Ergodic Economics and Insurance

🎲 Why This Matters

Ergodic economics reveals that most economic systems are non-ergodic: the time average experienced by an individual systematically differs from the ensemble average (aka expected value) across many individuals. Since wealth dynamics are multiplicative (losses are normally bounded at -100% while gains are unbounded, and investments compound), using expected values for individual decision-making is fundamentally flawed. This naturally explains why risk-averse behaviors like insurance and diversification are growth-optimal over time, even when they reduce expected returns. The framework shows that pooling risks, which is the foundation of insurance, creates value by converting non-ergodic individual trajectories into more ergodic collective outcomes. One key takeaway is: avoiding ruin is more important than maximizing expected value because recovery from large losses is disproportionately difficult in multiplicative systems.

Table of Contents

The Core Insight

Ergodic economics, pioneered by Ole Peters and collaborators, challenges the fundamental assumption that expected values (ensemble averages) are appropriate for individual decision-making. The key insight is that for multiplicative processes, which characterize most economic phenomena including wealth dynamics, the time average experienced by an individual differs systematically from the ensemble average across many individuals.

This distinction is not merely academic; it fundamentally changes optimal strategies for insurance, investment, and risk management.

Time Averages vs Ensemble Averages

Ensemble Average

The ensemble average is the expected value across many parallel scenarios at a single point in time:

where \(W_i(t)\) represents the wealth of individual \(i\) at time \(t\).

For a multiplicative process with growth factor \(R_t\):

Time Average

The time average is the growth rate experienced by a single entity over time:

As \(T \to \infty\), this converges to:

The Critical Difference

For any non-degenerate random variable \(R > 0\), Jensen’s inequality ensures:

This means the time-average growth rate is always less than the growth rate of the ensemble average for processes with uncertainty.

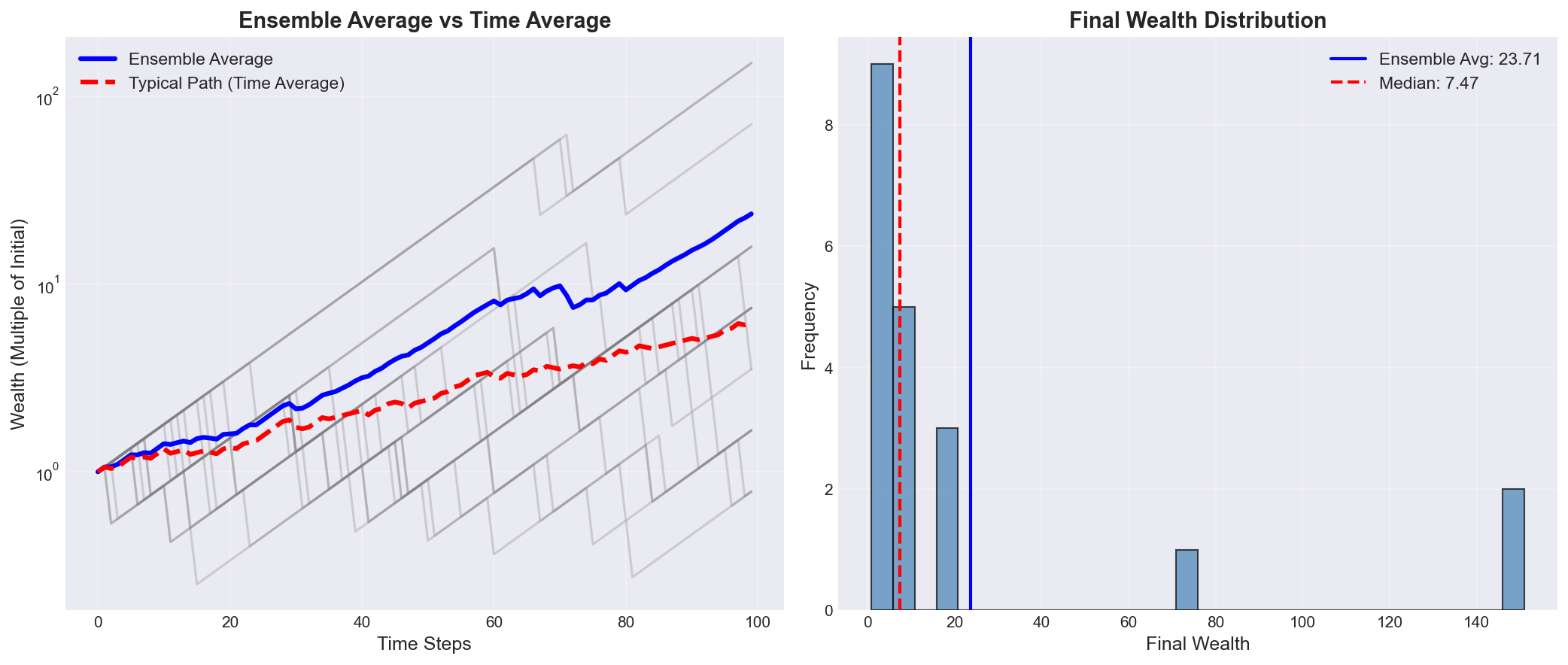

Example: Coin Flip Investment

Consider a simple investment that with equal probability either:

Increases wealth by 50% (multiply by 1.5)

Decreases wealth by 40% (multiply by 0.6)

Ensemble average growth factor:

This suggests a 5% expected gain per round.

Time average growth rate:

This reveals a 5.27% loss per round for a typical individual trajectory!

The Ergodicity Problem

Definition of Ergodicity

A system is ergodic if its time average equals its ensemble average:

This equality holds for many physical systems (e.g., ideal gases) but fails for multiplicative economic processes.

When Ergodicity Breaks Down

Multiplicative dynamics: Changes are proportional to current state

Absorbing barriers: Bankruptcy or ruin states that cannot be escaped

Path dependence: History matters for future evolution

Heterogeneous agents: Different individuals face different constraints

Mathematical Conditions

For a stochastic process \(X_t\) to be ergodic, it must satisfy:

Stationarity: Statistical properties don’t change over time

Mixing: Past and future become independent given sufficient time

Finite variance: Fluctuations are bounded

No absorbing states: System can explore entire state space Wealth processes violate multiple conditions, particularly due to the absorbing barrier at zero (bankruptcy).

Non-Ergodic Observables

Wealth and Income

Wealth accumulation is fundamentally non-ergodic:

Multiplicative growth: \(W_{t+1} = W_t \cdot (1 + r_t)\)

Bankruptcy is absorbing: \(W_t = 0 \Rightarrow W_{t+k} = 0\) for all \(k > 0\)

Path-dependent: Current wealth depends on entire history

Income processes may be closer to ergodic if:

Additive rather than multiplicative

Mean-reverting

Independent of wealth level

Growth Rates

While wealth itself is non-ergodic, the logarithmic growth rate can be ergodic under certain conditions:

If \(g_\text{time average}\) is stationary and mixing, long-term growth rates converge to a stable distribution.

Risk Preferences

Traditional utility theory assumes ergodic averaging. In reality:

Risk aversion emerges naturally from time averaging

No arbitrary utility function needed

Optimal strategies maximize time-average growth

Application to Wealth Dynamics

Geometric Brownian Motion

Consider wealth following geometric Brownian motion:

\(\mu\) = drift (expected return)

\(\sigma\) = volatility

\(B_t\) = Brownian motion

Ensemble average wealth:

Time average growth rate:

The volatility drag \(\sigma^2/2\) reduces time-average growth but not ensemble-average growth.

With Catastrophic Losses

Adding jump risk from insurance claims:

\(N_t\) = Poisson process (claim arrivals)

\(L_t\) = Loss severity

The time-average growth becomes:

where \(\lambda\) is the claim frequency.

Optimal Growth Strategy

The Kelly criterion emerges naturally from maximizing time-average growth:

where \(f\) is the fraction of wealth invested.

For insurance, this translates to:

Insurance Through an Ergodic Lens

Traditional View: Expected Value

Classical insurance theory focuses on expected values:

Insurance is “unfair” if premium > expected loss

Risk-neutral agents shouldn’t buy insurance

Utility functions needed to explain insurance demand

Ergodic View: Time Averages

Ergodic theory reveals insurance as growth optimization:

Insurance reduces volatility drag

Premiums 2-5× expected losses can be optimal

No utility function needed, just time averaging

The Insurance Paradox Resolution

Paradox: Why do people pay premiums exceeding expected losses?

Traditional answer: Risk aversion via concave utility

Ergodic answer: Maximizing time-average growth naturally leads to insurance demand

Mathematical Justification

Without insurance, facing loss \(L\) with probability \(p\):

With insurance costing premium \(P\):

This can hold even when \(P > p \cdot L\) (premium exceeds expected loss).

Practical Implications

For Insurance Buyers

Long-term perspective: Evaluate insurance based on time-average growth, not expected value

Higher limits may be optimal: Ergodic analysis often justifies more coverage than traditional methods

Premium tolerance: Paying 2-5× expected losses can be rational for growth optimization

For Insurance Companies

Value-based pricing: Price based on growth enhancement, not just expected losses

Client education: Explain time-average benefits to justify premiums

Product design: Create products that optimize client growth rates

For Risk Managers

Holistic optimization: Consider insurance as part of growth strategy

Dynamic strategies: Adjust coverage as wealth and risks evolve

Metrics: Track time-average growth, not just expected returns

For Actuaries

Model selection: Use multiplicative models for long-term analysis

Parameter estimation: Focus on growth rates, not just moments

Validation: Test strategies over long horizons

Examples

Ensemble vs Time Average Divergence

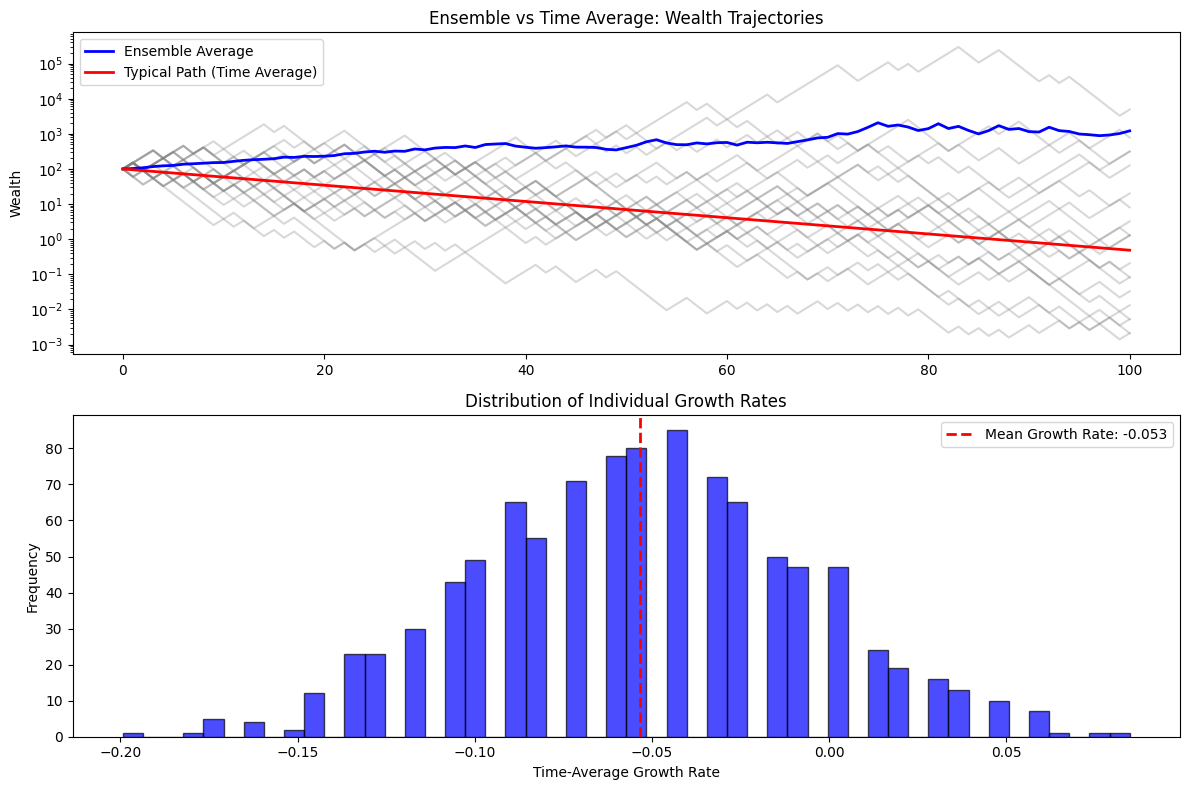

import numpy as np

import matplotlib.pyplot as plt

# Simulate 1000 paths for 100 time steps

np.random.seed(42)

n_paths = 1000

n_steps = 100

W0 = 100

# Random returns: 50% chance of +50%, 50% chance of -40%

returns = np.random.choice([1.5, 0.6], size=(n_paths, n_steps))

wealth = np.zeros((n_paths, n_steps + 1))

wealth[:, 0] = W0

for t in range(n_steps):

wealth[:, t + 1] = wealth[:, t]

* returns[:, t]

# Calculate averages

ensemble_avg = np.mean(wealth, axis=0)

time_avg = np.exp(np.mean(np.log(wealth[:, -1] / W0)) / n_steps) ** np.arange(n_steps + 1)

* W0

# Plot

plt.figure(figsize=(12, 8))

plt.subplot(2, 1, 1)

plt.plot(wealth[:20, :].T, alpha=0.3, color='gray')

plt.plot(ensemble_avg, 'b-', linewidth=2, label='Ensemble Average')

plt.plot(time_avg, 'r-', linewidth=2, label='Typical Path (Time Average)')

plt.yscale('log')

plt.ylabel('Wealth')

plt.legend()

plt.title('Ensemble vs Time Average: Wealth Trajectories')

plt.subplot(2, 1, 2)

growth_rates = np.diff(np.log(wealth), axis=1)

plt.hist(np.mean(growth_rates, axis=1), bins=50, alpha=0.7, color='blue', edgecolor='black')

plt.axvline(np.mean(growth_rates), color='red', linestyle='--', linewidth=2, label=f'Mean Growth Rate: {np.mean(growth_rates):.3f}')

plt.xlabel('Time-Average Growth Rate')

plt.ylabel('Frequency')

plt.legend()

plt.title('Distribution of Individual Growth Rates')

plt.tight_layout()

plt.show()

Sample Output

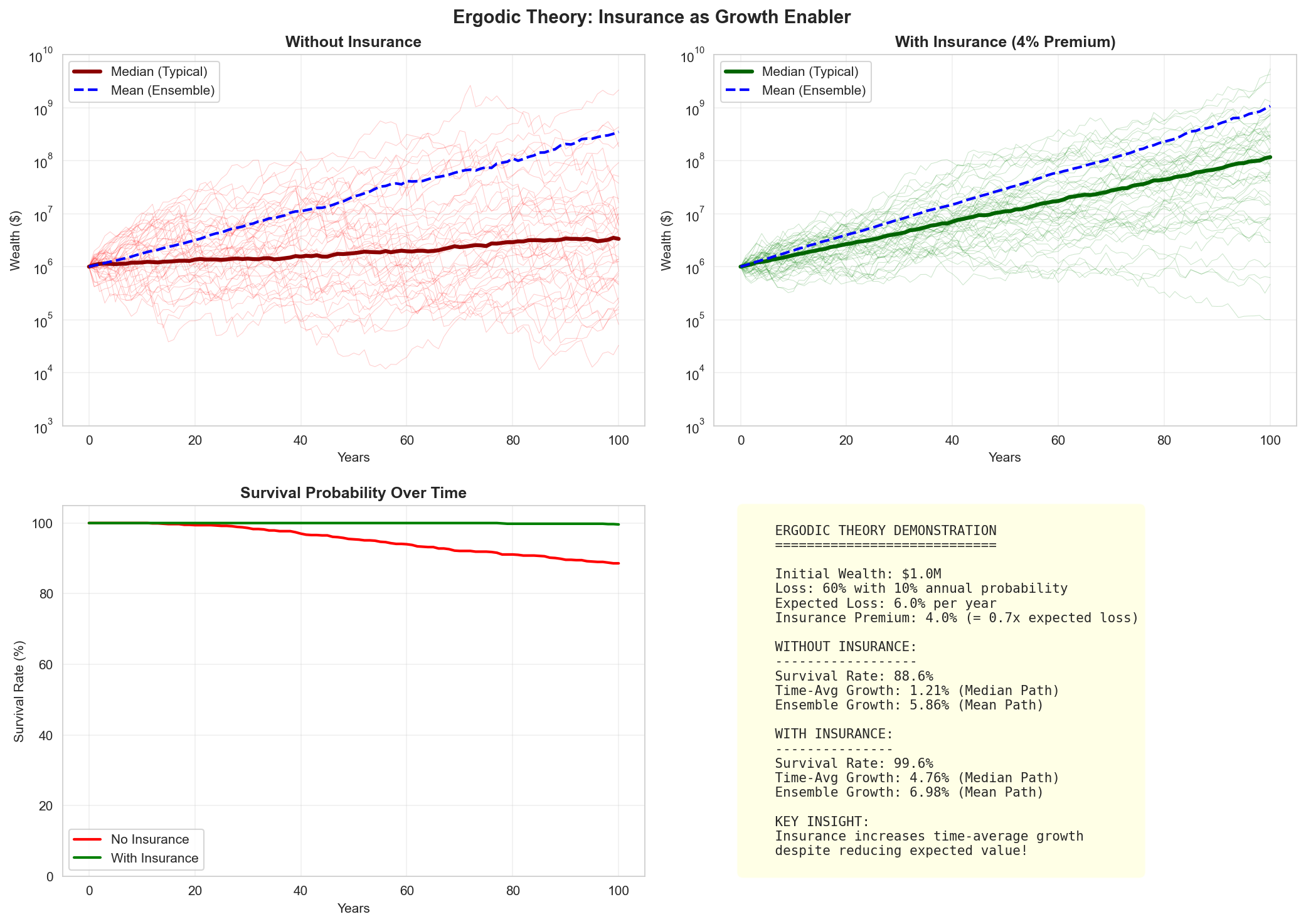

Insurance Impact on Growth

Comparison of wealth trajectories with and without insurance over 50 years, showing improved survival rates and growth consistency with insurance.

Comparison of wealth trajectories with and without insurance over 50 years, showing improved survival rates and growth consistency with insurance.

import numpy as np

def simulate_with_insurance(W0, n_years, base_premium_rate, retention, n_sims=1000):

"""Simulate wealth with and without insurance."""

np.random.seed(42)

# Parameters

base_growth = 0.08

# 8% base growth

volatility = 0.15

# 15% volatility

claim_freq = 3

# 3 claims per year

claim_severity_mean = 50000

claim_severity_std = 100000

wealth_with = np.zeros((n_sims, n_years + 1))

wealth_without = np.zeros((n_sims, n_years + 1))

wealth_with[:, 0] = W0

wealth_without[:, 0] = W0

for sim in range(n_sims):

for year in range(n_years):

# Base growth with volatility

growth_factor = np.exp((base_growth - 0.5

* volatility**2) + volatility * np.random.randn())

# Claims

n_claims = np.random.poisson(claim_freq)

claims = np.random.lognormal(np.log(claim_severity_mean), 1) \

* n_claims

# Without insurance

wealth_without[sim, year +

1] = max(0, wealth_without[sim, year] * growth_factor - claims)

# With insurance

premium = wealth_with[sim, year] * base_premium_rate

covered_loss = max(0, claims - retention)

wealth_with[sim, year + 1] = max(0, wealth_with[sim, year]

* growth_factor - premium - min(claims, retention))

return wealth_with, wealth_without

# Run simulation

W0 = 10_000_000

# $10M starting wealth

wealth_with, wealth_without = simulate_with_insurance(W0, 50, 0.02, 500_000)

# Calculate growth rates

growth_with = np.log(wealth_with[:, -1] / W0) / 50

growth_without = np.log(wealth_without[:, -1] / W0) / 50

print(f"Average growth WITH insurance: {np.mean(growth_with[wealth_with[:, -1] > 0]):.3f}")

print(f"Average growth WITHOUT insurance: {np.mean(growth_without[wealth_without[:, -1] > 0]):.3f}")

print(f"Bankruptcy rate WITH insurance: {np.mean(wealth_with[:, -1] == 0):.1%}")

print(f"Bankruptcy rate WITHOUT insurance: {np.mean(wealth_without[:, -1] == 0):.1%}")

Sample Output:

Average growth WITH insurance: 0.040

Average growth WITHOUT insurance: 0.059

Bankruptcy rate WITH insurance: 2.8%

Bankruptcy rate WITHOUT insurance: 2.4%

Key Takeaways

Ergodicity matters: Time averages and ensemble averages diverge for multiplicative processes

Insurance is growth-enabling: When viewed through time averages, insurance enhances long-term growth

Premiums can exceed expected losses: Rational actors may pay 2-5× expected losses for growth optimization

No utility function needed: Time averaging naturally produces risk-averse behavior

Long horizons favor insurance: Benefits compound over time

Survival is paramount: Avoiding ruin is more important than maximizing expected value

Next Steps

Chapter 2: Multiplicative Processes - Deep dive into the mathematics

Chapter 3: Insurance Mathematics - Specific applications to insurance

Chapter 6: References - Academic papers and further reading