1. Getting Started with Ergodic Insurance Framework

Welcome to the Ergodic Insurance Framework! This tutorial will help you get up and running with your first insurance optimization analysis in just a few minutes.

1.1. What You’ll Learn

By the end of this tutorial, you will:

Install the framework and verify your setup

Run your first manufacturer simulation

Understand the basic output metrics

Visualize wealth trajectories over time

Learn where to go next

1.2. Prerequisites

Python 3.12 or higher installed

Basic familiarity with Python (ability to run scripts)

No advanced mathematics or insurance knowledge required!

1.3. Installation

1.3.1. Step 1: Clone or Download the Framework

If you have git installed:

git clone https://github.com/AlexFiliakov/Ergodic-Insurance-Limits.git

cd Ergodic-Insurance-Limits

Or download the ZIP file from GitHub and extract it.

1.3.2. Step 2: Install Dependencies

We recommend using uv for faster installation:

pip install uv

uv sync

Alternatively, use standard pip:

cd ergodic_insurance

pip install -e .

1.3.3. Step 3: Verify Installation

Let’s verify everything is working:

# test_installation.py

from ergodic_insurance.manufacturer import WidgetManufacturer

from ergodic_insurance.claim_generator import ClaimGenerator

from ergodic_insurance.config_v2 import ManufacturerConfig

print("✅ Framework imported successfully!")

# Create configuration

config = ManufacturerConfig(

initial_assets=10_000_000,

asset_turnover_ratio=1.0,

base_operating_margin=0.08,

tax_rate=0.25,

retention_ratio=0.7

)

# Create a simple manufacturer

company = WidgetManufacturer(config)

print(f"✅ Created company with ${company.assets:,.0f} in assets")

print("🎉 Installation successful!")

1.4. Your First Simulation

Now let’s run a real simulation to see how insurance affects your company’s growth trajectory.

1.4.1. Step 1: Create the Basic Setup

# first_simulation.py

import numpy as np

import matplotlib.pyplot as plt

from ergodic_insurance.manufacturer import WidgetManufacturer

from ergodic_insurance.claim_generator import ClaimGenerator

from ergodic_insurance.config_v2 import ManufacturerConfig

# Set random seed for reproducibility

np.random.seed(42)

# Configure the manufacturer

config = ManufacturerConfig(

initial_assets=10_000_000, # Starting with $10M

asset_turnover_ratio=1.0, # Generate revenue equal to assets

base_operating_margin=0.12, # Profit margin before losses (~8% margin after losses)

tax_rate=0.25, # 25% corporate tax

retention_ratio=0.7 # Retain 70% of earnings

)

# Create a $10M widget manufacturer

manufacturer = WidgetManufacturer(config)

print(f"Company Profile:")

print(f" Initial Assets: ${manufacturer.assets:,.0f}")

print(f" Expected Annual Revenue: ${manufacturer.assets * config.asset_turnover_ratio:,.0f}")

print(f" Expected Operating Income (Before Losses): ${manufacturer.assets * config.asset_turnover_ratio * config.base_operating_margin:,.0f}")

1.4.1.1. Expected Output:

Company Profile:

Initial Assets: $10,000,000

Expected Annual Revenue: $10,000,000

Expected Operating Income (Before Losses): $1,200,000

1.4.3. Step 3: Run the Simulation

bankruptcy_no_ins_scenarios = []

bankruptcy_with_ins_scenarios = []

scenarios_no_insurance = []

scenarios_with_insurance = []

for scen in range(scenarios):

### Configuration 1: No insurance #######

all_scenario_claims_no_ins = []

manufacturer_no_ins = WidgetManufacturer(config)

wealth_no_insurance = [config.initial_assets]

for year in range(years):

revenue = manufacturer_no_ins.calculate_revenue() # Current revenue

revenue_scale = revenue / config.initial_assets

# Regular losses: 4-6 per year on average, typically $50K-$150K

regular_frequency = regular_freq_baseline * revenue_scale # Scale with revenue

regular_generator = ClaimGenerator(

base_frequency=regular_frequency,

severity_mean=regular_sev_mean,

severity_std=regular_sev_std,

)

# Catastrophic losses: ~0.1 per year (once every 10 years), but can be $1M-$5M

catastrophic_frequency = cat_freq_baseline * revenue_scale # Also scales with revenue

catastrophic_generator = ClaimGenerator(

base_frequency=catastrophic_frequency,

severity_mean=cat_sev_mean,

severity_std=cat_sev_std,

)

# Generate regular losses for this year

regular_claims, _ = regular_generator.generate_enhanced_claims(

years=1,

revenue=revenue,

use_enhanced_distributions=False,

)

# Generate catastrophic losses for this year

catastrophic_claims, _ = catastrophic_generator.generate_enhanced_claims(

years=1,

revenue=revenue,

use_enhanced_distributions=False

)

# Combine all losses for this year

year_claims = regular_claims + catastrophic_claims

# For no insurance, company pays all losses over time without collateral

for claim in year_claims:

manufacturer_no_ins.process_uninsured_claim(claim.amount)

manufacturer_no_ins.step()

wealth_no_insurance.append(manufacturer_no_ins.assets)

if manufacturer_no_ins.is_ruined:

bankruptcy_no_ins_scenarios.append(scen)

scenarios_no_insurance.append(wealth_no_insurance)

### Configuration 2: With insurance ($100K deductible, $200M limit) #######

manufacturer_with_ins = WidgetManufacturer(config)

wealth_with_insurance = [config.initial_assets]

for year in range(years):

revenue = manufacturer_with_ins.calculate_revenue() # Current revenue

revenue_scale = revenue / config.initial_assets

# Regular losses: 4-6 per year on average, typically $50K-$150K

regular_frequency = regular_freq_baseline * revenue_scale # Scale with revenue

regular_generator = ClaimGenerator(

base_frequency=regular_frequency,

severity_mean=regular_sev_mean, # Mean claim size $80K

severity_std=regular_sev_std, # Moderate variation

)

# Catastrophic losses: ~0.1 per year (once every 10 years), but can be $1M-$5M

catastrophic_frequency = cat_freq_baseline * revenue_scale # Also scales with revenue

catastrophic_generator = ClaimGenerator(

base_frequency=catastrophic_frequency,

severity_mean=cat_sev_mean, # Mean catastrophic loss $2M

severity_std=cat_sev_std, # High variation - can reach $5M+

)

# Generate regular losses for this year

regular_claims, _ = regular_generator.generate_enhanced_claims(

years=1,

revenue=revenue,

use_enhanced_distributions=False,

)

# Generate catastrophic losses for this year

catastrophic_claims, _ = catastrophic_generator.generate_enhanced_claims(

years=1,

revenue=revenue,

use_enhanced_distributions=False

)

# Combine all losses for this year

year_claims = regular_claims + catastrophic_claims

# Process each claim through insurance

for claim in year_claims:

company_payment, insurance_payment = manufacturer_with_ins.process_insurance_claim(

claim_amount=claim.amount,

deductible_amount=100_000,

insurance_limit=200_000_000

)

# Pay annual premium based on current revenue scale

current_revenue = manufacturer_with_ins.calculate_revenue()

revenue_scale = current_revenue / config.initial_assets

annual_premium = annual_premium_baseline * revenue_scale

manufacturer_with_ins.record_insurance_premium(annual_premium)

manufacturer_with_ins.step()

wealth_with_insurance.append(manufacturer_with_ins.assets)

if manufacturer_with_ins.is_ruined:

bankruptcy_with_ins_scenarios.append(scen)

scenarios_with_insurance.append(wealth_with_insurance)

print(f"Bankruptcies (no insurance): {len(bankruptcy_no_ins_scenarios)}/{scenarios}")

print(f"Bankruptcies (with insurance): {len(bankruptcy_with_ins_scenarios)}/{scenarios}")

1.4.3.1. Sample Output:

<Several Insolvencies>

Bankruptcies (no insurance): 35/100

Bankruptcies (with insurance): 0/100

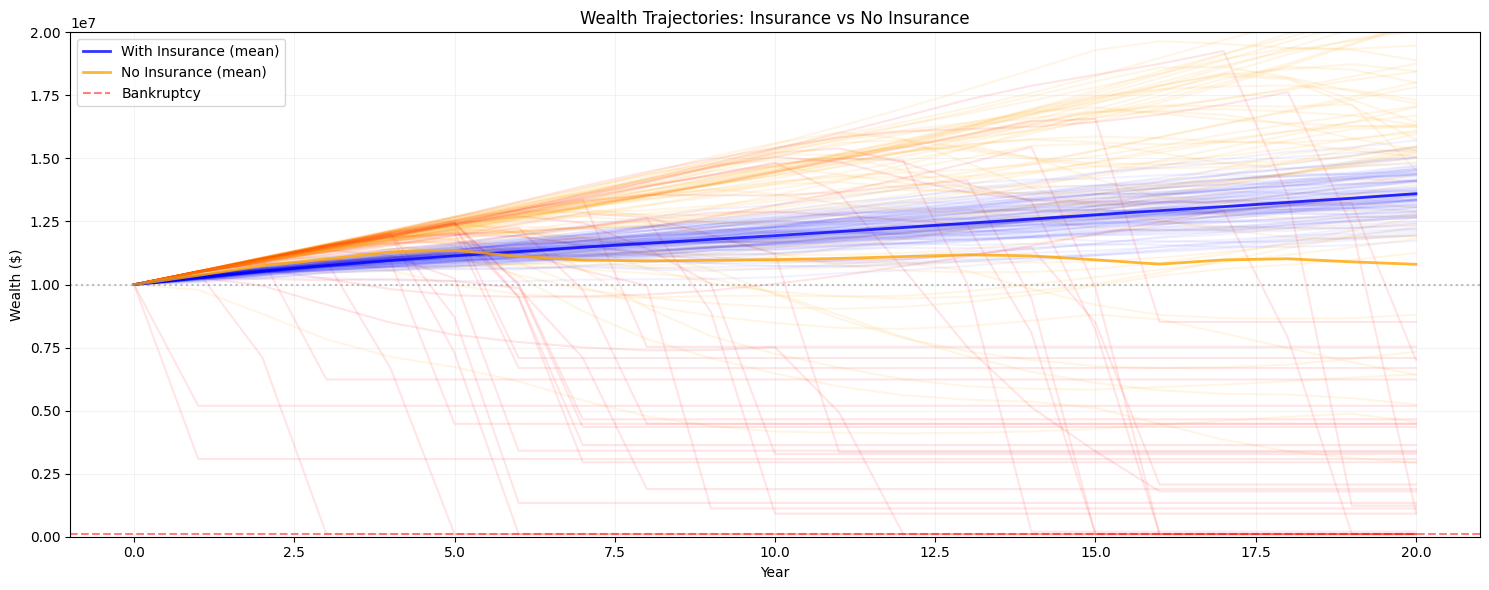

1.4.4. Step 4: Visualize the Results

# Create comprehensive visualization

fig = plt.figure(figsize=(15, 6))

### Plot 1: Wealth trajectories comparison #######

ax1 = plt.subplot()

bankrupt_no_ins = []

bankrupt_with_ins = []

# Plot all scenarios

for idx, s in enumerate(scenarios_no_insurance):

if idx in bankruptcy_no_ins_scenarios:

ax1.plot(range(len(s)), s, color='red', alpha=0.1)

bankrupt_no_ins.append(s)

else:

ax1.plot(range(len(s)), s, color='orange', alpha=0.1)

for idx, s in enumerate(scenarios_with_insurance):

if idx in bankruptcy_with_ins_scenarios:

bankrupt_with_ins.append(s)

ax1.plot(range(len(s)), s, color='blue', alpha=0.05)

# Compute and overlay means

no_ins_mean = np.average(np.array(scenarios_no_insurance, dtype=float), axis=0)

with_ins_mean = np.average(np.array(scenarios_with_insurance, dtype=float), axis=0)

ax1.plot(range(len(with_ins_mean)), with_ins_mean, color='blue', linewidth=2, alpha=0.8, label='With Insurance (mean)')

ax1.plot(range(len(no_ins_mean)), no_ins_mean, color='orange', linewidth=2, alpha=0.8, label='No Insurance (mean)')

ax1.axhline(y=100_000, color='r', linestyle='--', alpha=0.5, label='Bankruptcy')

ax1.axhline(y=config.initial_assets, color='gray', linestyle=':', alpha=0.5)

ax1.set_xlabel('Year')

ax1.set_ylabel('Wealth ($)')

ax1.set_title('Wealth Trajectories: Insurance vs No Insurance')

ax1.set_ylim(0, 20_000_000)

ax1.legend()

ax1.grid(True, alpha=0.15)

plt.tight_layout()

plt.show()

1.4.4.1. Sample Output:

1.5. Understanding the Results

1.5.1. Why Insurance Creates Value

This demonstration shows the true value of insurance: protection against catastrophic losses that can bankrupt the company.

1.5.1.1. The Loss Structure

Regular Losses (~2 per year, $50K$150K each)

These are manageable without insurance

Total ~$160K per year on average

Catastrophic Losses (~0.1 per year, $1M-$5M each)

Occur roughly once every 10 years

Can exceed annual profits by 2-5x

These are what make insurance valuable

What’s not shown in this scenario is that catastrophic attritional losses (retaining too much below the deductible) can also matter, as can extremely large losses above the limit.

1.5.1.2. Key Insights

Not Buying Insurance Outperforms Insurance At First:

Ensemble Average dominates early on

As catastrophic losses get averaged into scenarios over time, the value of insurance emerges

The Catastrophic Protection:

Without insurance: A single loss can wipe out years of profits

With insurance: Maximum exposure is the deductible ($100K) per event

Long-term Growth Impact:

Insurance smooths the growth trajectory

Prevents bankruptcy during catastrophic years

Enables compound growth over time

1.5.2. What to Look For in the Graph

Wealth Trajectories (Top Left):

Light Red lines designate scenarios without insurance that go bankrupt

Notice that many of these outperform insurance early on

Light Red and Orange lines with steep drops designate catastrophic events

Notice how “No Insurance” drops sharply at these points

“With Insurance” shows smoother, more consistent growth

1.6. Common Patterns You’ll See in Future Simulations

The Insurance Paradox: Sometimes paying 2-3x expected losses in premiums is optimal!

Volatility Reduction: Insurance smooths the wealth trajectory

Growth vs. Safety Trade-off: Lower retention = safer but more expensive

Long-term Benefits: Insurance benefits compound over time

1.7. Next Steps

Now that you’ve run your first simulation, explore these topics:

Basic Simulation: Deep dive into the simulation mechanics

Configuring Insurance: Understanding layers, retentions, and limits

Optimization Workflow: Finding the optimal insurance strategy

Analyzing Results: Advanced metrics and decision-making

1.8. Quick Tips

Start Simple: Begin with single-layer insurance before exploring complex programs

Use Seeds: Set

np.random.seed()for reproducible results during testingExperiment: Try different retention levels to see the trade-offs

Think Long-term: Run simulations for 20-50 years to see ergodic effects

1.9. Getting Help

Check the Troubleshooting Guide for common issues

Review the FAQ for conceptual questions

Explore the API Documentation for detailed function references

Open an issue on GitHub

Contact: Alex Filiakov

1.10. Summary

Congratulations! You’ve successfully:

✅ Installed the Ergodic Insurance Framework

✅ Created your first manufacturer model

✅ Generated realistic loss scenarios

✅ Run simulations with and without insurance

✅ Visualized and interpreted the results

You’re now ready to explore more advanced features and optimize your insurance strategy!