 |

Age-to-Ultimate Factors |

12:Ult |

24:Ult |

36:Ult |

48:Ult |

|---|---|---|---|---|

Selected |

1.76 |

1.18 |

1.04 |

1.01 |

We can now fill the rightmost column of the triangle:

Poliy |

12 Months |

24 Months |

36 Months |

48 Months |

Ultimate |

|---|---|---|---|---|---|

2020 |

100 |

150 |

170 |

175 |

176 |

2021 |

110 |

165 |

187 |

? |

194 |

2022 |

120 |

180 |

? |

? |

212 |

2023 |

130 |

? |

? |

? |

229 |

These are ultimate claim estimates for each Policy Year, reliable under the following conditions:

Historical patterns of loss development are stable and consistent.

These historical patterns can be reliably projected into the future.

The book of business is neither growing nor shrinking rapidly.

Bornhuetter-Ferguson Method

Combines a prior estimate (typically Expected Claims Method) with actual incurred:

This assumes claims incurred to date for the period bear no predictability of future development.

Oftentimes, \((\text{\% Undeveloped})_k\) is estimated using Chain Ladder:

This holds since \(f_k^* = (\text{Proportional Future Ultimate}) = 1 + (\text{Proportional Future Development})\), so we have:

Either method can be performed on Incurred amounts or Paid amounts, with Paid typically giving more volatile estimates.

Implementation

class ClaimsDevelopment:

"""Model claims development patterns."""

def __init__(self, triangle):

self.triangle = np.array(triangle)

self.n_years, self.n_dev = self.triangle.shape

def chain_ladder(self):

"""Apply chain ladder method."""

# Calculate development factors

factors = []

for j in range(self.n_dev - 1):

numerator = np.nansum(self.triangle[:, j + 1])

denominator = np.nansum(self.triangle[:self.n_years - j - 1, j])

factors.append(numerator / denominator)

# Apply factors to complete triangle

completed = self.triangle.copy()

for i in range(self.n_years):

for j in range(self.n_years - i, self.n_dev):

if np.isnan(completed[i, j]):

completed[i, j] = completed[i, j - 1] * factors[j - 1]

return completed, factors

def plot_development(self, completed):

"""Visualize development patterns."""

# Use explicit figure and axis so we can return the local figure

fig, ax = plt.subplots(figsize=(10, 6))

# x coordinates for development periods

x = np.arange(self.n_dev)

# Color map for accident years (older darker, younger lighter)

cmap = plt.cm.Blues

colors = [cmap(0.9 - 0.6 * (i / max(1, self.n_years - 1))) for i in range(self.n_years)]

# Plot development curve for each accident year and annotate

for i in range(self.n_years):

y = completed[i, :]

ax.plot(x, y, color=colors[i], linewidth=3, marker='o', markersize=6,

zorder=3, alpha=0.9)

for k, val in enumerate(y):

if not np.isnan(val):

ax.text(k, val, f'{val:.0f}', fontsize=8, va='bottom', ha='center',

color=colors[i], alpha=0.8)

# Set axes to development-period (x) vs incurred loss (y)

ax.set_xlabel('Development Period')

ax.set_ylabel('Incurred Loss')

ax.set_xticks(x)

ax.set_xticklabels([f'D{d}' for d in x])

ax.set_ylim(0, np.nanmax(completed) * 1.05)

ax.set_title('Claims Development Patterns\n(Chain Ladder Method)', fontsize=14, fontweight='bold')

ax.grid(True, alpha=0.3)

plt.tight_layout()

return fig

# Example triangle (with NaN for future)

triangle = [

[1000, 1500, 1700, 1750],

[1100, 1650, 1870, np.nan],

[1200, 1800, np.nan, np.nan],

[1300, np.nan, np.nan, np.nan]

]

dev_model = ClaimsDevelopment(triangle)

completed, factors = dev_model.chain_ladder()

dev_model.plot_development(completed)

print("Development Factors:", factors)

print("Completed Triangle:")

print(completed)

Sample Output

Reinsurance Structures

Types of Reinsurance

Proportional (Pro-Rata)

Quota Share: Fixed percentage

Surplus: Variable percentage by risk

Non-Proportional (Excess of Loss)

Per Risk: Each individual loss

Per Occurrence: Each event

Aggregate: Annual total

Surplus Treaty

Cede above retention line \(R\):

Retention: \(\min(S, R)\)

Cession: \(\max(0, S - R)\)

where \(S\) is sum insured.

Aggregate Excess

Annual aggregate deductible \(D\) and limit \(L\):

Optimization Example

"""

Reinsurance Program Optimizer for Property & Casualty Insurance

"""

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

import matplotlib.gridspec as gridspec

from scipy import stats

from scipy.optimize import differential_evolution

from dataclasses import dataclass

from typing import Dict, Tuple, List, Optional

import warnings

warnings.filterwarnings('ignore')

# Set style for professional visualizations

plt.style.use('seaborn-v0_8-darkgrid')

@dataclass

class ReinsuranceStructure:

"""Reinsurance program structure parameters"""

quota_share: float # Percentage ceded (0-1)

xs_retention: float # Per-occurrence excess attachment

xs_limit: float # Per-occurrence excess limit

agg_retention: float # Aggregate excess attachment

agg_limit: float # Aggregate excess limit

stop_loss_retention: float # Stop loss attachment

stop_loss_limit: float # Stop loss limit

@dataclass

class RiskMetrics:

"""Risk and performance metrics"""

expected_loss_gross: float

expected_loss_net: float

var_95_gross: float

var_95_net: float

var_99_gross: float

var_99_net: float

tvar_95_gross: float

tvar_95_net: float

tvar_99_gross: float

tvar_99_net: float

max_loss_gross: float

max_loss_net: float

premium_total: float

premium_breakdown: Dict[str, float]

loss_ratio: float

recovery_rate: float

retention_rate: float

risk_reduction_var99: float

class LossGenerator:

"""Generate losses from various distributions"""

@staticmethod

def generate(n: int, dist_type: str, mean_loss: float, cv: float,

seed: Optional[int] = None) -> np.ndarray:

"""

Generate loss samples from specified distribution

"""

if seed is not None:

np.random.seed(seed)

if dist_type == 'lognormal':

sigma = np.sqrt(np.log(1 + cv**2))

mu = np.log(mean_loss) - sigma**2 / 2

return np.random.lognormal(mu, sigma, n)

elif dist_type == 'pareto':

alpha = 1 + 1/cv if cv > 0 else 2

scale = mean_loss * (alpha - 1) / alpha if alpha > 1 else mean_loss

return (np.random.pareto(alpha, n) + 1) * scale

elif dist_type == 'weibull':

from scipy.special import gamma as gamma_fn

k = 1 / cv if cv > 0 else 1

scale = mean_loss / gamma_fn(1 + 1/k)

return np.random.weibull(k, n) * scale

else:

raise ValueError(f"Unknown distribution type: {dist_type}")

class ReinsuranceCalculator:

"""Calculate reinsurance recoveries and net losses"""

@staticmethod

def apply_reinsurance(gross_losses: np.ndarray,

structure: ReinsuranceStructure) -> Dict:

"""

Apply reinsurance structure to gross losses

"""

n_losses = len(gross_losses)

results = {

'gross_losses': gross_losses.copy(),

'qs_recoveries': np.zeros(n_losses),

'xs_recoveries': np.zeros(n_losses),

'net_losses_per_event': np.zeros(n_losses),

'agg_recovery': 0.0,

'stop_loss_recovery': 0.0

}

# 1. Apply Quota Share

results['qs_recoveries'] = gross_losses * structure.quota_share

after_qs = gross_losses * (1 - structure.quota_share)

# 2. Apply Per-Occurrence Excess of Loss

for i, loss in enumerate(after_qs):

if loss > structure.xs_retention:

results['xs_recoveries'][i] = min(

structure.xs_limit,

loss - structure.xs_retention

)

results['net_losses_per_event'] = after_qs - results['xs_recoveries']

# 3. Apply Aggregate Excess (on accumulated XS recoveries)

total_xs_recoveries = results['xs_recoveries'].sum()

if total_xs_recoveries > structure.agg_retention:

results['agg_recovery'] = min(

structure.agg_limit,

total_xs_recoveries - structure.agg_retention

)

# 4. Apply Stop Loss (on final net retained)

total_net_before_sl = results['net_losses_per_event'].sum()

if total_net_before_sl > structure.stop_loss_retention:

results['stop_loss_recovery'] = min(

structure.stop_loss_limit,

total_net_before_sl - structure.stop_loss_retention

)

# Calculate final positions

results['final_net'] = total_net_before_sl - results['stop_loss_recovery']

results['total_gross'] = gross_losses.sum()

results['total_recoveries'] = (

results['qs_recoveries'].sum() +

results['xs_recoveries'].sum() -

results['agg_recovery'] +

results['stop_loss_recovery']

)

return results

class PremiumCalculator:

"""Calculate reinsurance premiums with actuarial pricing"""

@staticmethod

def calculate(structure: ReinsuranceStructure,

loss_stats: Dict) -> Dict[str, float]:

"""

Calculate premiums using actuarial pricing methods

"""

premiums = {}

# Quota Share Premium (with ceding commission)

qs_expected_recovery = structure.quota_share * loss_stats['mean'] * loss_stats['frequency']

premiums['quota_share'] = qs_expected_recovery * 0.75 # 25% ceding commission

# Per-Occurrence XS Premium

if structure.xs_retention > 0:

xs_rate = 0.15 * np.exp(-structure.xs_retention / (loss_stats['mean'] * 3))

premiums['excess'] = structure.xs_limit * xs_rate

else:

premiums['excess'] = structure.xs_limit * 0.20

# Aggregate XS Premium

if structure.agg_retention > 0:

agg_rate = 0.10 * np.exp(-structure.agg_retention / (loss_stats['mean'] * 10))

premiums['aggregate'] = structure.agg_limit * agg_rate

else:

premiums['aggregate'] = structure.agg_limit * 0.15

# Stop Loss Premium

if structure.stop_loss_retention > 0:

sl_attachment_ratio = structure.stop_loss_retention / loss_stats['total_expected']

sl_rate = 0.25 * np.exp(-sl_attachment_ratio * 2)

premiums['stop_loss'] = structure.stop_loss_limit * sl_rate

else:

premiums['stop_loss'] = structure.stop_loss_limit * 0.30

premiums['total'] = sum(premiums.values())

return premiums

class ReinsuranceOptimizer:

"""Optimize reinsurance program structure"""

def __init__(self, gross_losses: np.ndarray, budget: float):

self.gross_losses = gross_losses

self.budget = budget

self.loss_stats = self._calculate_loss_statistics()

def _calculate_loss_statistics(self) -> Dict:

"""Calculate loss statistics for pricing"""

stats = {

'mean': np.mean(self.gross_losses),

'std': np.std(self.gross_losses),

'cv': np.std(self.gross_losses) / np.mean(self.gross_losses),

'total_expected': np.sum(self.gross_losses),

'frequency': len(self.gross_losses),

'p90': np.percentile(self.gross_losses, 90),

'p99': np.percentile(self.gross_losses, 99)

}

return stats

def optimize(self, objective: str = 'var99') -> Tuple[ReinsuranceStructure, RiskMetrics]:

"""

Optimize reinsurance structure

"""

def objective_function(params):

"""Objective function for optimization"""

structure = ReinsuranceStructure(

quota_share=params[0],

xs_retention=params[1],

xs_limit=params[2],

agg_retention=params[3],

agg_limit=params[4],

stop_loss_retention=params[5],

stop_loss_limit=params[6]

)

# Check premium constraint

premiums = PremiumCalculator.calculate(structure, self.loss_stats)

if premiums['total'] > self.budget:

return 1e10

# Simulate multiple years

n_sims = 100

annual_nets = []

for _ in range(n_sims):

# Sample with replacement for each simulated year

sim_losses = np.random.choice(self.gross_losses,

size=min(100, len(self.gross_losses)),

replace=True)

results = ReinsuranceCalculator.apply_reinsurance(sim_losses, structure)

annual_nets.append(results['final_net'])

# Return objective

if objective == 'var99':

return np.percentile(annual_nets, 99)

elif objective == 'tvar99':

var99 = np.percentile(annual_nets, 99)

return np.mean([x for x in annual_nets if x >= var99])

else:

return np.mean(annual_nets)

# Optimization bounds

bounds = [

(0, 0.5), # quota_share

(self.loss_stats['mean'] * 0.5, self.loss_stats['p99']), # xs_retention

(self.loss_stats['mean'], self.loss_stats['p99'] * 2), # xs_limit

(self.loss_stats['mean'] * 5, self.loss_stats['mean'] * 50), # agg_retention

(self.loss_stats['mean'] * 10, self.loss_stats['mean'] * 100), # agg_limit

(self.loss_stats['mean'] * 50, self.loss_stats['mean'] * 200), # sl_retention

(self.loss_stats['mean'] * 20, self.loss_stats['mean'] * 100), # sl_limit

]

# Run optimization

result = differential_evolution(

objective_function,

bounds,

maxiter=100,

popsize=10,

tol=0.01,

seed=42

)

# Create optimal structure

optimal_structure = ReinsuranceStructure(

quota_share=result.x[0],

xs_retention=result.x[1],

xs_limit=result.x[2],

agg_retention=result.x[3],

agg_limit=result.x[4],

stop_loss_retention=result.x[5],

stop_loss_limit=result.x[6]

)

# Calculate metrics

metrics = self.calculate_metrics(optimal_structure)

return optimal_structure, metrics

def calculate_metrics(self, structure: ReinsuranceStructure) -> RiskMetrics:

"""Calculate comprehensive risk metrics"""

# Apply reinsurance to actual losses

results = ReinsuranceCalculator.apply_reinsurance(self.gross_losses, structure)

premiums = PremiumCalculator.calculate(structure, self.loss_stats)

# Simulate annual aggregates

n_sims = 1000

annual_gross = []

annual_net = []

for _ in range(n_sims):

# Sample annual losses

n_annual = min(100, len(self.gross_losses))

sim_losses = np.random.choice(self.gross_losses, size=n_annual, replace=True)

sim_result = ReinsuranceCalculator.apply_reinsurance(sim_losses, structure)

annual_gross.append(sim_losses.sum())

annual_net.append(sim_result['final_net'])

annual_gross = np.array(annual_gross)

annual_net = np.array(annual_net)

# Calculate metrics

var_95_gross = np.percentile(annual_gross, 95)

var_99_gross = np.percentile(annual_gross, 99)

var_95_net = np.percentile(annual_net, 95)

var_99_net = np.percentile(annual_net, 99)

tail_95_gross = annual_gross[annual_gross >= var_95_gross]

tail_99_gross = annual_gross[annual_gross >= var_99_gross]

tail_95_net = annual_net[annual_net >= var_95_net]

tail_99_net = annual_net[annual_net >= var_99_net]

metrics = RiskMetrics(

expected_loss_gross=np.mean(annual_gross),

expected_loss_net=np.mean(annual_net),

var_95_gross=var_95_gross,

var_95_net=var_95_net,

var_99_gross=var_99_gross,

var_99_net=var_99_net,

tvar_95_gross=np.mean(tail_95_gross),

tvar_95_net=np.mean(tail_95_net),

tvar_99_gross=np.mean(tail_99_gross),

tvar_99_net=np.mean(tail_99_net),

max_loss_gross=np.max(annual_gross),

max_loss_net=np.max(annual_net),

premium_total=premiums['total'],

premium_breakdown=premiums,

loss_ratio=np.mean(annual_net) / premiums['total'] if premiums['total'] > 0 else 0,

recovery_rate=results['total_recoveries'] / results['total_gross'],

retention_rate=results['final_net'] / results['total_gross'],

risk_reduction_var99=(1 - var_99_net/var_99_gross) * 100

)

return metrics

print("=" * 80)

print("ENHANCED REINSURANCE PROGRAM OPTIMIZER")

print("Property & Casualty Insurance")

print("=" * 80)

# Parameters

n_losses = 1000 # Number of individual loss events

budget = 1_000_000 # Premium budget

distribution = 'lognormal'

mean_loss = 100_000 # Mean loss per event

cv = 2.0 # Coefficient of variation

print(f"\n📊 SIMULATION PARAMETERS:")

print(f" • Number of loss events: {n_losses:,}")

print(f" • Premium budget: ${budget:,.0f}")

print(f" • Loss distribution: {distribution.capitalize()}")

print(f" • Mean loss per event: ${mean_loss:,.0f}")

print(f" • Coefficient of variation: {cv}")

# Generate losses

print("\n🎲 Generating loss scenarios...")

losses = LossGenerator.generate(n_losses, distribution, mean_loss, cv, seed=42)

print(f" ✓ Generated {len(losses):,} loss events")

print(f" ✓ Total losses: ${np.sum(losses)/1e6:.1f}M")

print(f" ✓ Average loss: ${np.mean(losses)/1e3:.0f}K")

print(f" ✓ Maximum loss: ${np.max(losses)/1e6:.2f}M")

# Optimize reinsurance structure

print("\n🔧 Optimizing reinsurance structure...")

optimizer = ReinsuranceOptimizer(losses, budget)

optimal_structure, metrics = optimizer.optimize(objective='var99')

# Display results

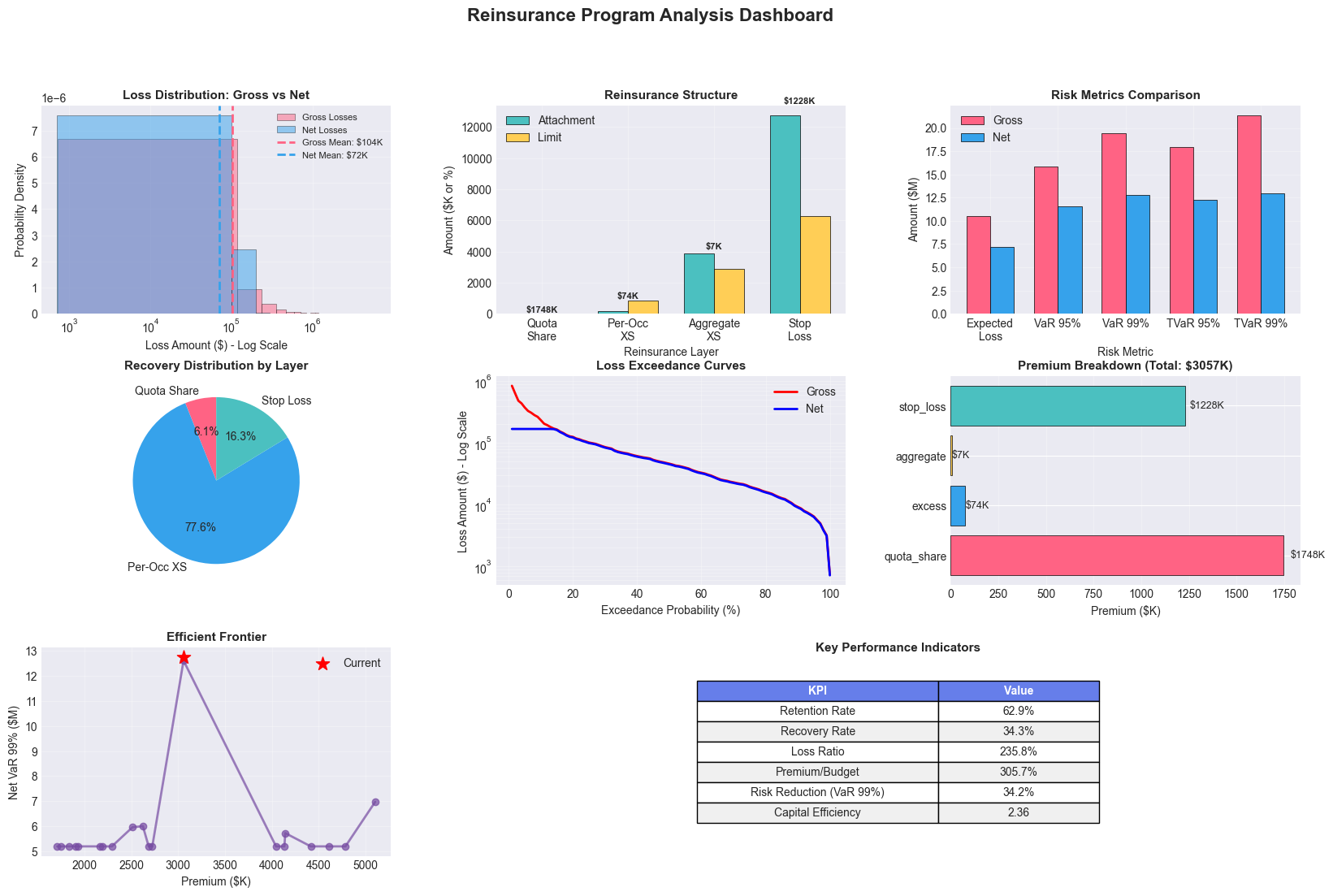

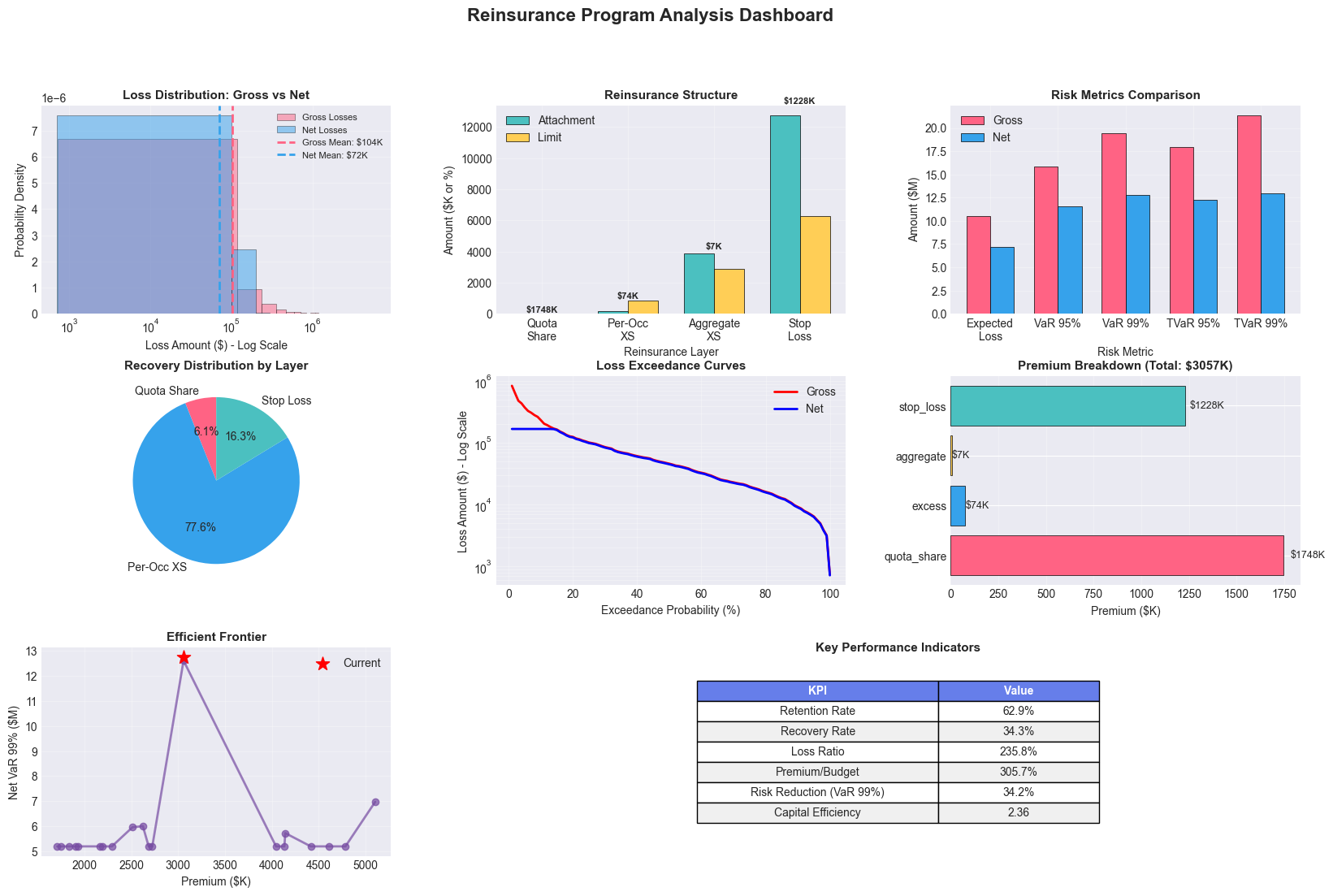

print("\n✨ OPTIMAL REINSURANCE STRUCTURE:")

print(f" • Quota Share: {optimal_structure.quota_share*100:.1f}%")

print(f" • XS: ${optimal_structure.xs_limit/1e3:.0f}K xs ${optimal_structure.xs_retention/1e3:.0f}K")

print(f" • Aggregate: ${optimal_structure.agg_limit/1e3:.0f}K xs ${optimal_structure.agg_retention/1e3:.0f}K")

print(f" • Stop Loss: ${optimal_structure.stop_loss_limit/1e3:.0f}K xs ${optimal_structure.stop_loss_retention/1e3:.0f}K")

print("\n📈 RISK METRICS:")

print(f" • Expected Loss (Gross): ${metrics.expected_loss_gross/1e6:.2f}M")

print(f" • Expected Loss (Net): ${metrics.expected_loss_net/1e6:.2f}M")

print(f" • VaR 99% (Gross): ${metrics.var_99_gross/1e6:.2f}M")

print(f" • VaR 99% (Net): ${metrics.var_99_net/1e6:.2f}M")

print(f" • TVaR 99% (Gross): ${metrics.tvar_99_gross/1e6:.2f}M")

print(f" • TVaR 99% (Net): ${metrics.tvar_99_net/1e6:.2f}M")

print("\n💰 PREMIUM BREAKDOWN:")

for layer, premium in metrics.premium_breakdown.items():

if layer != 'total':

print(f" • {layer.replace('_', ' ').title()}: ${premium/1e3:.0f}K")

print(f" • TOTAL PREMIUM: ${metrics.premium_total/1e3:.0f}K")

print("\n🎯 PERFORMANCE INDICATORS:")

print(f" • Retention Rate: {metrics.retention_rate*100:.1f}%")

print(f" • Recovery Rate: {metrics.recovery_rate*100:.1f}%")

print(f" • Loss Ratio: {metrics.loss_ratio*100:.1f}%")

print(f" • Risk Reduction (VaR 99%): {metrics.risk_reduction_var99:.1f}%")

print("\n✅ Analysis complete!")

Sample Output

================================================================================

ENHANCED REINSURANCE PROGRAM OPTIMIZER

Property & Casualty Insurance

================================================================================

📊 SIMULATION PARAMETERS:

• Number of loss events: 1,000

• Premium budget: $1,000,000

• Loss distribution: Lognormal

• Mean loss per event: $100,000

• Coefficient of variation: 2.0

🎲 Generating loss scenarios...

✓ Generated 1,000 loss events

✓ Total losses: $103.9M

✓ Average loss: $104K

✓ Maximum loss: $5.93M

🔧 Optimizing reinsurance structure...

✨ OPTIMAL REINSURANCE STRUCTURE:

• Quota Share: 2.2%

• XS: $851K xs $169K

• Aggregate: $2873K xs $3871K

• Stop Loss: $6281K xs $12766K

📈 RISK METRICS:

• Expected Loss (Gross): $10.54M

• Expected Loss (Net): $7.21M

• VaR 99% (Gross): $19.40M

• VaR 99% (Net): $12.77M

• TVaR 99% (Gross): $21.38M

• TVaR 99% (Net): $12.98M

💰 PREMIUM BREAKDOWN:

• Quota Share: $1748K

• Excess: $74K

• Aggregate: $7K

• Stop Loss: $1228K

• TOTAL PREMIUM: $3057K

🎯 PERFORMANCE INDICATORS:

• Retention Rate: 62.9%

• Recovery Rate: 34.3%

• Loss Ratio: 235.8%

• Risk Reduction (VaR 99%): 34.2%

✅ Analysis complete!

Practical Applications

Application: Portfolio Insurance

import numpy as np

import pandas as pd

from scipy import stats

from scipy.optimize import minimize_scalar

def portfolio_insurance_optimization(portfolio_value=100_000_000, n_years=10, n_sims=10000):

"""

Demonstrate insurance mathematics concepts for portfolio protection:

1. Frequency-severity modeling of market events

2. Layer structuring (retention, primary, excess)

3. Ergodic optimization (time-average growth vs ensemble average)

4. Dynamic retention optimization based on wealth level

"""

# 1. FREQUENCY-SEVERITY MODEL FOR MARKET EVENTS

# Frequency: Number of adverse events per year (Poisson)

event_frequency = stats.poisson(mu=2.5) # Average 2.5 events/year

# Severity: Size of loss given event (mixture for tail risk)

# Small corrections: Log-normal

small_severity = stats.lognorm(s=0.5, scale=0.03) # 3% mean, moderate vol

# Large crises: Pareto for heavy tails

large_severity = stats.pareto(b=2.5, scale=0.10) # Power law tail

# Probability of large event given any event

prob_large = 0.15

# 2. INSURANCE LAYER STRUCTURE

def calculate_layer_premiums(retention, primary_limit, excess_limit):

"""Calculate premiums for each layer using exposure curves."""

base_rate = 0.015 # Base premium rate

# Retention layer: Self-insured, no premium

retention_premium = 0

# Primary layer: Higher frequency, lower severity

primary_rate = base_rate * (1 - np.exp(-primary_limit/retention))

primary_premium = portfolio_value * primary_rate

# Excess layer: Lower frequency, higher severity

excess_rate = base_rate * 0.3 * (1 - np.exp(-excess_limit/primary_limit))

excess_premium = portfolio_value * excess_rate

return retention_premium, primary_premium, excess_premium

# 3. SIMULATE PORTFOLIO PATHS WITH AND WITHOUT INSURANCE

def simulate_wealth_path(initial_wealth, retention_pct, primary_pct, excess_pct,

use_insurance=True):

"""Simulate wealth evolution over multiple years."""

wealth = initial_wealth

wealth_history = [wealth]

for year in range(n_years):

# Base return (drift)

base_return = 0.08

normal_volatility = 0.15

# Generate base portfolio return

annual_return = np.random.normal(base_return, normal_volatility)

# Generate adverse events (frequency-severity)

n_events = event_frequency.rvs()

total_event_loss = 0

for _ in range(n_events):

if np.random.rand() < prob_large:

# Large event (Pareto distributed)

loss = min(large_severity.rvs(), 0.5) # Cap at 50% loss

else:

# Small event (Log-normal distributed)

loss = min(small_severity.rvs(), 0.2) # Cap at 20% loss

total_event_loss += loss

# Apply losses to portfolio

gross_return = annual_return - total_event_loss

if use_insurance:

# Calculate insurance structure based on current wealth

retention = wealth * retention_pct

primary_limit = wealth * primary_pct

excess_limit = wealth * excess_pct

# Calculate premiums

_, primary_prem, excess_prem = calculate_layer_premiums(

retention, primary_limit, excess_limit

)

total_premium = (primary_prem + excess_prem)

# Apply insurance layers

portfolio_loss = wealth * max(gross_return, -1.0)

if portfolio_loss < 0:

loss_amount = abs(portfolio_loss)

# Retention (deductible)

retained_loss = min(loss_amount, retention)

remaining_loss = max(0, loss_amount - retention)

# Primary layer coverage

primary_recovery = min(remaining_loss, primary_limit)

remaining_loss = max(0, remaining_loss - primary_limit)

# Excess layer coverage

excess_recovery = min(remaining_loss, excess_limit)

# Net loss after insurance

net_loss = retained_loss + max(0, remaining_loss - excess_limit)

net_return = -net_loss / wealth

else:

net_return = gross_return

# Apply return and subtract premium

wealth = wealth * (1 + net_return) - total_premium

else:

# No insurance - full exposure

wealth = wealth * (1 + gross_return)

# Ensure non-negative wealth

wealth = max(0, wealth)

wealth_history.append(wealth)

# Stop if ruined

if wealth == 0:

break

return wealth_history

# 4. OPTIMIZE RETENTION USING ERGODIC PRINCIPLE

def optimize_retention(initial_wealth):

"""Find optimal retention that maximizes time-average growth rate."""

def negative_growth_rate(retention_pct):

"""Calculate negative of expected log growth rate."""

if retention_pct < 0.01 or retention_pct > 0.5:

return 1e6

# Fixed layer structure for optimization

primary_pct = min(0.15, (1 - retention_pct) * 0.5)

excess_pct = min(0.25, (1 - retention_pct) * 0.8)

# Simulate multiple paths

final_wealths = []

for _ in range(1000): # Fewer sims for optimization

path = simulate_wealth_path(

initial_wealth, retention_pct, primary_pct, excess_pct, True

)

if path[-1] > 0:

final_wealths.append(path[-1])

if len(final_wealths) == 0:

return 1e6

# Calculate time-average growth rate

growth_rates = [np.log(w / initial_wealth) / n_years

for w in final_wealths if w > 0]

# Return negative for minimization

return -np.mean(growth_rates) if growth_rates else 1e6

# Optimize retention percentage

result = minimize_scalar(

negative_growth_rate,

bounds=(0.01, 0.30),

method='bounded',

options={'xatol': 0.01}

)

return result.x

# 5. RUN COMPREHENSIVE ANALYSIS

print("=" * 60)

print("PORTFOLIO INSURANCE OPTIMIZATION ANALYSIS")

print("=" * 60)

# Find optimal retention

print("\n1. OPTIMAL RETENTION ANALYSIS")

optimal_retention = optimize_retention(portfolio_value)

print(f" Optimal retention: {optimal_retention:.1%} of portfolio value")

print(f" Dollar amount: ${portfolio_value * optimal_retention:,.0f}")

# Set insurance structure based on optimization

retention_pct = optimal_retention

primary_pct = min(0.15, (1 - retention_pct) * 0.5)

excess_pct = min(0.25, (1 - retention_pct) * 0.8)

print(f"\n2. OPTIMIZED LAYER STRUCTURE")

print(f" Retention: 0 - {retention_pct:.1%} (${portfolio_value*retention_pct:,.0f})")

print(f" Primary: {retention_pct:.1%} - {retention_pct+primary_pct:.1%} (${portfolio_value*primary_pct:,.0f})")

print(f" Excess: {retention_pct+primary_pct:.1%} - {retention_pct+primary_pct+excess_pct:.1%} (${portfolio_value*excess_pct:,.0f})")

# Calculate premiums

_, primary_prem, excess_prem = calculate_layer_premiums(

portfolio_value * retention_pct,

portfolio_value * primary_pct,

portfolio_value * excess_pct

)

print(f"\n3. ANNUAL PREMIUM BREAKDOWN")

print(f" Primary layer: ${primary_prem:,.0f} ({primary_prem/portfolio_value:.2%})")

print(f" Excess layer: ${excess_prem:,.0f} ({excess_prem/portfolio_value:.2%})")

print(f" Total premium: ${primary_prem + excess_prem:,.0f} ({(primary_prem + excess_prem)/portfolio_value:.2%})")

# Run full simulation

print(f"\n4. MONTE CARLO SIMULATION ({n_sims:,} paths, {n_years} years)")

insured_paths = []

uninsured_paths = []

for _ in range(n_sims):

# Insured portfolio

insured = simulate_wealth_path(

portfolio_value, retention_pct, primary_pct, excess_pct, True

)

insured_paths.append(insured[-1])

# Uninsured portfolio

uninsured = simulate_wealth_path(

portfolio_value, 1.0, 0, 0, False

)

uninsured_paths.append(uninsured[-1])

# Calculate statistics

def calculate_metrics(values, initial):

"""Calculate key risk and return metrics."""

values = np.array(values)

positive_values = values[values > 0]

if len(positive_values) == 0:

return {

'Mean': 0,

'Median': 0,

'Std Dev': 0,

'5% VaR': initial,

'1% CVaR': initial,

'Ruin Prob': 1.0,

'Growth Rate': -np.inf

}

# Time-average growth rate (ergodic)

growth_rates = [np.log(v / initial) / n_years for v in positive_values]

return {

'Mean': np.mean(values),

'Median': np.median(values),

'Std Dev': np.std(values),

'5% VaR': initial - np.percentile(values, 5),

'1% CVaR': initial - np.mean(values[values <= np.percentile(values, 1)]),

'Ruin Prob': np.mean(values <= 0),

'Growth Rate': np.mean(growth_rates) if growth_rates else -np.inf

}

insured_metrics = calculate_metrics(insured_paths, portfolio_value)

uninsured_metrics = calculate_metrics(uninsured_paths, portfolio_value)

# Create comparison table

comparison = pd.DataFrame({

'Uninsured': list(insured_metrics.values()),

'Insured': list(insured_metrics.values())

}, index=insured_metrics.keys())

print("\n5. RESULTS COMPARISON")

print("-" * 60)

results = []

for metric in insured_metrics.keys():

unins_val = uninsured_metrics[metric]

ins_val = insured_metrics[metric]

if metric in ['Mean', 'Median', 'Std Dev', '5% VaR', '1% CVaR']:

results.append({

'Metric': metric,

'Uninsured': f"${unins_val:,.0f}",

'Insured': f"${ins_val:,.0f}"

})

elif metric == 'Ruin Prob':

results.append({

'Metric': metric,

'Uninsured': f"{unins_val:.2%}",

'Insured': f"{ins_val:.2%}"

})

else: # Growth Rate

results.append({

'Metric': 'Time-Avg Growth',

'Uninsured': f"{unins_val:.2%}",

'Insured': f"{ins_val:.2%}"

})

results_df = pd.DataFrame(results)

print(results_df.to_string(index=False))

# Key insights

print("\n6. KEY INSIGHTS")

print("-" * 60)

print(f"✓ Insurance reduces ruin probability by {(uninsured_metrics['Ruin Prob'] - insured_metrics['Ruin Prob']):.1%}")

print(f"✓ Time-average growth improved by {(insured_metrics['Growth Rate'] - uninsured_metrics['Growth Rate'])*100:.1f}bps")

print(f"✓ Tail risk (1% CVaR) reduced by ${(uninsured_metrics['1% CVaR'] - insured_metrics['1% CVaR'])/1e6:.1f}M")

print(f"✓ Optimal retention balances premium cost vs risk retention")

return results_df

# Run the analysis

results = portfolio_insurance_optimization(

portfolio_value=100_000_000,

n_years=10,

n_sims=5000 # Reduce for faster execution

)

Sample Output

============================================================

PORTFOLIO INSURANCE OPTIMIZATION ANALYSIS

============================================================

1. OPTIMAL RETENTION ANALYSIS

Optimal retention: 1.6% of portfolio value

Dollar amount: $1,617,301

2. OPTIMIZED LAYER STRUCTURE

Retention: 0 - 1.6% ($1,617,301)

Primary: 1.6% - 16.6% ($15,000,000)

Excess: 16.6% - 41.6% ($25,000,000)

3. ANNUAL PREMIUM BREAKDOWN

Primary layer: $1,499,859 (1.50%)

Excess layer: $365,006 (0.37%)

Total premium: $1,864,865 (1.86%)

4. MONTE CARLO SIMULATION (5,000 paths, 10 years)

5. RESULTS COMPARISON

------------------------------------------------------------

Metric Uninsured Insured

Mean $60,021,752 $122,654,929

Median $49,754,072 $114,719,654

Std Dev $43,522,383 $43,328,475

5% VaR $87,719,760 $31,093,881

1% CVaR $97,415,436 $61,322,870

Ruin Prob 0.20% 0.00%

Time-Avg Growth -7.61% 1.47%

6. KEY INSIGHTS

------------------------------------------------------------

✓ Insurance reduces ruin probability by 0.2%

✓ Time-average growth improved by 9.1bps

✓ Tail risk (1% CVaR) reduced by $36.1M

✓ Optimal retention balances premium cost vs risk retention

Key Takeaways

Claims develop over time: Reserve adequacy is crucial

Frequency-severity framework is the foundation of insurance modeling

Multiple premium principles: Different approaches for different risks

Heavy tails matter: Extreme events dominate risk

Retention optimization balances premium savings with risk tolerance

Layers reduce cost: Structured coverage optimizes premium spend

Reinsurance complexity: Multiple structures serve different purposes

Next Steps

Chapter 4: Optimization Theory - Mathematical optimization methods

Chapter 5: Statistical Methods - Validation and testing

Chapter 1: Ergodic Economics - Foundational concepts