2. Basic Simulation Tutorial

This tutorial provides a comprehensive guide to running simulations with the Ergodic Insurance Framework. You’ll learn how to configure manufacturers, generate realistic losses, and run various simulation scenarios.

2.1. Learning Objectives

After completing this tutorial, you will be able to:

Configure manufacturer models with realistic parameters

Generate different types of loss distributions

Run Monte Carlo simulations

Analyze simulation results statistically

Visualize outcomes effectively

2.2. Setting Up a Manufacturer

The Manufacturer class models a company’s financial dynamics. Let’s explore its key parameters:

2.2.1. Basic Configuration

import numpy as np

from ergodic_insurance.manufacturer import WidgetManufacturer

from ergodic_insurance.config_v2 import ManufacturerConfig, WorkingCapitalConfig

# Create a medium-sized manufacturer

mfg_config = ManufacturerConfig(

initial_assets=10_000_000, # Starting with $10M

asset_turnover_ratio=1.0, # Generate revenue equal to assets

base_operating_margin=0.12, # Profit margin before losses

tax_rate=0.25, # 25% corporate tax

retention_ratio=0.7 # Retain 70% of earnings

)

mfg_working_capital_config = WorkingCapitalConfig(

percent_of_sales=0.20 # 20% of revenue tied up in WC

)

manufacturer = WidgetManufacturer(mfg_config, mfg_working_capital_config)

# Calculate key metrics

annual_revenue = manufacturer.assets * manufacturer.asset_turnover_ratio

operating_income = annual_revenue * manufacturer.base_operating_margin

net_income = operating_income * (1 - manufacturer.tax_rate)

print(f"Company Financial Profile:")

print(f" Assets: ${manufacturer.assets:,.0f}")

print(f" Annual Revenue: ${annual_revenue:,.0f}")

print(f" Operating Income: ${operating_income:,.0f}")

print(f" Net Income: ${net_income:,.0f}")

print(f" ROA: {net_income / manufacturer.assets:.1%}")

2.2.1.1. Expected Output

Company Financial Profile:

Assets: $10,000,000

Annual Revenue: $10,000,000

Operating Income: $1,200,000

Net Income: $900,000

ROA: 9.0%

2.2.2. Sector-Specific Configurations

Different manufacturing sectors have different financial characteristics:

import numpy as np

from ergodic_insurance.manufacturer import WidgetManufacturer

from ergodic_insurance.config_v2 import ManufacturerConfig

# Capital-intensive manufacturing

heavy_industry = WidgetManufacturer(ManufacturerConfig(

initial_assets=50_000_000,

asset_turnover_ratio=0.5, # Low turnover

base_operating_margin=0.05, # 5% margins

tax_rate=0.25,

retention_ratio=0.7

))

# High-efficiency light manufacturer (e.g., consumer goods, textiles)

light_manufacturer = WidgetManufacturer(ManufacturerConfig(

initial_assets=5_000_000,

asset_turnover_ratio=2.0, # High turnover - efficient asset use

base_operating_margin=0.08, # Moderate margins

tax_rate=0.25,

retention_ratio=0.6 # Lower retention due to distribution needs

))

# High-tech manufacturer (e.g., semiconductors, medical devices)

high_tech = WidgetManufacturer(ManufacturerConfig(

initial_assets=25_000_000, # Capital intensive

asset_turnover_ratio=0.8, # Moderate turnover

base_operating_margin=0.35, # High margins from IP/technology

tax_rate=0.21, # Lower effective tax rate

retention_ratio=0.85 # High retention for R&D investment

))

# Compare profitability

for company, name in [

(heavy_industry, "Heavy Industry"),

(light_manufacturer, "Light Manufacturer"),

(high_tech, "High-Tech")

]:

revenue = company.assets * company.asset_turnover_ratio

profit = revenue * company.base_operating_margin * (1 - company.tax_rate)

roe = profit / company.assets

print(f"{name}:")

print(f" Assets: ${company.assets:,.0f}")

print(f" Revenue: ${revenue:,.0f}")

print(f" ROE: {roe:.1%}")

print()

2.2.2.1. Expected Output

Warning: Operating margin 35.0% is unusually high

Heavy Industry:

Assets: $50,000,000

Revenue: $25,000,000

ROE: 1.9%

Light Manufacturer:

Assets: $5,000,000

Revenue: $10,000,000

ROE: 12.0%

High-Tech:

Assets: $25,000,000

Revenue: $20,000,000

ROE: 22.1%

2.3. Generating Losses

The ClaimGenerator creates realistic loss scenarios. Let’s explore different loss patterns:

2.3.1. Basic Loss Generation

import numpy as np

from ergodic_insurance.claim_generator import ClaimGenerator

# Standard loss generator

standard_losses = ClaimGenerator(

base_frequency=5,

severity_mean=80_000,

severity_std=65_000

)

# Generate 5 years of losses

sim_years = 5

standard_losses.rng.seed(42) # For reproducibility

losses_by_year = standard_losses.generate_claims(years=sim_years)

for year in range(sim_years):

annual_losses = [loss for loss in losses_by_year if loss.year == year]

annual_total = sum(loss.amount for loss in annual_losses)

print(f"Year {year+1}: {len(annual_losses)} losses, Total: ${annual_total:,.0f}")

2.3.1.1. Sample Output

Year 1: 5 losses, Total: $478,808

Year 2: 5 losses, Total: $328,959

Year 3: 3 losses, Total: $148,976

Year 4: 4 losses, Total: $210,324

Year 5: 9 losses, Total: $488,578

2.3.2. Different Risk Profiles

from ergodic_insurance.claim_generator import ClaimGenerator

# Low frequency, high severity (catastrophic risk)

catastrophic_risk = ClaimGenerator(

base_frequency=0.1, # One loss every 10 years

severity_mean=1_000_000, # Much larger losses

severity_std=500_000 # More variability

)

# High frequency, low severity (operational risk)

operational_risk = ClaimGenerator(

base_frequency=20, # Many small losses

severity_mean=3_000, # Smaller losses

severity_std=1_000 # Less variability

)

# Simulate and compare

np.random.seed(42)

years = 10

risk_profiles = {

"Standard": standard_losses,

"Catastrophic": catastrophic_risk,

"Operational": operational_risk

}

all_losses = []

for name, generator in risk_profiles.items():

generator_losses = []

for year in range(years):

generator.rng.seed(42 + year) # Different seed each year

annual = generator.generate_year(year=year)

generator_losses.extend(annual)

if generator_losses:

print(f"\n{name} Risk Profile ({years} years):")

print(f" Total losses: {len(generator_losses)}")

print(f" Average loss: ${np.mean([loss.amount for loss in generator_losses]):,.0f}")

print(f" Largest loss: ${max(loss.amount for loss in generator_losses):,.0f}")

print(f" Total amount: ${sum(loss.amount for loss in generator_losses):,.0f}")

all_losses.extend(generator_losses)

2.3.2.1. Sample Output

Standard Risk Profile (10 years):

Total losses: 46

Average loss: $76,491

Largest loss: $233,220

Total amount: $3,518,578

Catastrophic Risk Profile (10 years):

Total losses: 4

Average loss: $1,075,799

Largest loss: $1,614,911

Total amount: $4,303,197

Operational Risk Profile (10 years):

Total losses: 202

Average loss: $2,936

Largest loss: $8,345

Total amount: $593,058

2.4. Running Simulations

Now let’s run comprehensive simulations with different scenarios:

2.4.1. Single Path Simulation

from ergodic_insurance.insurance import InsurancePolicy, InsuranceLayer

from ergodic_insurance.simulation import Simulation

### Using previously defined manufacturer and losses #######

# Policy parameters

deductible = 200_000

limit = 40_000_000

### Calculate a fair premium #######

# Calculate pure premium

total_covered_losses = sum(min(max(0, loss.amount - deductible), limit) \

for loss in all_losses)

pure_premium = total_covered_losses / years # As a fraction of assets

loss_ratio = 0.70 # 70% of premiums go towards losses

reasonable_premium = pure_premium / loss_ratio

reasonable_rate = reasonable_premium / limit

print(f"Calculated Reasonable Premium: ${reasonable_premium:,.0f}")

### Set up the policy #######

single_layer = InsuranceLayer(

attachment_point=deductible,

limit=limit,

rate=reasonable_rate

)

insurance_policy = InsurancePolicy(

layers=[single_layer],

deductible=deductible

)

### Set up the simulation #######

sim = Simulation(

manufacturer=heavy_industry,

claim_generator=[standard_losses, catastrophic_risk, operational_risk],

insurance_policy=insurance_policy,

time_horizon=20, # 20-year simulation

seed=42

)

results = sim.run()

result_summary = results.summary_stats()

print(f"20-Year Simulation Results:")

print(f"Starting Assets: ${heavy_industry.config.initial_assets:,.0f}")

print(f"Final Assets: ${result_summary['final_assets']:,.0f}")

print(f"Final Assets: ${result_summary['final_assets']:,.0f}")

print(f"Time-Weighted ROE: {result_summary['time_weighted_roe']:.2%}")

2.4.1.1. Sample Output

Calculated Reasonable Premium: $85,661

20-Year Simulation Results:

Starting Assets: $50,000,000

Final Assets: $53,379,921

Final Assets: $53,379,921

Time-Weighted ROE: 1.82%

2.4.2. Monte Carlo Simulation

For robust analysis, we need multiple simulation paths:

from ergodic_insurance.monte_carlo import MonteCarloEngine, SimulationConfig

from ergodic_insurance.insurance_program import InsuranceProgram, EnhancedInsuranceLayer

from ergodic_insurance.loss_distributions import ManufacturingLossGenerator

# Create a ManufacturingLossGenerator for Monte Carlo simulation

# (MonteCarloEngine expects this type, not ClaimGenerator)

mc_loss_generator = ManufacturingLossGenerator(

attritional_params={

'base_frequency': 3.0, # Similar to standard_losses frequency

'severity_mean': 40_000, # Similar to standard_losses severity

'severity_cv': 0.8 # Coefficient of variation

},

large_params={

'base_frequency': 0.1, # Occasional large losses

'severity_mean': 500_000,

'severity_cv': 1.2

},

seed=42

)

# Create insurance program with enhanced layers

# EnhancedInsuranceLayer has the required methods for InsuranceProgram

insurance_layers = [

EnhancedInsuranceLayer(

attachment_point=100_000, # $100K deductible

limit=10_000_000, # $10M limit

base_premium_rate=0.015 # 2% rate on limit

)

]

insurance_program = InsuranceProgram(layers=insurance_layers)

# Configure Monte Carlo simulation

mc_config = SimulationConfig(

n_simulations=1000,

n_years=20,

parallel=False, # Set to False for simpler execution

progress_bar=True,

seed=42

)

# Create Monte Carlo engine

mc_engine = MonteCarloEngine(

loss_generator=mc_loss_generator,

insurance_program=insurance_program,

manufacturer=heavy_industry,

config=mc_config

)

# Run simulations

print("Running Monte Carlo simulations...")

mc_results = mc_engine.run()

# Extract results

survival_rate = 1 - mc_results.ruin_probability

mean_growth = np.mean(mc_results.growth_rates)

median_growth = np.median(mc_results.growth_rates)

var_95 = np.percentile(mc_results.growth_rates, 5)

mean_final_assets = np.mean(mc_results.final_assets)

print(f"\nMonte Carlo Results (1000 simulations):")

print(f" Survival Rate: {survival_rate:.1%}")

print(f" Mean Growth Rate: {mean_growth:.2%}")

print(f" Median Growth Rate: {median_growth:.2%}")

print(f" 95% VaR Growth: {var_95:.2%}")

print(f" Starting Wealth: ${mc_engine.manufacturer._initial_assets:,.0f}")

print(f" Mean Final Wealth: ${mean_final_assets:,.0f}")

2.4.2.1. Sample Output

Monte Carlo Results (1000 simulations):

Survival Rate: 100.0%

Mean Growth Rate: 0.51%

Median Growth Rate: 0.56%

95% VaR Growth: 0.03%

Starting Wealth: $50,000,000

Mean Final Wealth: $59,211,744

2.4.3. Comparing Insurance Strategies

# Define different insurance strategies

strategies = [

{"name": "No Insurance", "attachment": float('inf'), "limit": 0, "base_premium_rate": 0},

{"name": "High Deductible", "attachment": 2_000_000, "limit": 10_000_000, "base_premium_rate": 0.01},

{"name": "Medium Coverage", "attachment": 500_000, "limit": 5_000_000, "base_premium_rate": 0.015},

{"name": "Full Coverage", "attachment": 100_000, "limit": 20_000_000, "base_premium_rate": 0.02}

]

# Run simulations for each strategy

results_comparison = {}

for strategy in strategies:

# Create insurance layers for this strategy

if strategy['limit'] > 0:

strategy_layers = [

EnhancedInsuranceLayer(

attachment_point=strategy['attachment'],

limit=strategy['limit'],

base_premium_rate=strategy['base_premium_rate']

)

]

strategy_insurance = InsuranceProgram(layers=strategy_layers)

else:

# No insurance case

strategy_insurance = InsuranceProgram(layers=[])

# Configure simulation for this strategy

strategy_config = SimulationConfig(

n_simulations=500,

n_years=20,

parallel=False,

progress_bar=False, # Disable for cleaner output

seed=42

)

# Create new engine for this strategy

strategy_engine = MonteCarloEngine(

loss_generator=mc_loss_generator,

insurance_program=strategy_insurance,

manufacturer=heavy_industry.copy(), # Use a copy to ensure independence

config=strategy_config

)

# Run simulations

print(f"Running {strategy['name']}...")

strategy_results = strategy_engine.run()

results_comparison[strategy['name']] = strategy_results

# Compare strategies

print("\nStrategy Comparison:")

print(f"{'Strategy':<20} {'Survival':<12} {'Mean Growth':<12} {'Volatility':<12}")

print("-" * 56)

for name, results in results_comparison.items():

survival = 1 - results.ruin_probability

mean_growth = np.mean(results.growth_rates)

vol = np.std(results.growth_rates)

print(f"{name:<20} {survival:>10.1%} {mean_growth:>10.2%} {vol:>10.2%}")

2.4.3.1. Sample Output

Strategy Comparison:

Strategy Survival Mean Growth Volatility

--------------------------------------------------------

No Insurance 100.0% 0.98% 0.26%

High Deductible 100.0% 0.90% 0.32%

Medium Coverage 100.0% 0.94% 0.22%

Full Coverage 100.0% 0.59% 0.31%

2.5. Visualizing Results

Effective visualization helps understand simulation outcomes:

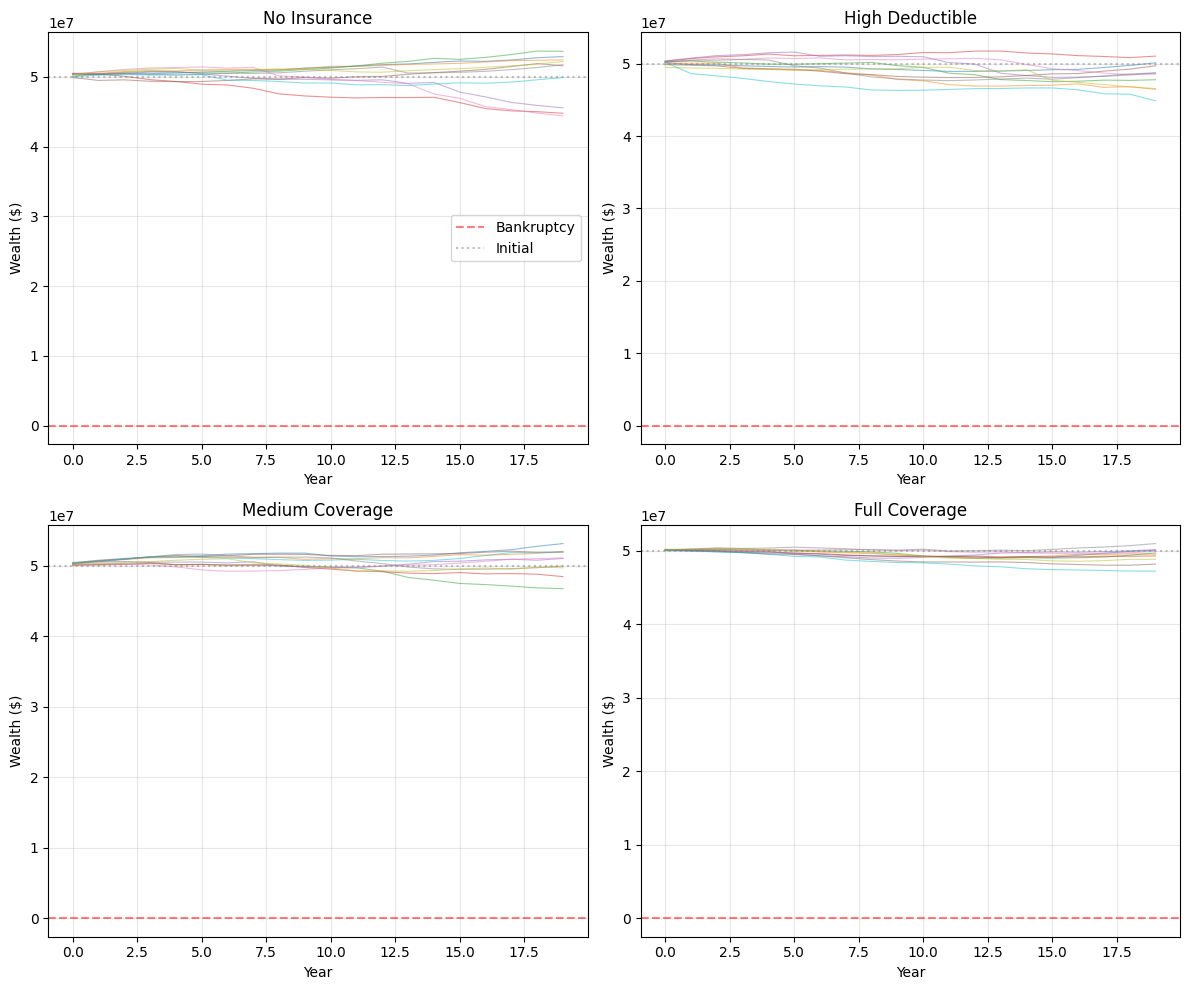

2.5.1. Wealth Trajectories

import matplotlib.pyplot as plt

from ergodic_insurance.simulation import Simulation

# Run simulation with multiple seeds

fig, axes = plt.subplots(2, 2, figsize=(12, 10))

strategies_to_plot = strategies[:4]

for ax, strategy in zip(axes.flat, strategies_to_plot):

# Run 10 simulations with different seeds for this strategy

trajectories = []

for seed in range(10):

# Create insurance policy for this strategy

if strategy['limit'] > 0:

strategy_layer = InsuranceLayer(

attachment_point=strategy['attachment'],

limit=strategy['limit'],

rate=strategy['base_premium_rate']

)

strategy_policy = InsurancePolicy(

layers=[strategy_layer],

deductible=strategy['attachment']

)

else:

# No insurance case

strategy_policy = InsurancePolicy(layers=[], deductible=float('inf'))

# Create and run simulation

strategy_sim = Simulation(

manufacturer=heavy_industry.copy(), # Use a copy for independence

claim_generator=[standard_losses, catastrophic_risk, operational_risk],

insurance_policy=strategy_policy,

time_horizon=20,

seed=seed

)

result = strategy_sim.run()

# Extract wealth trajectory from the assets array

trajectories.append(result.assets)

# Plot trajectories

for traj in trajectories:

ax.plot(range(len(traj)), traj, alpha=0.5, linewidth=0.8)

ax.axhline(y=0, color='red', linestyle='--', alpha=0.5, label='Bankruptcy')

ax.axhline(y=heavy_industry.config.initial_assets, color='gray',

linestyle=':', alpha=0.5, label='Initial')

ax.set_title(strategy['name'])

ax.set_xlabel('Year')

ax.set_ylabel('Wealth ($)')

ax.grid(True, alpha=0.3)

# Only show legend on first subplot

if ax == axes.flat[0]:

ax.legend(loc='best')

plt.tight_layout()

plt.show()

2.5.1.1. Sample Output

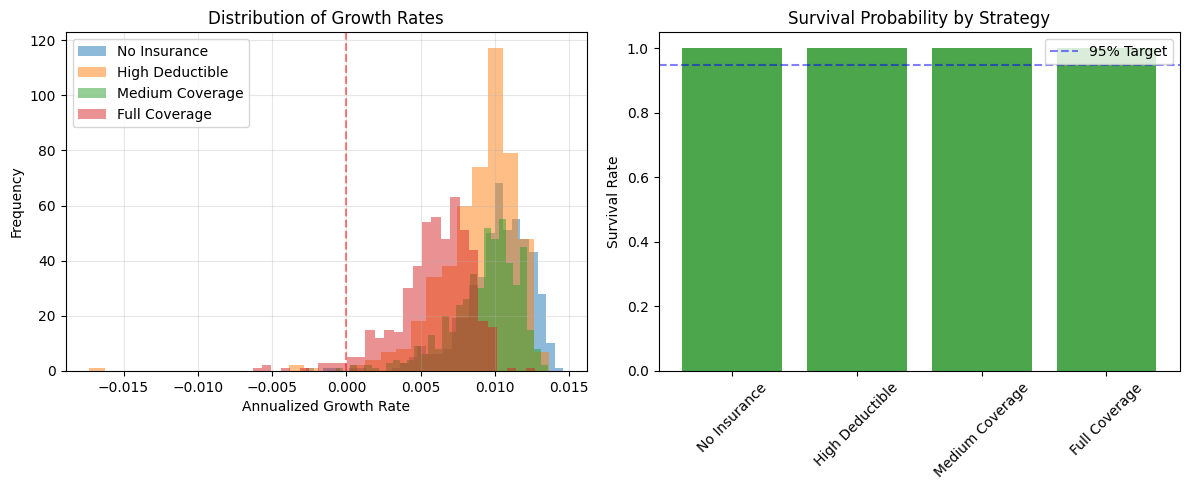

2.5.2. Distribution of Outcomes

# Plot distribution of final wealth

fig, axes = plt.subplots(1, 2, figsize=(12, 5))

# Growth rate distribution

ax1 = axes[0]

for name, results in results_comparison.items():

ax1.hist(results.growth_rates, bins=30, alpha=0.5, label=name)

ax1.axvline(x=0, color='red', linestyle='--', alpha=0.5)

ax1.set_xlabel('Annualized Growth Rate')

ax1.set_ylabel('Frequency')

ax1.set_title('Distribution of Growth Rates')

ax1.legend()

ax1.grid(True, alpha=0.3)

# Survival analysis

ax2 = axes[1]

names = list(results_comparison.keys())

# Calculate survival rates from ruin_probability

survival_rates = [1 - results_comparison[name].ruin_probability for name in names]

colors = ['red' if sr < 0.95 else 'green' for sr in survival_rates]

ax2.bar(names, survival_rates, color=colors, alpha=0.7)

ax2.axhline(y=0.95, color='blue', linestyle='--', alpha=0.5, label='95% Target')

ax2.set_ylabel('Survival Rate')

ax2.set_title('Survival Probability by Strategy')

ax2.legend()

ax2.set_ylim([0, 1.05])

plt.xticks(rotation=45)

plt.tight_layout()

plt.show()

2.5.2.1. Sample Output

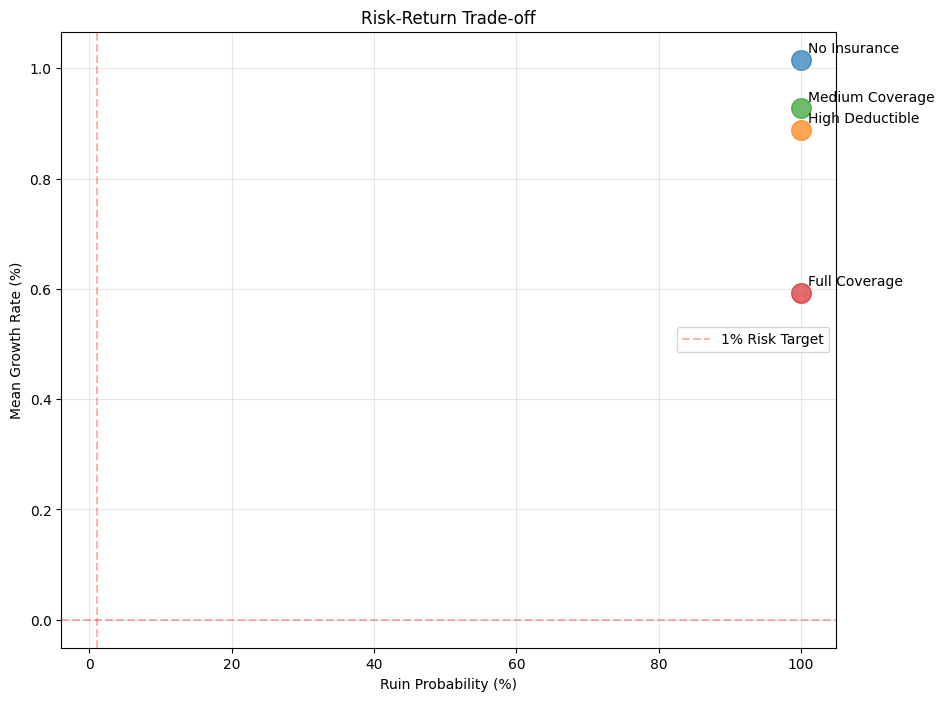

2.5.3. Risk-Return Scatter

# Create risk-return scatter plot

plt.figure(figsize=(10, 8))

for name, results in results_comparison.items():

mean_return = np.mean(results.growth_rates)

risk = 1 - results.ruin_probability # Ruin probability as risk

plt.scatter(risk * 100, mean_return * 100, s=200, alpha=0.7)

plt.annotate(name, (risk * 100, mean_return * 100),

xytext=(5, 5), textcoords='offset points')

plt.xlabel('Ruin Probability (%)')

plt.ylabel('Mean Growth Rate (%)')

plt.title('Risk-Return Trade-off')

plt.grid(True, alpha=0.3)

# Add efficient frontier concept

plt.axhline(y=0, color='red', linestyle='--', alpha=0.3)

plt.axvline(x=1, color='red', linestyle='--', alpha=0.3, label='1% Risk Target')

plt.legend(loc='best')

plt.show()

2.5.3.1. Sample Output

2.6. Advanced Simulation Features

2.6.1. Using Different Random Processes

from ergodic_insurance.stochastic_processes import GeometricBrownianMotion, StochasticConfig

from ergodic_insurance.simulation import Simulation

# Create a stochastic process for revenue volatility

# This adds market volatility to the manufacturer's revenue generation

stochastic_config = StochasticConfig(

drift=0.05, # 5% drift (growth trend)

volatility=0.15, # 15% volatility (market uncertainty)

time_step=1.0, # Annual time step

random_seed=42 # For reproducibility

)

gbm = GeometricBrownianMotion(stochastic_config)

# Create a stochastic version of heavy_industry

stochastic_manufacturer = WidgetManufacturer(

config=heavy_industry.config, # Use same configuration

stochastic_process=gbm # Add stochastic process

)

# Compare deterministic vs stochastic simulations

comparison_results = {}

# Run deterministic simulation (no stochastic process)

print("Running deterministic simulation...")

deterministic_sim = Simulation(

manufacturer=heavy_industry.copy(),

claim_generator=[standard_losses],

insurance_policy=insurance_policy,

time_horizon=20,

seed=42

)

det_result = deterministic_sim.run()

comparison_results['Deterministic'] = det_result

# Run stochastic simulation (with GBM process)

print("Running stochastic simulation...")

stochastic_sim = Simulation(

manufacturer=stochastic_manufacturer.copy(),

claim_generator=[standard_losses],

insurance_policy=insurance_policy,

time_horizon=20,

seed=42

)

# Note: The step() method in manufacturer will apply stochastic shocks when available

stoch_result = stochastic_sim.run()

comparison_results['Stochastic'] = stoch_result

# Compare results

print("\n" + "="*50)

print("Deterministic vs Stochastic Comparison")

print("="*50)

for name, result in comparison_results.items():

stats = result.summary_stats()

print(f"\n{name} Simulation:")

print(f" Final Assets: ${stats['final_assets']:,.0f}")

print(f" Mean ROE: {stats['mean_roe']:.2%}")

print(f" ROE Volatility: {stats['roe_std']:.2%}")

print(f" Survived: {stats['survived']}")

if not stats['survived']:

print(f" Insolvency Year: {result.insolvency_year}")

2.6.1.1. Sample Output

==================================================

Deterministic vs Stochastic Comparison

==================================================

Deterministic Simulation:

Final Assets: $51,132,355

Mean ROE: 1.72%

ROE Volatility: 0.53%

Survived: True

Stochastic Simulation:

Final Assets: $55,664,614

Mean ROE: 1.95%

ROE Volatility: 0.64%

Survived: True

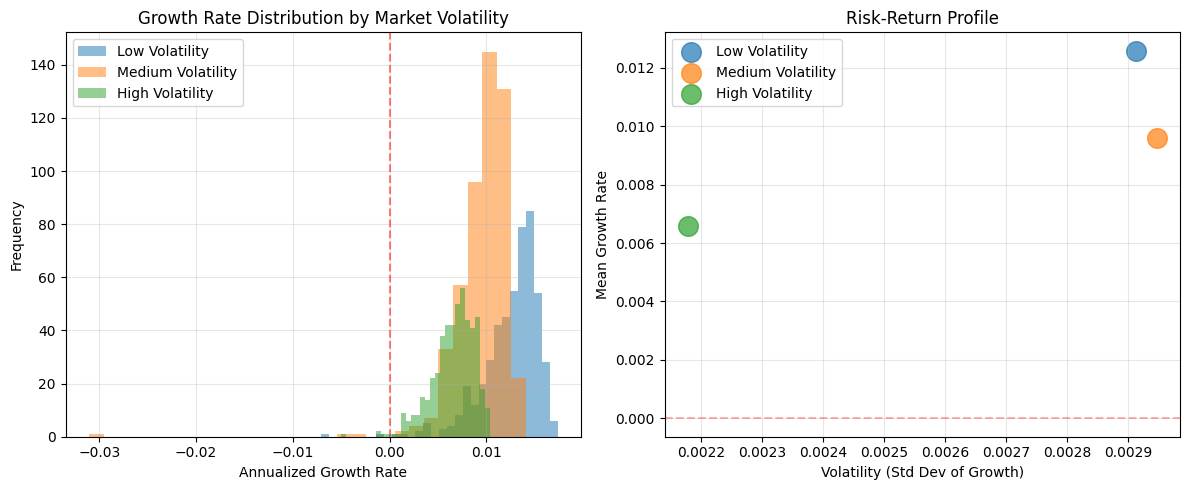

2.6.2. Monte Carlo with Stochastic Processes

This shows how market volatility affects insurance strategy effectiveness

# Create manufacturers with different volatility levels

volatility_scenarios = {

"Low Volatility": StochasticConfig(drift=0.03, volatility=0.05, random_seed=42),

"Medium Volatility": StochasticConfig(drift=0.03, volatility=0.15, random_seed=42),

"High Volatility": StochasticConfig(drift=0.03, volatility=0.25, random_seed=42)

}

# Test with medium coverage insurance strategy

test_insurance = InsuranceProgram(layers=[

EnhancedInsuranceLayer(

attachment_point=500_000,

limit=5_000_000,

base_premium_rate=0.015

)

])

# Run Monte Carlo for each volatility scenario

volatility_results = {}

for vol_name, stoch_config in volatility_scenarios.items():

print(f"Running Monte Carlo for {vol_name}...")

# Create manufacturer with stochastic process

gbm_process = GeometricBrownianMotion(stoch_config)

vol_manufacturer = WidgetManufacturer(

config=heavy_industry.config,

stochastic_process=gbm_process

)

# Configure Monte Carlo

mc_config = SimulationConfig(

n_simulations=500,

n_years=20,

parallel=False,

progress_bar=False,

seed=42

)

# Run Monte Carlo

mc_engine = MonteCarloEngine(

loss_generator=mc_loss_generator,

insurance_program=test_insurance,

manufacturer=vol_manufacturer,

config=mc_config

)

vol_results = mc_engine.run()

volatility_results[vol_name] = vol_results

# Analyze impact of volatility

print("\n" + "="*60)

print("Impact of Market Volatility on Insurance Effectiveness")

print("="*60)

print(f"{'Scenario':<20} {'Survival':<12} {'Mean Growth':<15} {'Growth Vol':<12}")

print("-"*60)

for name, results in volatility_results.items():

survival = 1 - results.ruin_probability

mean_growth = np.mean(results.growth_rates)

growth_vol = np.std(results.growth_rates)

print(f"{name:<20} {survival:>10.1%} {mean_growth:>12.2%} {growth_vol:>10.2%}")

# Visualize the results

fig, axes = plt.subplots(1, 2, figsize=(12, 5))

# Growth rate distributions

ax1 = axes[0]

for name, results in volatility_results.items():

ax1.hist(results.growth_rates, bins=30, alpha=0.5, label=name)

ax1.axvline(x=0, color='red', linestyle='--', alpha=0.5)

ax1.set_xlabel('Annualized Growth Rate')

ax1.set_ylabel('Frequency')

ax1.set_title('Growth Rate Distribution by Market Volatility')

ax1.legend()

ax1.grid(True, alpha=0.3)

# Risk-return scatter

ax2 = axes[1]

for name, results in volatility_results.items():

mean_return = np.mean(results.growth_rates)

vol_return = np.std(results.growth_rates)

survival = 1 - results.ruin_probability

# Size proportional to survival rate

ax2.scatter(vol_return, mean_return, s=survival*200, alpha=0.7, label=name)

ax2.set_xlabel('Volatility (Std Dev of Growth)')

ax2.set_ylabel('Mean Growth Rate')

ax2.set_title('Risk-Return Profile')

ax2.legend()

ax2.grid(True, alpha=0.3)

# Add efficient frontier reference line

ax2.axhline(y=0, color='red', linestyle='--', alpha=0.3)

plt.tight_layout()

plt.show()

2.6.2.1. Sample Output

============================================================

Impact of Market Volatility on Insurance Effectiveness

============================================================

Scenario Survival Mean Growth Growth Vol

------------------------------------------------------------

Low Volatility 100.0% 1.26% 0.29%

Medium Volatility 100.0% 0.96% 0.29%

High Volatility 100.0% 0.66% 0.22%

2.6.3. Parallel Processing

# Parallel processing considerations on Windows

# Note: On Windows, parallel processing often has significant overhead due to process spawning

# It's only beneficial for large simulations (typically >5000 simulations)

import time

import warnings

# Create insurance program for test

parallel_insurance = InsuranceProgram(layers=[

EnhancedInsuranceLayer(

attachment_point=1_000_000,

limit=10_000_000,

base_premium_rate=0.02

)

])

print("="*60)

print("Parallel Processing Performance Test")

print("="*60)

# Test with different simulation sizes

test_sizes = [500, 1000, 5000, 10000]

results_comparison = {}

for n_sims in test_sizes:

print(f"\nTesting with {n_sims} simulations:")

print("-" * 40)

# Sequential execution

start_time = time.time()

sequential_config = SimulationConfig(

n_simulations=n_sims,

n_years=20, # Reduced years for faster testing

parallel=False,

progress_bar=False, # Disable for cleaner output

seed=42

)

sequential_engine = MonteCarloEngine(

loss_generator=mc_loss_generator,

insurance_program=parallel_insurance,

manufacturer=heavy_industry.copy(),

config=sequential_config

)

with warnings.catch_warnings():

warnings.simplefilter("ignore")

sequential_results = sequential_engine.run()

sequential_time = time.time() - start_time

# Standard parallel execution (not enhanced)

start_time = time.time()

parallel_config = SimulationConfig(

n_simulations=n_sims,

n_years=20,

parallel=True,

n_workers=-2,

use_enhanced_parallel=False, # Disable enhanced parallel to avoid Windows issues

progress_bar=False,

seed=42

)

parallel_engine = MonteCarloEngine(

loss_generator=mc_loss_generator,

insurance_program=parallel_insurance,

manufacturer=heavy_industry.copy(),

config=parallel_config

)

with warnings.catch_warnings():

warnings.simplefilter("ignore")

parallel_results = parallel_engine.run()

parallel_time = time.time() - start_time

# Store results

results_comparison[n_sims] = {

'sequential_time': sequential_time,

'parallel_time': parallel_time,

'speedup': sequential_time / parallel_time if parallel_time > 0 else 0

}

print(f" Sequential: {sequential_time:.2f}s")

print(f" Parallel: {parallel_time:.2f}s")

print(f" Speedup: {results_comparison[n_sims]['speedup']:.2f}x")

# Verify results match

seq_survival = 1 - sequential_results.ruin_probability

par_survival = 1 - parallel_results.ruin_probability

if abs(seq_survival - par_survival) < 0.01:

print(f" ✓ Results match (survival ~{seq_survival:.1%})")

else:

print(f" ⚠ Results differ: seq={seq_survival:.1%}, par={par_survival:.1%}")

# Recommendations

print("\n" + "="*60)

print("Recommendations for Your System")

print("="*60)

# Find crossover point

efficient_threshold = None

for n_sims, data in results_comparison.items():

if data['speedup'] > 1.1: # 10% improvement threshold

efficient_threshold = n_sims

break

if efficient_threshold:

print(f"✓ Use parallel execution for simulations > {efficient_threshold}")

print(f" (Achieves {results_comparison[efficient_threshold]['speedup']:.1f}x speedup)")

else:

print("⚠ On this system, sequential execution is generally faster")

print(" due to parallel processing overhead.")

print("\nFor better parallel performance:")

print(" - Use larger simulation counts (>5000)")

print(" - Use Linux/Mac where process spawning is faster")

print(" - Consider using enhanced parallel with shared memory (if available)")

2.6.3.1. Sample Output

============================================================

Parallel Processing Performance Test

============================================================

Testing with 500 simulations:

----------------------------------------

Sequential: 1.13s

Parallel: 1.00s

Speedup: 1.13x

✓ Results match (survival ~100.0%)

Testing with 1000 simulations:

----------------------------------------

Sequential: 2.07s

Parallel: 1.89s

Speedup: 1.10x

✓ Results match (survival ~100.0%)

Testing with 5000 simulations:

----------------------------------------

Sequential: 8.74s

Parallel: 8.72s

Speedup: 1.00x

✓ Results match (survival ~100.0%)

Testing with 10000 simulations:

----------------------------------------

Sequential: 17.61s

Parallel: 16.77s

Speedup: 1.05x

✓ Results match (survival ~100.0%)

2.7. Best Practices

2.7.1. 1. Choose Appropriate Time Horizons

Short-term (1-5 years): Focus on survival

Medium-term (5-20 years): Balance growth and safety

Long-term (20+ years): Ergodic effects dominate

2.7.2. 2. Set Realistic Parameters

2.7.3. 3. Validate Results

# Sanity checks for simulation results

def validate_simulation(result, manufacturer):

"""Validate simulation results for reasonableness."""

# Calculate growth rate from assets

if len(result.assets) > 1:

initial_assets = result.assets[0]

final_assets = result.assets[-1]

n_years = len(result.assets) - 1

if initial_assets > 0 and final_assets > 0:

annualized_growth = (final_assets / initial_assets) ** (1/n_years) - 1

else:

annualized_growth = -1.0

else:

annualized_growth = 0.0

# Get stats for validation

stats = result.summary_stats()

checks = {

"Positive initial wealth": result.assets[0] > 0,

"Reasonable growth": -0.5 < annualized_growth < 0.5,

"Trajectory length matches years": len(result.assets) == len(result.years),

"Final wealth matches stats": abs(stats['final_assets'] - result.assets[-1]) < 1,

"ROE array length matches": len(result.roe) == len(result.years),

"No NaN in assets": not np.any(np.isnan(result.assets)),

"Survived matches insolvency": (result.insolvency_year is None) == stats['survived']

}

print("Simulation Validation Results:")

print("-" * 40)

for check, passed in checks.items():

status = "✅" if passed else "❌"

print(f"{status} {check}")

# Additional info

print("\nKey Metrics:")

print(f" Initial Assets: ${result.assets[0]:,.0f}")

print(f" Final Assets: ${result.assets[-1]:,.0f}")

print(f" Annualized Growth: {annualized_growth:.2%}")

print(f" Mean ROE: {stats['mean_roe']:.2%}")

print(f" Simulation Years: {len(result.years)}")

print(f" Survived: {stats['survived']}")

return all(checks.values())

# Validate the deterministic simulation result

is_valid = validate_simulation(det_result, heavy_industry)

print(f"\n{'✅ Simulation is valid!' if is_valid else '❌ Simulation has issues!'}")

2.7.3.1. Sample Output

Simulation Validation Results:

----------------------------------------

✅ Positive initial wealth

✅ Reasonable growth

✅ Trajectory length matches years

✅ Final wealth matches stats

✅ ROE array length matches

✅ No NaN in assets

✅ Survived matches insolvency

Key Metrics:

Initial Assets: $50,187,227

Final Assets: $51,132,355

Annualized Growth: 0.10%

Mean ROE: 1.72%

Simulation Years: 20

Survived: True

✅ Simulation is valid!

2.8. Troubleshooting Common Issues

2.8.1. Issue: Simulation runs too slowly

Solution: Reduce number of simulations or use parallel processing.

2.8.2. Issue: All paths show bankruptcy

Solution: Check if losses are too severe relative to assets.

2.8.3. Issue: Results vary wildly between runs

Solution: Increase simulation count and use seeds for diagnostic stability.

2.9. Next Steps

Now that you understand basic simulations:

Configuring Insurance: Learn about multi-layer programs

Optimization Workflow: Find optimal insurance parameters

Analyzing Results: Deep dive into metrics and decisions

2.10. Summary

You’ve learned how to:

✅ Configure manufacturer models for different industries

✅ Generate various loss distributions

✅ Run single-path and Monte Carlo simulations

✅ Compare insurance strategies

✅ Visualize and interpret results

✅ Apply best practices and troubleshoot issues

You’re now ready to explore more complex insurance structures and optimization!